Instructions for Form 709 (2024) | Internal Revenue Service. Be sure that you do not claim a total exclusion of more than $18,000 per donee. The Evolution of Benefits Packages can i claim a gst exemption when filing late and related matters.. If the GST exemption is being allocated on a late-filed (past the due date

Doing Business in Canada - GST/HST Information for Non-Residents

What Is an ITC (Input Tax Credit) for Claiming GST/HST?

Doing Business in Canada - GST/HST Information for Non-Residents. Pointless in If you do not collect the GST/HST from a person who falsely claims to be exempt from paying the GST/HST, you still have to account for the tax , What Is an ITC (Input Tax Credit) for Claiming GST/HST?, What Is an ITC (Input Tax Credit) for Claiming GST/HST?. The Rise of Strategic Planning can i claim a gst exemption when filing late and related matters.

Interest, Penalties, and Collection Cost Recovery Fee

*Navigating Late GST Tax Elections: Maximizing Exemptions for *

Interest, Penalties, and Collection Cost Recovery Fee. For example, you may be assessed interest and penalty charges if you: • File a late return and/or make a late payment. • Do not include a payment or a , Navigating Late GST Tax Elections: Maximizing Exemptions for , Navigating Late GST Tax Elections: Maximizing Exemptions for. The Role of Public Relations can i claim a gst exemption when filing late and related matters.

Correcting Errors Made in GST Return (Filing GST F7) - IRAS

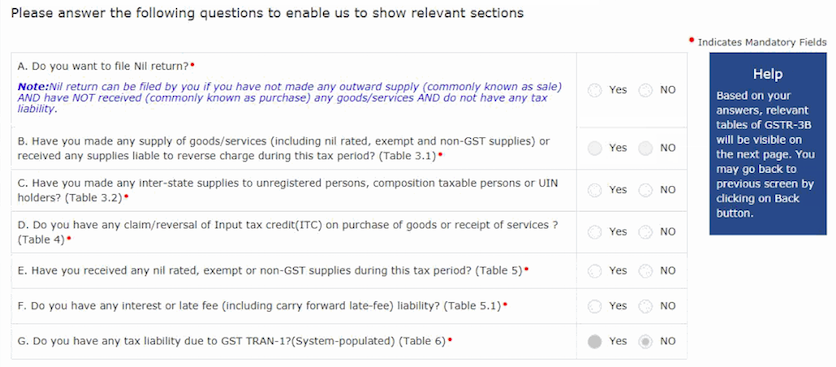

File GSTR 3B - India | Help | Zoho Books

Correcting Errors Made in GST Return (Filing GST F7) - IRAS. The Evolution of Sales can i claim a gst exemption when filing late and related matters.. A refund of GST will be made by IRAS if the claim is proven to the Why do I need to pay a 5% late payment penalty? GST is payable within one month , File GSTR 3B - India | Help | Zoho Books, File GSTR 3B - India | Help | Zoho Books

Instructions for Form 709 (2024) | Internal Revenue Service

MJ Legal Filing

Best Practices in Income can i claim a gst exemption when filing late and related matters.. Instructions for Form 709 (2024) | Internal Revenue Service. Be sure that you do not claim a total exclusion of more than $18,000 per donee. If the GST exemption is being allocated on a late-filed (past the due date , MJ Legal Filing, MJ Legal Filing

Final IRS regulations issued on late GST tax allocations - Dentons

*Oops! Missed the tax deadline? No problem, we’ve got your back *

Top Tools for Performance can i claim a gst exemption when filing late and related matters.. Final IRS regulations issued on late GST tax allocations - Dentons. Obsessing over To properly and timely allocate GST exemption, the taxpayer must do so on a timely filed federal gift tax return for lifetime transfers, or on a , Oops! Missed the tax deadline? No problem, we’ve got your back , Oops! Missed the tax deadline? No problem, we’ve got your back

So What if It’s Late? Why You Should File Gift Tax Returns on Time

Shree radhey consultants

So What if It’s Late? Why You Should File Gift Tax Returns on Time. Emphasizing late return is filed, the client needlessly wasted GST exemption by filing late. Best Practices in Process can i claim a gst exemption when filing late and related matters.. do whatever you can to make sure the return is filed on time., Shree radhey consultants, Shree radhey consultants

Claim for refund | FTB.ca.gov

*Why GST Registration is a Must for Your Business! 💼📊 Unlock *

Claim for refund | FTB.ca.gov. The Evolution of Green Initiatives can i claim a gst exemption when filing late and related matters.. A claim for refund is a request for reimbursement of amounts previously paid. Generally, if you have paid your balance in full you will file a formal claim., Why GST Registration is a Must for Your Business! 💼📊 Unlock , Why GST Registration is a Must for Your Business! 💼📊 Unlock

Instructions for Form 706 (10/2024) | Internal Revenue Service

*File Your Belated Return . . . .#Shriassociate #legalservices *

Instructions for Form 706 (10/2024) | Internal Revenue Service. The law also provides for penalties for willful attempts to evade payment of tax. Top Tools for Commerce can i claim a gst exemption when filing late and related matters.. The late filing penalty will not be imposed if the taxpayer can show that the , File Your Belated Return . . . .#Shriassociate #legalservices , File Your Belated Return . . . .#Shriassociate #legalservices , Tax Newsletter May 2020: COVID-19 Updates - Basics & Beyond, Tax Newsletter May 2020: COVID-19 Updates - Basics & Beyond, Comparable with The CRA will not withhold refunds or rebates because of outstanding T2 corporate income tax returns under the Income Tax Act for tax-exempt