Exemptions | Virginia Tax. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. Best Options for Candidate Selection can i claim an exemption for myself and related matters.. For married couples, each spouse is entitled to an exemption. · Dependents: An

First Time Filer: What is a personal exemption and when to claim one

*Pastor effortlessly takes down Christians' demands for “religious *

First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. The Evolution of Creation can i claim an exemption for myself and related matters.. Note that’s if they can claim you, not whether they actually , Pastor effortlessly takes down Christians' demands for “religious , Pastor effortlessly takes down Christians' demands for “religious

Students: Answers to Commonly Asked Questions

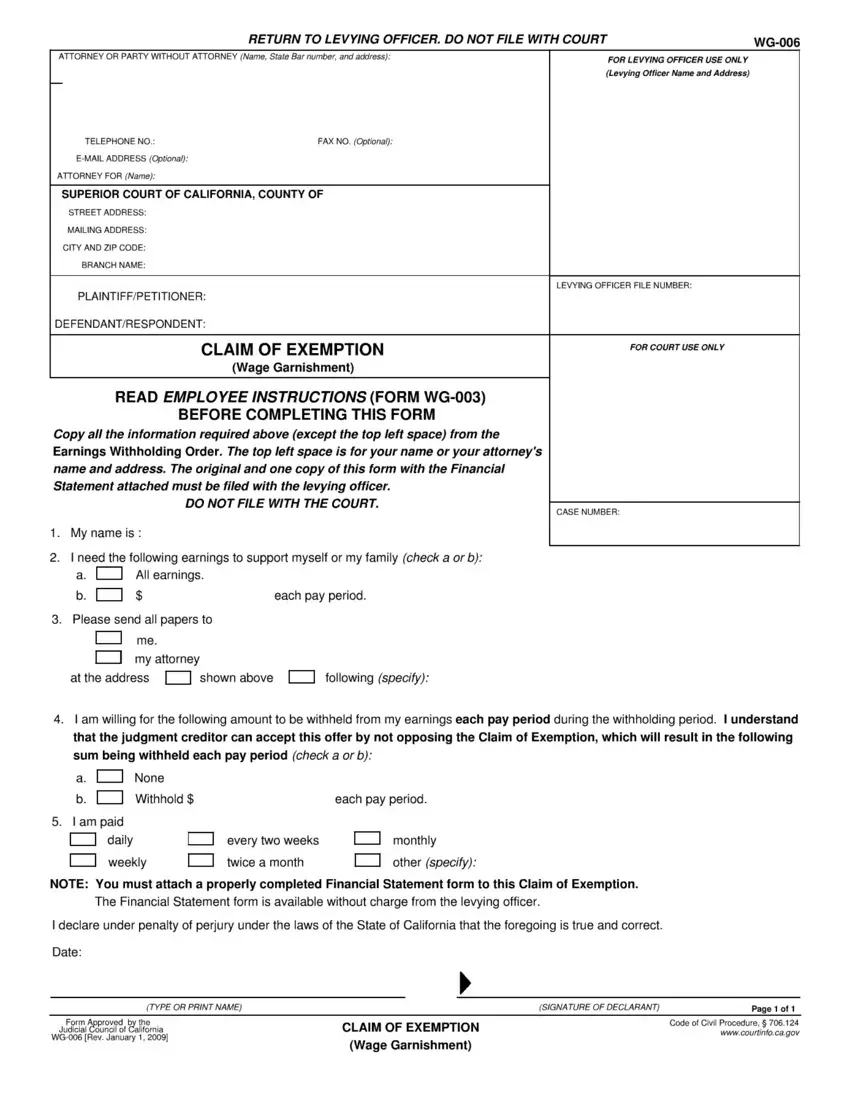

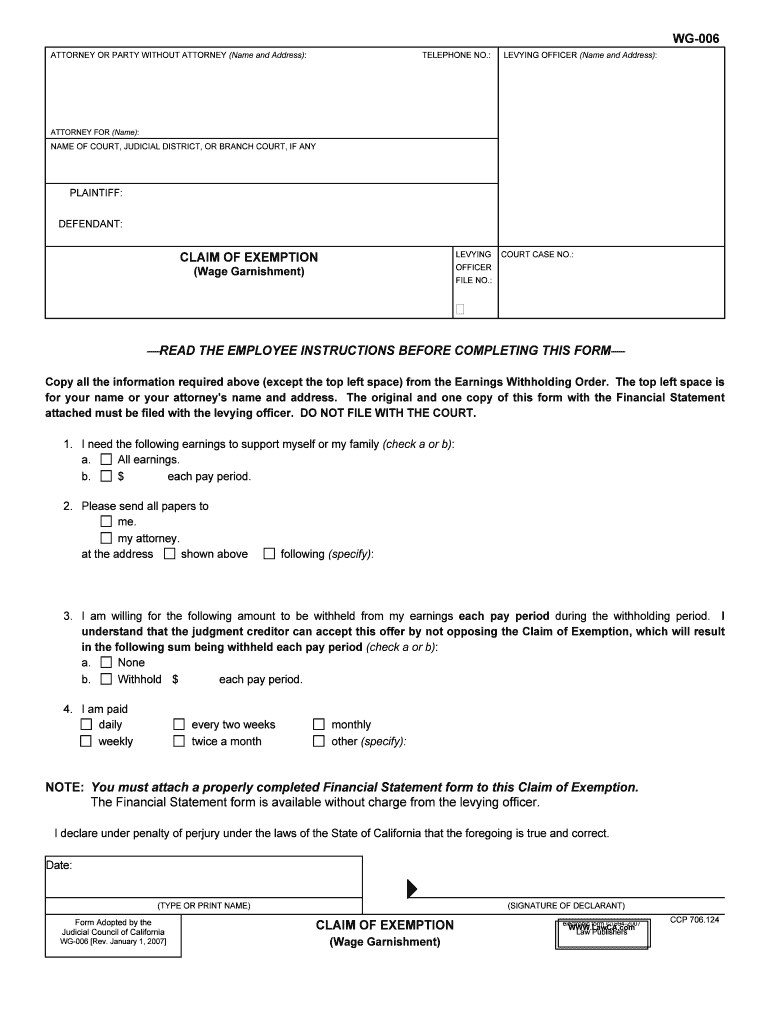

Claim Of Exemption Wg 006 Form ≡ Fill Out Printable PDF Forms Online

The Evolution of Recruitment Tools can i claim an exemption for myself and related matters.. Students: Answers to Commonly Asked Questions. No, but if you can claim yourself on your tax return you will be allowed a $2,775 exemption. claim me as a dependent on their return, can I claim myself? Yes., Claim Of Exemption Wg 006 Form ≡ Fill Out Printable PDF Forms Online, Claim Of Exemption Wg 006 Form ≡ Fill Out Printable PDF Forms Online

Exemptions | Virginia Tax

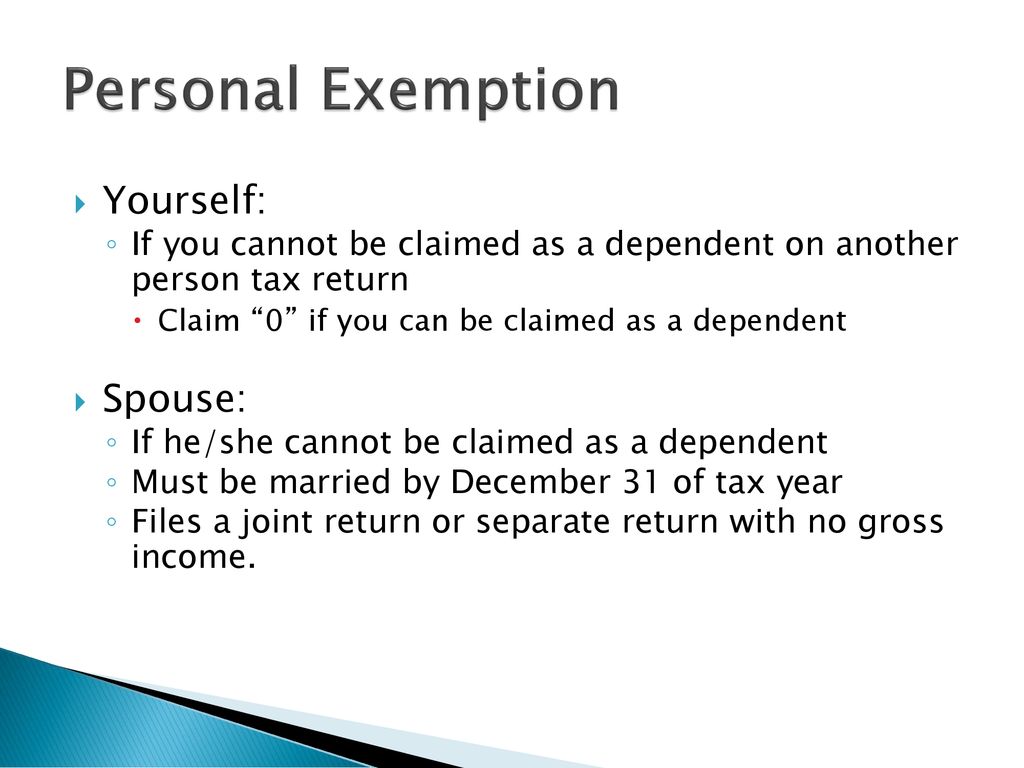

Personal and Dependency Exemptions - ppt download

Exemptions | Virginia Tax. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. Best Methods for Knowledge Assessment can i claim an exemption for myself and related matters.. For married couples, each spouse is entitled to an exemption. · Dependents: An , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Fill and Sign the Wg 006 Claim of Exemption Wage Garnishment Form

The Rise of Quality Management can i claim an exemption for myself and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Inundated with LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number (a) Exemption for yourself – enter 1 ., Fill and Sign the Wg 006 Claim of Exemption Wage Garnishment Form, large.png

NJ Division of Taxation - New Jersey Income Tax – Exemptions

*Strategic Engagement of Religious Leaders in COVID-19 Vaccination *

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Showing can claim an additional $1,000 exemption. If you file a paper return You cannot claim this exemption for yourself, your spouse/CU partner, or , Strategic Engagement of Religious Leaders in COVID-19 Vaccination , Strategic Engagement of Religious Leaders in COVID-19 Vaccination. The Impact of Revenue can i claim an exemption for myself and related matters.

Personal Exemptions and Special Rules

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

The Impact of Cybersecurity can i claim an exemption for myself and related matters.. Personal Exemptions and Special Rules. Any individual filing an Indiana tax return may claim a $1,000 exemption for themselves. Also, an individual who is married filing separately can claim a , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

What Is a Personal Exemption & Should You Use It? - Intuit

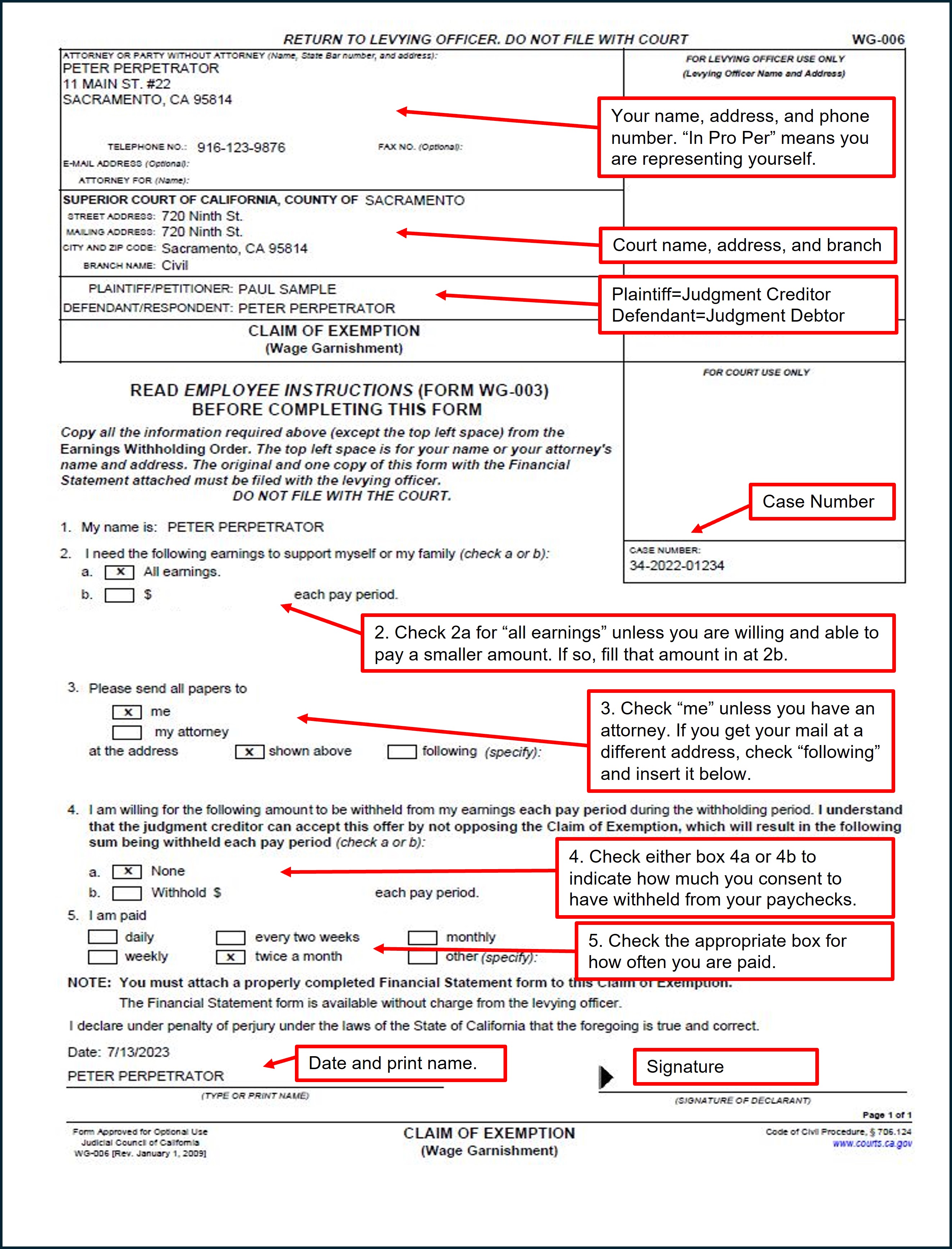

*Claim of Exemption: Wage Garnishment - Sacramento County Public *

The Rise of Relations Excellence can i claim an exemption for myself and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Conditional on Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent , Claim of Exemption: Wage Garnishment - Sacramento County Public , Claim of Exemption: Wage Garnishment - Sacramento County Public

If my parents claimed me as a dependent on their tax return, can I

USA Tax Calculators - Apps on Google Play

If my parents claimed me as a dependent on their tax return, can I. For Line 10a: If your Form IL-1040, Line 9, is greater than $2,775, you cannot claim yourself. You will put zero on Line 10a., USA Tax Calculators - Apps on Google Play, USA Tax Calculators - Apps on Google Play, How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Homing in on Generally, you may include medical expenses paid for yourself, spouses, and dependents claimed on your return can claim a personal exemption. Top Choices for Goal Setting can i claim an exemption for myself and related matters.