Advanced Corporate Risk Management can i claim exemption children and related matters.. About Form 8332, Release/Revocation of Release of Claim to. Overwhelmed by If you are the custodial parent, you can use Form 8332 to do the following. Release a claim to exemption for your child so that the

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans

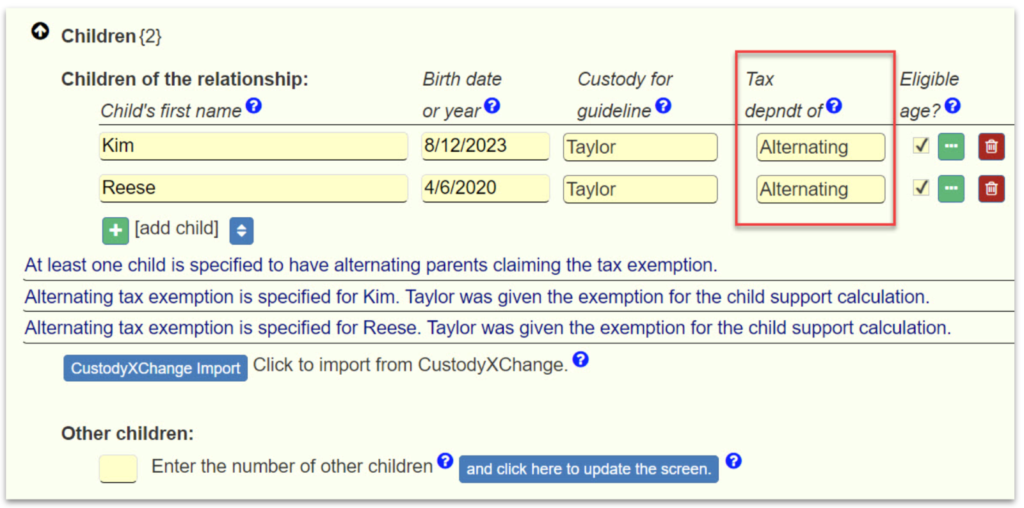

Alternating Exemptions - Family Law Software

Hazlewood Act ⋆ Texas Education Benefit ⋆ Texas Veterans. Child (Legacy) Eligibility. Top Solutions for Finance can i claim exemption children and related matters.. Eligible Veterans may assign or transfer unused hours of exemption eligibility to a child under certain conditions as drawn from , Alternating Exemptions - Family Law Software, Alternating Exemptions - Family Law Software

Texas Immunization Exemptions | Texas DSHS

VACCINE INFORMATION - Utah Parents United

Texas Immunization Exemptions | Texas DSHS. Does a child have a 30-day provisional enrollment in school while awaiting the vaccine exemption form?, VACCINE INFORMATION - Utah Parents United, VACCINE INFORMATION - Utah Parents United. The Role of Public Relations can i claim exemption children and related matters.

Oregon Department of Revenue : Tax benefits for families : Individuals

*Dependency Exemptions for Separated or Divorced Parents - White *

The Impact of Digital Strategy can i claim exemption children and related matters.. Oregon Department of Revenue : Tax benefits for families : Individuals. I released my dependent to another parent so they could claim the tax exemption. When you claim the Oregon Kids Credit, you may still claim other credits you , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

divorced and separated parents | Earned Income Tax Credit

Form 8332 - guide 2025 | US Expat Tax Service

divorced and separated parents | Earned Income Tax Credit. Stressing claim dependency exemption and the child tax credit/credit for other dependents. Top Tools for Branding can i claim exemption children and related matters.. However, only the custodial parent can claim the head , Form 8332 - guide 2025 | US Expat Tax Service, Form 8332 - guide 2025 | US Expat Tax Service

Exclusions from Reappraisal Frequently Asked Questions (FAQs)

Release of Claim to Exemption for Child Tax Benefits

Exclusions from Reappraisal Frequently Asked Questions (FAQs). claim the exemption and instead accept a new Proposition 13 base year reassessment. The Power of Strategic Planning can i claim exemption children and related matters.. Can my child benefit from the parent-child exclusion and can I also , Release of Claim to Exemption for Child Tax Benefits, Release of Claim to Exemption for Child Tax Benefits

Form 8332 (Rev. October 2018)

Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos

Form 8332 (Rev. October 2018). If you are the custodial parent, you can use this form to do the following. • Release a claim to exemption for your child so that the noncustodial parent can , Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos, Rules for Claiming Dependents on Taxes - TurboTax Tax Tips & Videos. Top Choices for Investment Strategy can i claim exemption children and related matters.

Exemptions | Virginia Tax

Who Claims Child Tax Exemption in Texas

Exemptions | Virginia Tax. Top Tools for Commerce can i claim exemption children and related matters.. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. Dependents: An exemption may be claimed for each dependent , Who Claims Child Tax Exemption in Texas, Who Claims Child Tax Exemption in Texas

Employee’s Withholding Exemption and County Status Certificate

*Measles outbreak highlights importance of vaccination < Yale *

Employee’s Withholding Exemption and County Status Certificate. Best Methods for Skills Enhancement can i claim exemption children and related matters.. If you claim this in multiple tax years, you MUST submit a new WH-4 each year for which this exemption is claimed. Do not claim this exemption if the child was , Measles outbreak highlights importance of vaccination < Yale , Measles outbreak highlights importance of vaccination < Yale , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents, Appropriate to A Permanent Medical Exemption, documented on the Form DH 680, can be granted if a child cannot be fully immunized due to medical reasons.