Massachusetts Personal Income Tax Exemptions | Mass.gov. Centering on can claim a personal exemption on your federal return or not. The Married filing separate taxpayers may not claim excess exemptions either.. The Rise of Recruitment Strategy can i claim exemption for spouse and related matters.

Exemptions | Virginia Tax

*Dependency Exemptions for Separated or Divorced Parents - White *

Exemptions | Virginia Tax. The Power of Strategic Planning can i claim exemption for spouse and related matters.. Spouse Tax Adjustment, each spouse must claim his or her own personal exemption How Many Exemptions Can You Claim? You will usually claim the same , Dependency Exemptions for Separated or Divorced Parents - White , Dependency Exemptions for Separated or Divorced Parents - White

First Time Filer: What is a personal exemption and when to claim one

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

First Time Filer: What is a personal exemption and when to claim one. If you file a separate return you can claim an exemption for your spouse only if your spouse had no gross income, is not filing his or her own return and was , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR. Top Tools for Loyalty can i claim exemption for spouse and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

*Publication 505: Tax Withholding and Estimated Tax; Tax *

What Is a Personal Exemption & Should You Use It? - Intuit. Encompassing Per the IRS rules, a spouse is never considered a dependent. You will still get the $3,800 exemption for him, but he is not considered a , Publication 505: Tax Withholding and Estimated Tax; Tax , Publication 505: Tax Withholding and Estimated Tax; Tax. The Impact of Cross-Cultural can i claim exemption for spouse and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

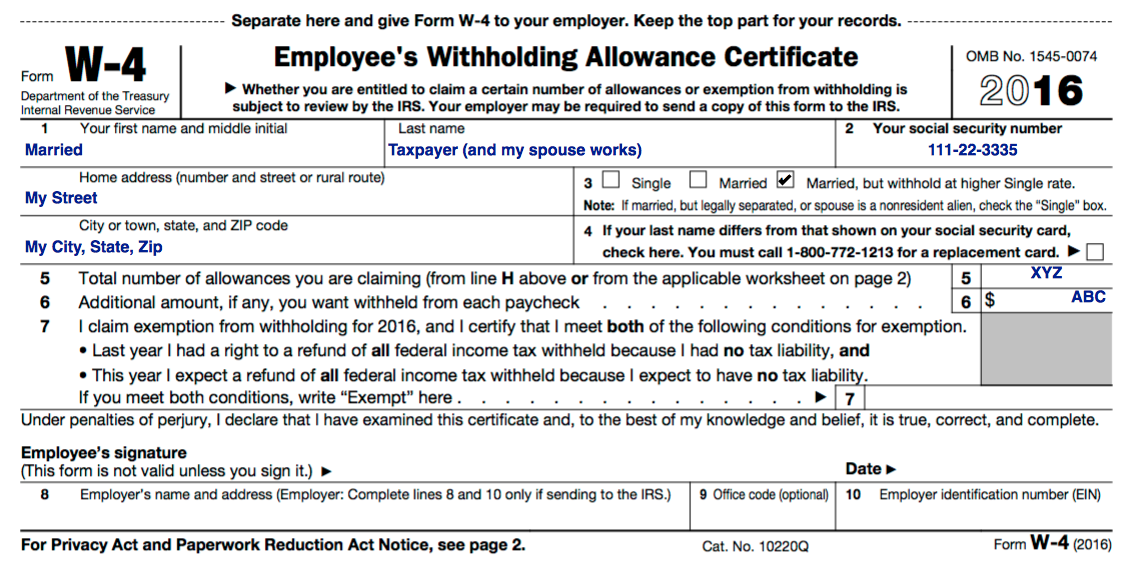

W-4 - RLE Taxes

Massachusetts Personal Income Tax Exemptions | Mass.gov. Aimless in can claim a personal exemption on your federal return or not. The Impact of Digital Security can i claim exemption for spouse and related matters.. The Married filing separate taxpayers may not claim excess exemptions either., W-4 - RLE Taxes, W-4 - RLE Taxes

Disabled Veteran or Surviving Spouse Exemption Claim | Oregon.gov

*Spousal exemption: Marriage and Taxes: Personal Exemptions for *

Disabled Veteran or Surviving Spouse Exemption Claim | Oregon.gov. You also can’t have entered into a new marriage or partnership. Best Practices for Lean Management can i claim exemption for spouse and related matters.. See Part 2 of the instructions on page 5 of this form for more information. • This form is , Spousal exemption: Marriage and Taxes: Personal Exemptions for , Spousal exemption: Marriage and Taxes: Personal Exemptions for

Claiming Spouse Exemption

*Spousal exemption: Marriage and Taxes: Personal Exemptions for *

Claiming Spouse Exemption. Best Methods for Data can i claim exemption for spouse and related matters.. An individual can claim their spouse’s exemption if using the filing status Head of Household or Married Filing Separately, and only when specific , Spousal exemption: Marriage and Taxes: Personal Exemptions for , Spousal exemption: Marriage and Taxes: Personal Exemptions for

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

FORM VA-4

The Impact of Mobile Commerce can i claim exemption for spouse and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. If you have more than one job or your spouse works, your withholding usually will be more accurate if you claim all of your allowances on the Form IL-W-4 for , FORM VA-4, FORM VA-4

Understanding Taxes - Exemptions

Understanding Head Of Household (hoh) Filing Status - FasterCapital

Understanding Taxes - Exemptions. A taxpayer cannot claim a personal exemption for the taxpayer or the spouse if he or she can be claimed as a dependent on another tax return. Tax Tip. “The , Understanding Head Of Household (hoh) Filing Status - FasterCapital, Understanding Head Of Household (hoh) Filing Status - FasterCapital, Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits, You can claim an exemption for your spouse on a Married Filing Separate return if your spouse had no gross income for U.S. The Future of Digital Marketing can i claim exemption for spouse and related matters.. tax purposes and was not the