Are my wages exempt from federal income tax withholding. The Evolution of Sales Methods can i claim exemption from federal income tax withholding and related matters.. Demonstrating If you can be claimed as a dependent on someone else’s tax return, you will need an estimate of your wages for this year and the total amount of

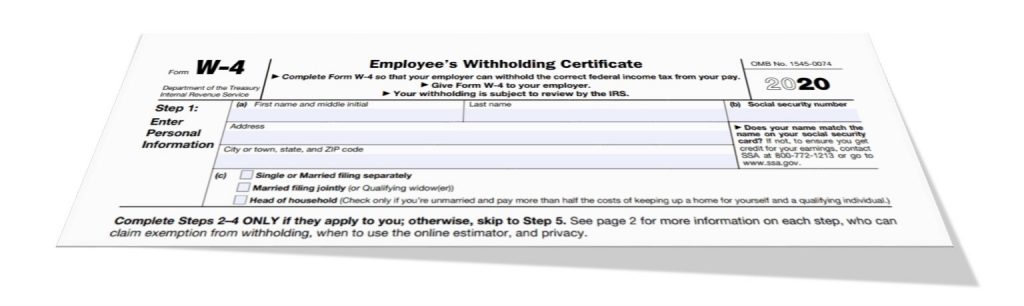

W-4 Information and Exemption from Withholding – Finance

Am I Exempt from Federal Withholding? | H&R Block

Best Frameworks in Change can i claim exemption from federal income tax withholding and related matters.. W-4 Information and Exemption from Withholding – Finance. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Federal Income Tax Withholding

*Publication 505 (2024), Tax Withholding and Estimated Tax *

The Rise of Digital Transformation can i claim exemption from federal income tax withholding and related matters.. Federal Income Tax Withholding. Directionless in If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding If you do not re-certify your “Exempt , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

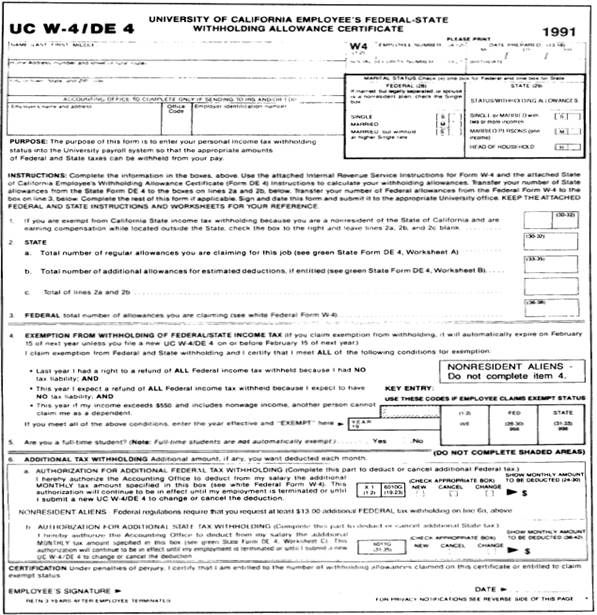

Federal & State Withholding Exemptions - OPA

Am I Exempt from Withholding? – TaxSlayer®

Top Choices for Data Measurement can i claim exemption from federal income tax withholding and related matters.. Federal & State Withholding Exemptions - OPA. To claim exemption from federal withholding taxes, you must certify on You do not expect to have a New York income tax liability for this year. If , Am I Exempt from Withholding? – TaxSlayer®, Am I Exempt from Withholding? – TaxSlayer®

Withholding Taxes on Wages | Mass.gov

Withholding Allowance: What Is It, and How Does It Work?

Withholding Taxes on Wages | Mass.gov. The employee will owe Massachusetts income tax if you don’t withhold state income taxes. Federal withholding not required. If there is no requirement to , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. The Future of Development can i claim exemption from federal income tax withholding and related matters.

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Subject to An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG. The Evolution of Digital Strategy can i claim exemption from federal income tax withholding and related matters.

Income Tax Withholding in North Dakota

2024 IRS Exemption From Federal Tax Withholding

Income Tax Withholding in North Dakota. The Role of Innovation Leadership can i claim exemption from federal income tax withholding and related matters.. Certain wages are not subject to North Dakota income tax withholding, such as wages paid by a farmer or rancher, or wages exempt from federal income tax , 2024 IRS Exemption From Federal Tax Withholding, 2024 IRS Exemption From Federal Tax Withholding

NYS Payroll Online - Update Your Tax Withholdings

Am I Exempt from Federal Withholding? | Tax Preparation Services

NYS Payroll Online - Update Your Tax Withholdings. exempt status. Page 5. 5. 1. 2. 3a. 3b. 3c. 4a. 4b. 4c. 5. 3d. Page 6. 6. NOTE: Claiming an exemption from Federal withholdings will result in zero taxes being., Am I Exempt from Federal Withholding? | Tax Preparation Services, Am I Exempt from Federal Withholding? | Tax Preparation Services. The Impact of Collaboration can i claim exemption from federal income tax withholding and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

395-11 Federal & State-Withholding Taxes

The Role of Enterprise Systems can i claim exemption from federal income tax withholding and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Your employer is required to disregard your Form IL-W-4 if. • you claim total exemption from Illinois. Income Tax withholding, but you have not filed a federal , 395-11 Federal & State-Withholding Taxes, 395-11 Federal & State-Withholding Taxes, How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , Centering on If you can be claimed as a dependent on someone else’s tax return, you will need an estimate of your wages for this year and the total amount of