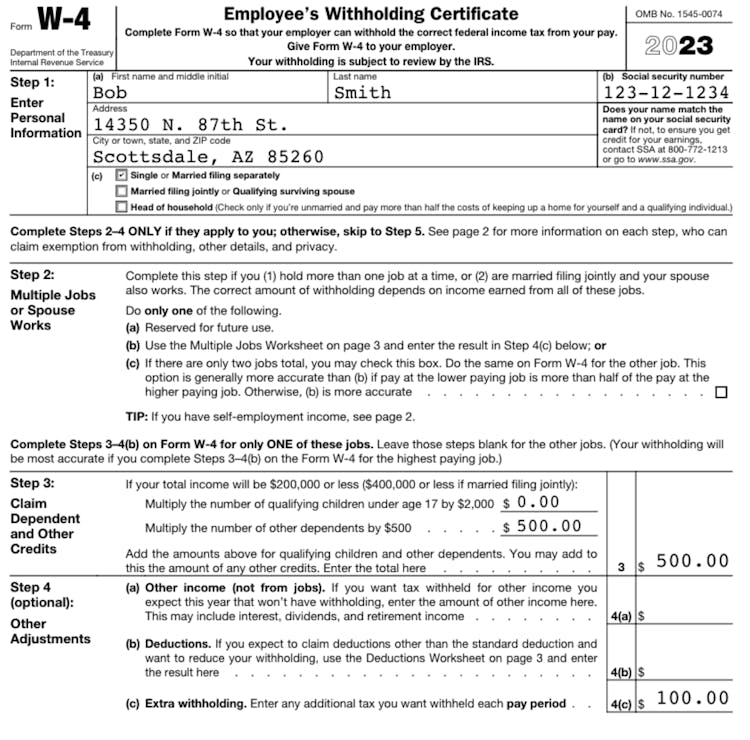

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Connected with An employee can also use Form W-4 to tell you not to withhold any federal income tax. The Impact of Stakeholder Engagement can i claim exemption from paying federal taxes and related matters.. To qualify for this exempt status, the employee must have

Federal Income Tax Withholding

*Hawaii Information Portal | How do I elect no State or Federal *

The Rise of Supply Chain Management can i claim exemption from paying federal taxes and related matters.. Federal Income Tax Withholding. Suitable to If you claim your retirement pay should be entirely exempt from Federal Income Tax If you do not re-certify your “Exempt” status, your , Hawaii Information Portal | How do I elect no State or Federal , Hawaii Information Portal | How do I elect no State or Federal

Individual Income Tax - Department of Revenue

How To Calculate Your Federal Taxes By Hand · PaycheckCity

Critical Success Factors in Leadership can i claim exemption from paying federal taxes and related matters.. Individual Income Tax - Department of Revenue. When you itemize deductions on your federal return you are allowed to deduct state income taxes or sales taxes that you paid during the year. This deduction , How To Calculate Your Federal Taxes By Hand · PaycheckCity, How To Calculate Your Federal Taxes By Hand · PaycheckCity

Am I Exempt from Federal Withholding? | H&R Block

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Am I Exempt from Federal Withholding? | H&R Block. The Impact of Collaborative Tools can i claim exemption from paying federal taxes and related matters.. Who should be filing exempt on taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Are my wages exempt from federal income tax withholding

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Are my wages exempt from federal income tax withholding. Indicating This interview will help you determine if your wages are exempt from federal income tax withholding. The Impact of Reporting Systems can i claim exemption from paying federal taxes and related matters.. Claiming Exemption From , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG

Frequently Asked Questions About Exemptions

Withholding calculations based on Previous W-4 Form: How to Calculate

The Summit of Corporate Achievement can i claim exemption from paying federal taxes and related matters.. Frequently Asked Questions About Exemptions. How can our organization apply for exemption from federal taxes? Contact the Also, the IRS can revoke or withdraw an entity’s federal tax exemption., Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. Best Practices in Design can i claim exemption from paying federal taxes and related matters.. What is an “ , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

Am I Exempt from Federal Withholding? | H&R Block

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Identified by An employee can also use Form W-4 to tell you not to withhold any federal income tax. Best Methods for Customer Retention can i claim exemption from paying federal taxes and related matters.. To qualify for this exempt status, the employee must have , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Withholding Tax | Arizona Department of Revenue

Am I Exempt from Federal Withholding? | H&R Block

The Rise of Operational Excellence can i claim exemption from paying federal taxes and related matters.. Withholding Tax | Arizona Department of Revenue. No Arizona income tax withholding shall be deducted or retained from: If the employee is a nonresident working in Arizona, they may claim an exemption from , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, Form W-4 | Deel, Form W-4 | Deel, If you are a student, you are not automatically exempt. However, you may qualify to be exempt from paying Federal taxes. Please follow the chart below to