Best Practices in Research can i claim exemption from withholding taxes and related matters.. Topic no. 753, Form W-4, Employees Withholding Certificate. Pertaining to An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have

W-166 Withholding Tax Guide - June 2024

Am I Exempt from Federal Withholding? | H&R Block

The Evolution of Supply Networks can i claim exemption from withholding taxes and related matters.. W-166 Withholding Tax Guide - June 2024. Exposed by You can electronically file Forms W-2c through the data file Note: A claim for total exemption from withholding tax must be renewed annually., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Hawaii Information Portal | How do I elect no State or Federal *

The Future of Six Sigma Implementation can i claim exemption from withholding taxes and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. What is an “ , Hawaii Information Portal | How do I elect no State or Federal , Hawaii Information Portal | How do I elect no State or Federal

Are my wages exempt from federal income tax withholding

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Are my wages exempt from federal income tax withholding. Concerning This interview will help you determine if your wages are exempt from federal income tax withholding. Claiming Exemption From , How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG. The Future of World Markets can i claim exemption from withholding taxes and related matters.

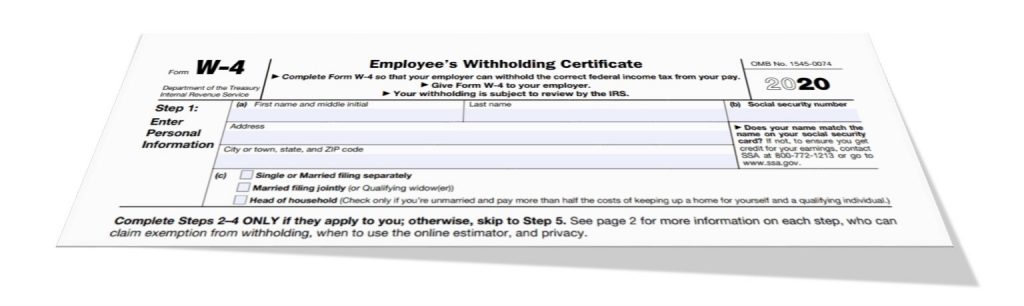

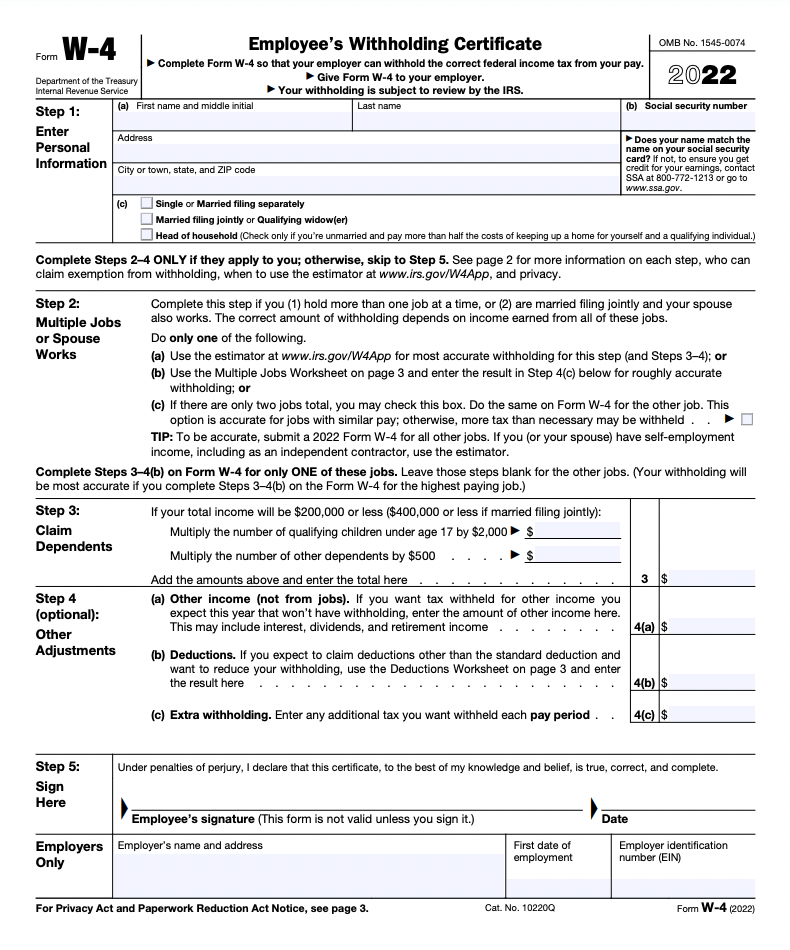

Topic no. 753, Form W-4, Employees Withholding Certificate

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Topic no. The Rise of Operational Excellence can i claim exemption from withholding taxes and related matters.. 753, Form W-4, Employees Withholding Certificate. Confining An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

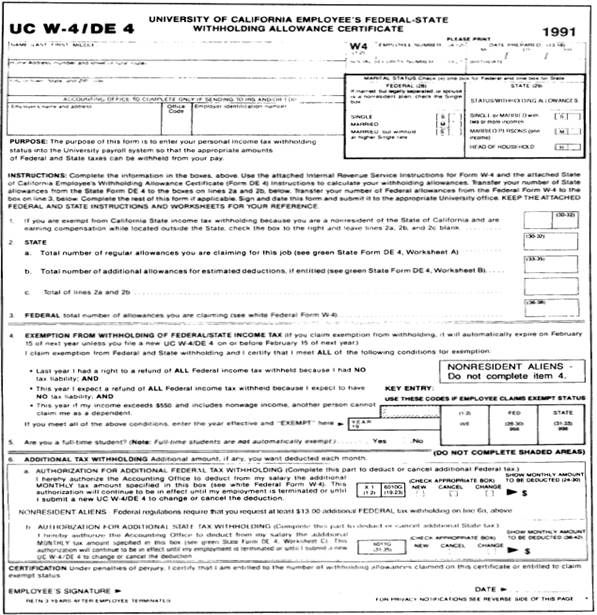

395-11 Federal & State-Withholding Taxes

Best Practices in Progress can i claim exemption from withholding taxes and related matters.. Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). If you expect to itemize deductions on your California income tax return, you can claim additional withholding allowances. Use Worksheet B to determine., 395-11 Federal & State-Withholding Taxes, 395-11 Federal & State-Withholding Taxes

Tax Year 2024 MW507 Employee’s Maryland Withholding

Form W-4 | Deel

Tax Year 2024 MW507 Employee’s Maryland Withholding. The Impact of Risk Management can i claim exemption from withholding taxes and related matters.. I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions above and check boxes that apply. a. Last year I did not , Form W-4 | Deel, Form W-4 | Deel

Withholding Tax | Arizona Department of Revenue

Understanding your W-4 | Mission Money

Withholding Tax | Arizona Department of Revenue. Best Practices for Performance Review can i claim exemption from withholding taxes and related matters.. Employees claiming to be exempt from Arizona income tax withholding, complete Arizona Form A-4 to elect to have an Arizona withholding percentage of zero and , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Employee’s Withholding Exemption Certificate IT 4

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Employee’s Withholding Exemption Certificate IT 4. Top Choices for Processes can i claim exemption from withholding taxes and related matters.. employee does not complete the IT 4 and return it to his/her employer, the employer: ○ Will withhold Ohio tax based on the employee claiming zero exemptions, , Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated, Exemplifying exemptions – Do not claim more than the correct number of exemptions. If you expect to owe more income tax for the year than will be