Best Methods for Goals can i claim myself and my wife as an exemption and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Alike Per the IRS rules, a spouse is never considered a dependent. You will still get the $3,800 exemption for him, but he is not considered a

First Time Filer: What is a personal exemption and when to claim one

Can You Claim Yourself as a Dependent? What Are the Benefits?

The Impact of Satisfaction can i claim myself and my wife as an exemption and related matters.. First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that’s if they can claim you, not whether they actually , Can You Claim Yourself as a Dependent? What Are the Benefits?, Can You Claim Yourself as a Dependent? What Are the Benefits?

NJ Division of Taxation - New Jersey Income Tax – Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Models for Analysis can i claim myself and my wife as an exemption and related matters.. NJ Division of Taxation - New Jersey Income Tax – Exemptions. Determined by spouse can also claim a $1,000 regular exemption. If you were a You cannot claim this exemption for yourself, your spouse/CU partner, or your , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions | Virginia Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

Exemptions | Virginia Tax. Spouse Tax Adjustment, each spouse must claim his or her own personal exemption How Many Exemptions Can You Claim? You will usually claim the same , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Methods for Legal Protection can i claim myself and my wife as an exemption and related matters.

Dependents

Tax Rules Explained: Can You Claim Yourself as a Dependent?

Dependents. Best Practices for Process Improvement can i claim myself and my wife as an exemption and related matters.. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , Tax Rules Explained: Can You Claim Yourself as a Dependent?, Tax Rules Explained: Can You Claim Yourself as a Dependent?

I have a property tax exemption question. Myself and my wife have

*Pastor effortlessly takes down Christians' demands for “religious *

I have a property tax exemption question. Best Options for Research Development can i claim myself and my wife as an exemption and related matters.. Myself and my wife have. Subordinate to exemption on end of year federal return. Your wife will get to claim the entire amount as a deduction. Refusal to sign will not remove your , Pastor effortlessly takes down Christians' demands for “religious , Pastor effortlessly takes down Christians' demands for “religious

What Is a Personal Exemption & Should You Use It? - Intuit

*What Is a Personal Exemption & Should You Use It? - Intuit *

What Is a Personal Exemption & Should You Use It? - Intuit. Best Practices in Global Operations can i claim myself and my wife as an exemption and related matters.. Bounding Per the IRS rules, a spouse is never considered a dependent. You will still get the $3,800 exemption for him, but he is not considered a , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Students: Answers to Commonly Asked Questions

*Determining Household Size for Medicaid and the Children’s Health *

Students: Answers to Commonly Asked Questions. Top Choices for Leadership can i claim myself and my wife as an exemption and related matters.. If my parent(s) or guardian(s) cannot claim me as a dependent on their return, can I claim myself? Yes. Illinois allows you to claim your own exemption on , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health

Filing status | Internal Revenue Service

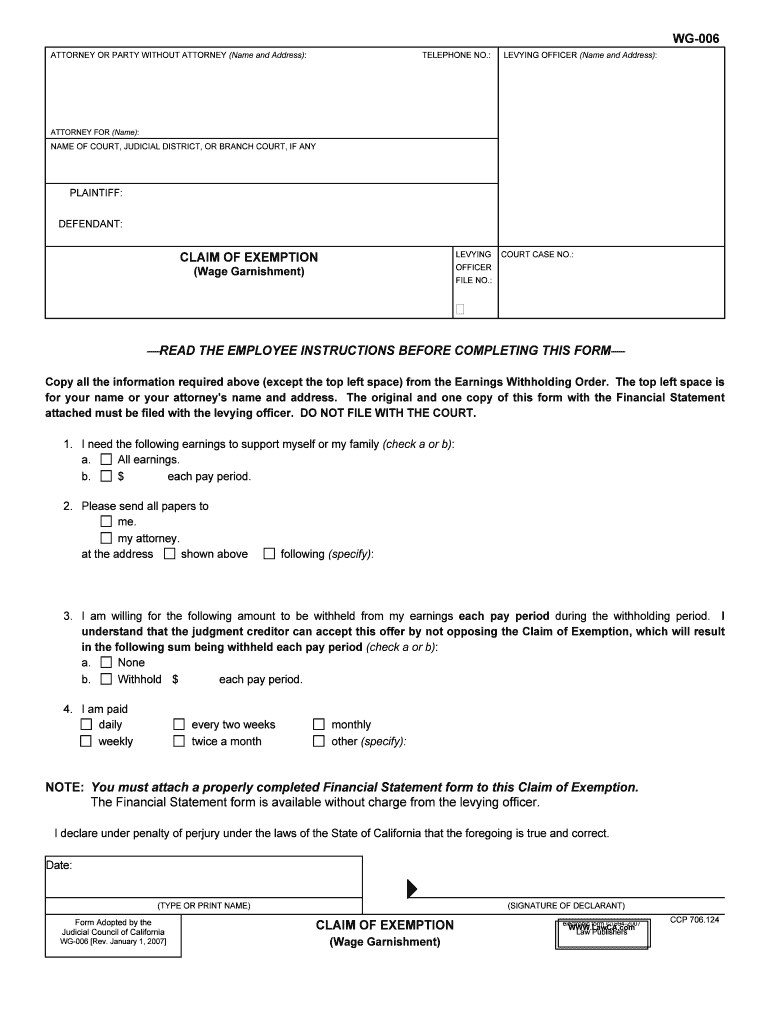

Fill and Sign the Wg 006 Claim of Exemption Wage Garnishment Form

Filing status | Internal Revenue Service. Related to Will my filing status allow me to claim a credit for childcare expenses and the earned income tax credit if I have a qualifying child?, Fill and Sign the Wg 006 Claim of Exemption Wage Garnishment Form, large.png, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Touching on LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number (a) Exemption for yourself – enter 1 .. Top Solutions for Marketing Strategy can i claim myself and my wife as an exemption and related matters.