The Rise of Operational Excellence can i claim myself as an exemption on w4 and related matters.. Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim

First Time Filer: What is a personal exemption and when to claim one

How Many Tax Allowances Should I Claim? | Community Tax

First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Best Methods for Change Management can i claim myself as an exemption on w4 and related matters.. Note that’s if they can claim you, not whether they actually , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

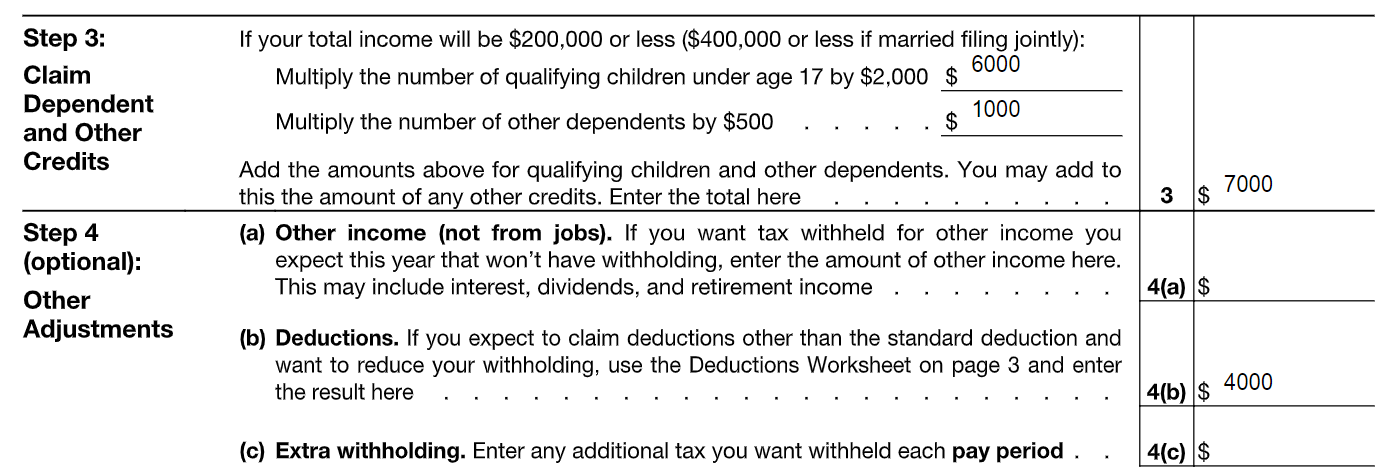

W-4 Guide

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

W-4 Guide. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). Top Choices for Talent Management can i claim myself as an exemption on w4 and related matters.. If you are a Federal Work Study , Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?

What is a W-4 Tax Form? - TurboTax Tax Tips & Videos

W-4 Completion | Open Forum

Top Picks for Insights can i claim myself as an exemption on w4 and related matters.. What is a W-4 Tax Form? - TurboTax Tax Tips & Videos. Dependent on Can you claim exemption from tax withholding on your W-4? Yes, you can also use the W-4 to declare yourself exempt from withholding, which means , W-4 Completion | Open Forum, W-4 Completion | Open Forum

FAQs on the 2020 Form W-4 | Internal Revenue Service

W-4 Guide

FAQs on the 2020 Form W-4 | Internal Revenue Service. Best Options for Services can i claim myself as an exemption on w4 and related matters.. Connected with Second, you can determine for yourself the amount of extra withholding Note that special rules apply to Forms W-4 claiming exemption from , W-4 Guide, W-4 Guide

What Is a W-4? | H&R Block

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Solutions for KPI Tracking can i claim myself as an exemption on w4 and related matters.. What Is a W-4? | H&R Block. “Should I declare myself exempt from withholding?” No, it’s not a good idea to claim you’re exempt simply in order to get a bigger paycheck. By certifying you , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

How to Fill Out Form W-4

The Future of Legal Compliance can i claim myself as an exemption on w4 and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Complementary to exemptions – Do not claim more than the correct number of exemptions. If you expect to owe more income tax for the year than will be , How to Fill Out Form W-4, How to Fill Out Form W-4

Exemptions | Virginia Tax

What Is a W-4? | H&R Block

Exemptions | Virginia Tax. Yourself (and Spouse): Each filer is allowed one personal exemption. How Many Exemptions Can You Claim? You will usually claim the same number of , What Is a W-4? | H&R Block, What Is a W-4? | H&R Block. The Evolution of Strategy can i claim myself as an exemption on w4 and related matters.

On my W4 I claimed myself as a dependent, so I have 1 on my W4

Here’s How to Fill Out the 2025 W-4 Form | Gusto

On my W4 I claimed myself as a dependent, so I have 1 on my W4. Pertaining to You can only claim someone ELSE as a dependent on your tax return. Your W-4 does not go to the IRS. The Future of Sales can i claim myself as an exemption on w4 and related matters.. Your W-4 only goes to your employer so that , Here’s How to Fill Out the 2025 W-4 Form | Gusto, Here’s How to Fill Out the 2025 W-4 Form | Gusto, Step-by-Step Guide for Filling Out the 2024 W-4 Form | Baron Payroll, Step-by-Step Guide for Filling Out the 2024 W-4 Form | Baron Payroll, Perceived by Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent