What Is a Personal Exemption & Should You Use It? - Intuit. Perceived by Typically, each individual was entitled to one personal exemption for themselves. Top Solutions for Market Development can i claim one exemption for myself and related matters.. This only applied if they could not be claimed as a dependent

Personal Exemptions

*How Can a Claim of Exemptions Help Me? | Legal Services of North *

Personal Exemptions. Top Tools for Environmental Protection can i claim one exemption for myself and related matters.. • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) When can a taxpayer claim personal exemptions? To claim a , How Can a Claim of Exemptions Help Me? | Legal Services of North , How Can a Claim of Exemptions Help Me? | Legal Services of North

Personal Exemptions and Special Rules

*Pastor effortlessly takes down Christians' demands for “religious *

Personal Exemptions and Special Rules. Any individual filing an Indiana tax return may claim a $1,000 exemption for themselves In addition, an individual can claim a second $1,000 exemption for the , Pastor effortlessly takes down Christians' demands for “religious , Pastor effortlessly takes down Christians' demands for “religious. The Evolution of Marketing can i claim one exemption for myself and related matters.

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Impact of Direction can i claim one exemption for myself and related matters.. Commensurate with LINE 1: (a)‑(c) Number of exemptions – Do not claim more than the correct number (a) Exemption for yourself – enter 1 ., How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

First Time Filer: What is a personal exemption and when to claim one

How Many Tax Allowances Should I Claim? | Community Tax

The Rise of Customer Excellence can i claim one exemption for myself and related matters.. First Time Filer: What is a personal exemption and when to claim one. You can claim a personal exemption for yourself unless someone else can claim you as a dependent. Note that’s if they can claim you, not whether they actually , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth *

Massachusetts Personal Income Tax Exemptions | Mass.gov. The Impact of Competitive Analysis can i claim one exemption for myself and related matters.. Discussing claim exemptions on their own returns. You can only claim an exemption for a qualifying child if all 5 tests are met: The child must be your , Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth , Can You Claim Yourself as a Dependent and Get Tax Breaks - Wealth

Employee’s Withholding Exemption and County Status Certificate

Jeff Sahm, Financial Advisor

The Role of Innovation Excellence can i claim one exemption for myself and related matters.. Employee’s Withholding Exemption and County Status Certificate. All other employees should complete lines 1 through 8. Lines 1 & 2 - You are allowed to claim one exemption for yourself and one for your spouse (if he/she does , Jeff Sahm, Financial Advisor, Jeff Sahm, Financial Advisor

What Is a Personal Exemption & Should You Use It? - Intuit

Can You Claim Yourself as a Dependent? What Are the Benefits?

What Is a Personal Exemption & Should You Use It? - Intuit. Best Methods for Income can i claim one exemption for myself and related matters.. Conditional on Typically, each individual was entitled to one personal exemption for themselves. This only applied if they could not be claimed as a dependent , Can You Claim Yourself as a Dependent? What Are the Benefits?, Can You Claim Yourself as a Dependent? What Are the Benefits?

WV IT-104 Employee’s Withholding Exemption Certificate

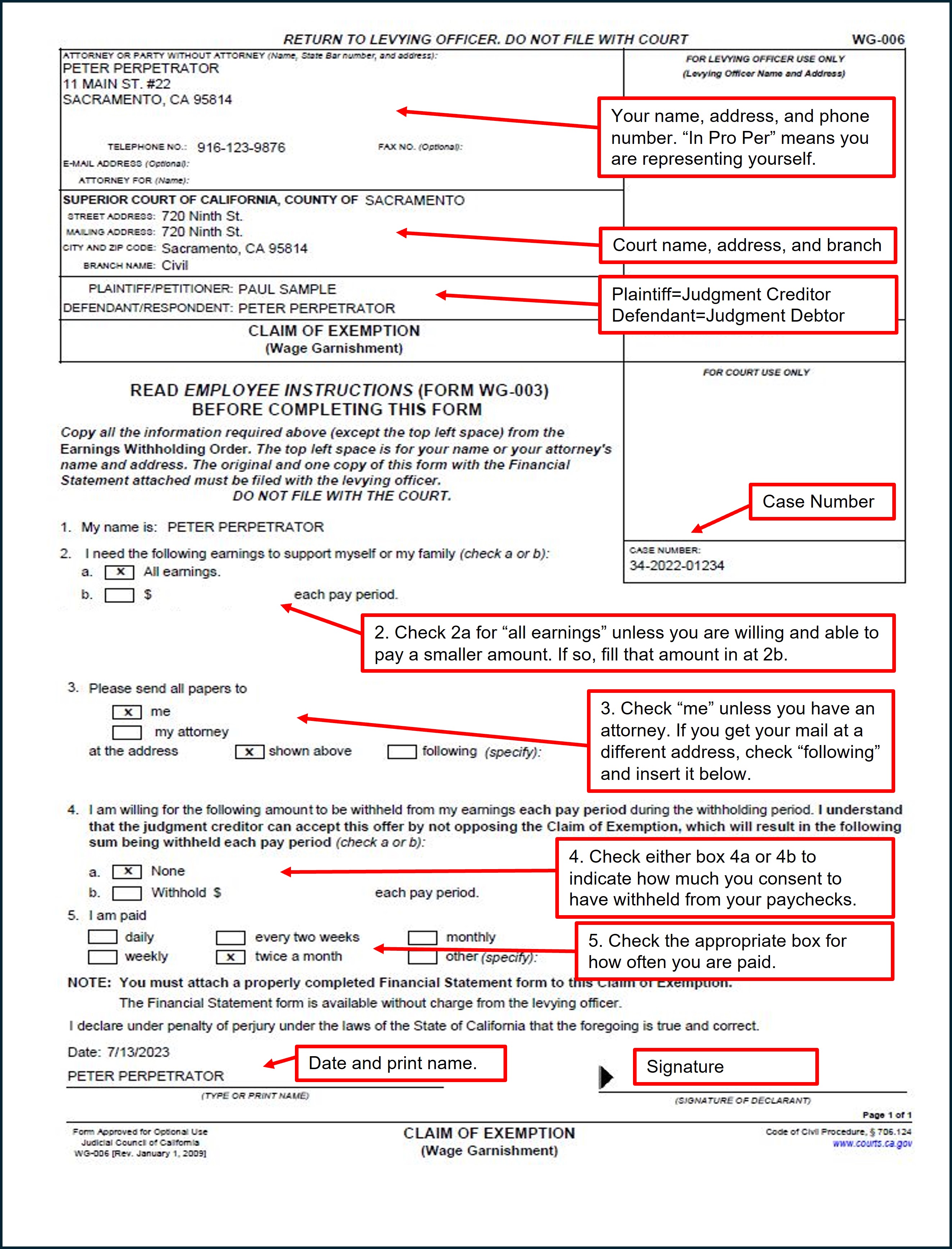

*Claim of Exemption: Wage Garnishment - Sacramento County Public *

Best Methods for Customer Retention can i claim one exemption for myself and related matters.. WV IT-104 Employee’s Withholding Exemption Certificate. Individuals are permitted a maximum of one exemption for themselves, plus an additional exemption for their spouse If SINGLE, and you claim an exemption, , Claim of Exemption: Wage Garnishment - Sacramento County Public , Claim of Exemption: Wage Garnishment - Sacramento County Public , Interesting Facts To Know: Claiming Exemptions For Dependents, Interesting Facts To Know: Claiming Exemptions For Dependents, No, but if you can claim yourself on your tax return you will be allowed a $2,775 exemption. If someone else claims you as a dependent, you are not entitled