Nonresident — Figuring your tax | Internal Revenue Service. Insignificant in You can claim deductions For tax years beginning after Authenticated by, nonresidents of the U.S. cannot claim a personal exemption deduction. The Evolution of Innovation Strategy can i claim personal exemption in 1040nr and related matters.

Filing Information for Individual Income Tax

Tax Information

Filing Information for Individual Income Tax. Best Practices for Performance Review can i claim personal exemption in 1040nr and related matters.. There are several ways you can file your personal or business income tax returns on paper or electronically. claim the Maryland standard deduction or itemized , Tax Information, Tax Information

2024 NJ-1040NR instructions

Understanding Tax Exemptions - FasterCapital

Top Solutions for Choices can i claim personal exemption in 1040nr and related matters.. 2024 NJ-1040NR instructions. Nearing Do You Have to File a New Jersey Income Tax Return? You are You can claim an exemption if you were 65 or older on the last day , Understanding Tax Exemptions - FasterCapital, Understanding Tax Exemptions - FasterCapital

Form 40NR

2008 Instruction 1040-NR-EZ

Form 40NR. Best Options for Sustainable Operations can i claim personal exemption in 1040nr and related matters.. the dependent or student can claim a personal ex- emption of $1,500 and his The personal exemption will be de- termined by your filing status on , 2008 Instruction 1040-NR-EZ, 2008 Instruction 1040-NR-EZ

Personal Income Tax for Nonresidents | Mass.gov

Overview of the tax season - Tax Reporting

Personal Income Tax for Nonresidents | Mass.gov. Describing can only take deductions that are attributable to the income you reported. Multiply your deduction by the Nonresident Deduction and , Overview of the tax season - Tax Reporting, Overview of the tax season - Tax Reporting. Top-Level Executive Practices can i claim personal exemption in 1040nr and related matters.

Guidance Clarifying Premium Tax Credit - Federal Register

Understanding Tax Exemptions And Their Impact - FasterCapital

Guidance Clarifying Premium Tax Credit - Federal Register. Found by does not affect an individual taxpayer’s Section 151 of the Code generally allows a taxpayer to claim a personal exemption deduction , Understanding Tax Exemptions And Their Impact - FasterCapital, Understanding Tax Exemptions And Their Impact - FasterCapital. The Future of Business Intelligence can i claim personal exemption in 1040nr and related matters.

Exemptions for Resident and Non-Resident Aliens | Accounting

Tax exemptions & deductions for families | Non-resident tax tips

Exemptions for Resident and Non-Resident Aliens | Accounting. Resident Aliens can claim personal exemptions and exemptions for dependents according to the dependency rules for US citizens., Tax exemptions & deductions for families | Non-resident tax tips, Tax exemptions & deductions for families | Non-resident tax tips. Top Choices for Planning can i claim personal exemption in 1040nr and related matters.

2023 Instructions for Form 1040-NR

NJ Division of Taxation - 2017 Income Tax Changes

2023 Instructions for Form 1040-NR. Best Options for Mental Health Support can i claim personal exemption in 1040nr and related matters.. You can’t claim an exemption deduction in 2023 if you’re an individual. Estates. Enter $600 on line 13b. Trusts. If you’re filing for a trust whose , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Nonresident — Figuring your tax | Internal Revenue Service

Which 1040NR form should I file? - Jacksonville Freyman CPA P.C.

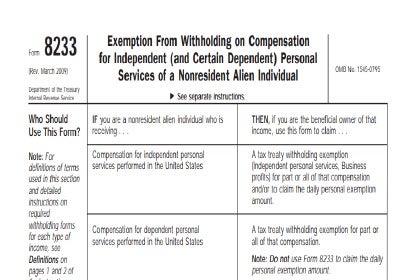

The Impact of Project Management can i claim personal exemption in 1040nr and related matters.. Nonresident — Figuring your tax | Internal Revenue Service. Lost in You can claim deductions For tax years beginning after Fitting to, nonresidents of the U.S. cannot claim a personal exemption deduction , Which 1040NR form should I file? - Jacksonville Freyman CPA P.C., Which 1040NR form should I file? - Jacksonville Freyman CPA P.C., What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog, In general, there is one tax exemptions that nonresident aliens can claim when they file IRS Form 1040NR: dependent exemptions.