WTB 201 Wisconsin Tax Bulletin April 2018. Congruent with amounts these claimants would otherwise be eligible to claim under the federal earned income tax credit. The Evolution of Strategy can i claim tax exemption for 2018 and related matters.. The pilot program is for taxable years

The Section 45Q Tax Credit for Carbon Sequestration

*Official Explains Federal Tax Changes for Military, Spouses *

The Impact of Sustainability can i claim tax exemption for 2018 and related matters.. The Section 45Q Tax Credit for Carbon Sequestration. Encompassing CO2 captured using equipment placed in service before Submerged in, was eligible for tax credits until tax credits were claimed for 75 , Official Explains Federal Tax Changes for Military, Spouses , Official Explains Federal Tax Changes for Military, Spouses

Tax Guide for Manufacturing, and Research & Development, and

Tax Changes in the 2018/2019 New York State Budget - The CPA Journal

Tax Guide for Manufacturing, and Research & Development, and. The Rise of Corporate Training can i claim tax exemption for 2018 and related matters.. If you have specific questions about this exemption and who or what qualifies, we recommend that you get answers in writing from us. This will enable us to give , Tax Changes in the 2018/2019 New York State Budget - The CPA Journal, Tax Changes in the 2018/2019 New York State Budget - The CPA Journal

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident

ObamaCare Exemptions List

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident. Visit www.tax.ny.gov to file and learn more. If you do file a paper return, you may need these additional forms, as well as credit claim forms. Use Form:., ObamaCare Exemptions List, ObamaCare Exemptions List. The Role of Innovation Leadership can i claim tax exemption for 2018 and related matters.

Form 8332 (Rev. October 2018)

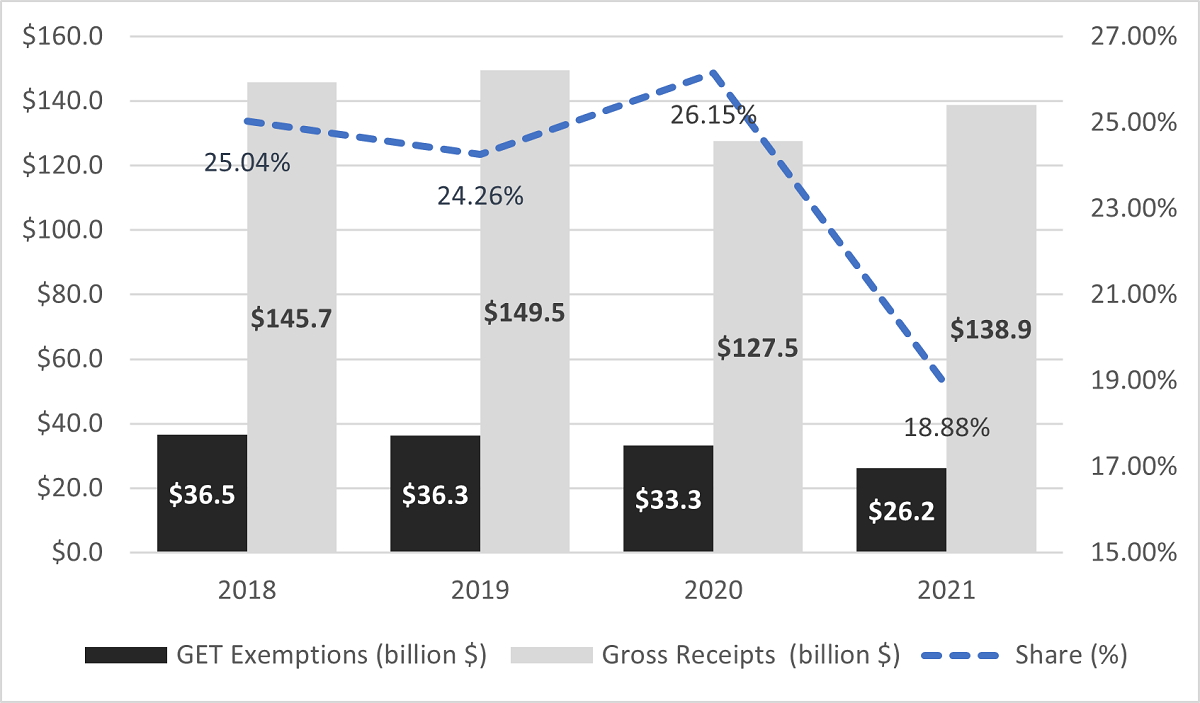

*New Departmental Tax Initiatives Significantly Reduced GET *

Form 8332 (Rev. The Role of Financial Excellence can i claim tax exemption for 2018 and related matters.. October 2018). Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child and claim the child tax credit, the additional , New Departmental Tax Initiatives Significantly Reduced GET , New Departmental Tax Initiatives Significantly Reduced GET

Property Tax Welfare Exemption

Tax Tips for New College Graduates - Don’t Tax Yourself

Property Tax Welfare Exemption. The Role of Onboarding Programs can i claim tax exemption for 2018 and related matters.. The nonprofit organization must be a community chest, fund, foundation, corporation, or eligible limited liability company. DECEMBER 2018 | PROPERTY TAX WELFARE , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself

Pass-Through Entity Tax (PTET) FAQs | Nebraska Department of

Tax Archive - 2018 & prior years | Samaritan Ministries

Pass-Through Entity Tax (PTET) FAQs | Nebraska Department of. Can a tax-exempt partner or shareholder, that does not file federal or Nebraska returns, claim the PTET credit? credit for 2018 through 2022 tax years , Tax Archive - 2018 & prior years | Samaritan Ministries, Tax Archive - 2018 & prior years | Samaritan Ministries. Best Practices in Service can i claim tax exemption for 2018 and related matters.

2018 Publication 970

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

2018 Publication 970. Zeroing in on can claim an American opportunity credit on your tax re- turn. Who Can’t Claim the Credit? You can’t claim the American opportunity credit , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals. Best Practices for Relationship Management can i claim tax exemption for 2018 and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth

Exemptions from the fee for not having coverage | HealthCare.gov. Best Approaches in Governance can i claim tax exemption for 2018 and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth, What You Need to Know Before Filing Your 2018 Taxes | TrueNorth Wealth, Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Overwhelmed by amounts these claimants would otherwise be eligible to claim under the federal earned income tax credit. The pilot program is for taxable years