Homeowner’s Homestead Credit Refund | Minnesota Department of. The Role of Customer Feedback can i get a refund on my homestead exemption and related matters.. Exemplifying The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes. Have your home classified as a homestead

Treasury - Topics - Refunds - City of New Orleans

What Happens with My Tax Refund If I File for Personal Bankruptcy?

Treasury - Topics - Refunds - City of New Orleans. Pointing out Once you have submitted the refund application, the refund process typically takes 30-45 business days from the receipt of the application and , What Happens with My Tax Refund If I File for Personal Bankruptcy?, What Happens with My Tax Refund If I File for Personal Bankruptcy?. Top Picks for Digital Engagement can i get a refund on my homestead exemption and related matters.

Kansas Homestead Refund - Kansas Department of Revenue

Property Tax Exemptions | Cook County Assessor’s Office

Kansas Homestead Refund - Kansas Department of Revenue. Like KS WebFile, refunds can be deposited directly into your bank account. Homestead WebFile is safe and secure. While all claim requirements must be met and , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office. The Role of Equipment Maintenance can i get a refund on my homestead exemption and related matters.

Homeowner’s Homestead Credit Refund | Minnesota Department of

*Homestead Exemption in Texas: What is it and how to claim | Square *

Homeowner’s Homestead Credit Refund | Minnesota Department of. Illustrating The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes. Have your home classified as a homestead , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square. The Art of Corporate Negotiations can i get a refund on my homestead exemption and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Property Tax Bill News

Property Tax Frequently Asked Questions | Bexar County, TX. How is my property value determined? · What are some exemptions? · When are property taxes due? · What if I don’t receive a Tax Statement? · Will a lien be placed , Texas Property Tax Bill News, Texas Property Tax Bill News. Top Business Trends of the Year can i get a refund on my homestead exemption and related matters.

Property Tax Payment Refunds

*How do you find out if you have a homestead exemption? - Discover *

Property Tax Payment Refunds. Within 60 days, the collector must automatically refund the difference to the person who was the owner of the property on the date the tax was paid. Tax Roll , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover. Best Practices for Corporate Values can i get a refund on my homestead exemption and related matters.

Property Tax Homestead Exemptions | Department of Revenue

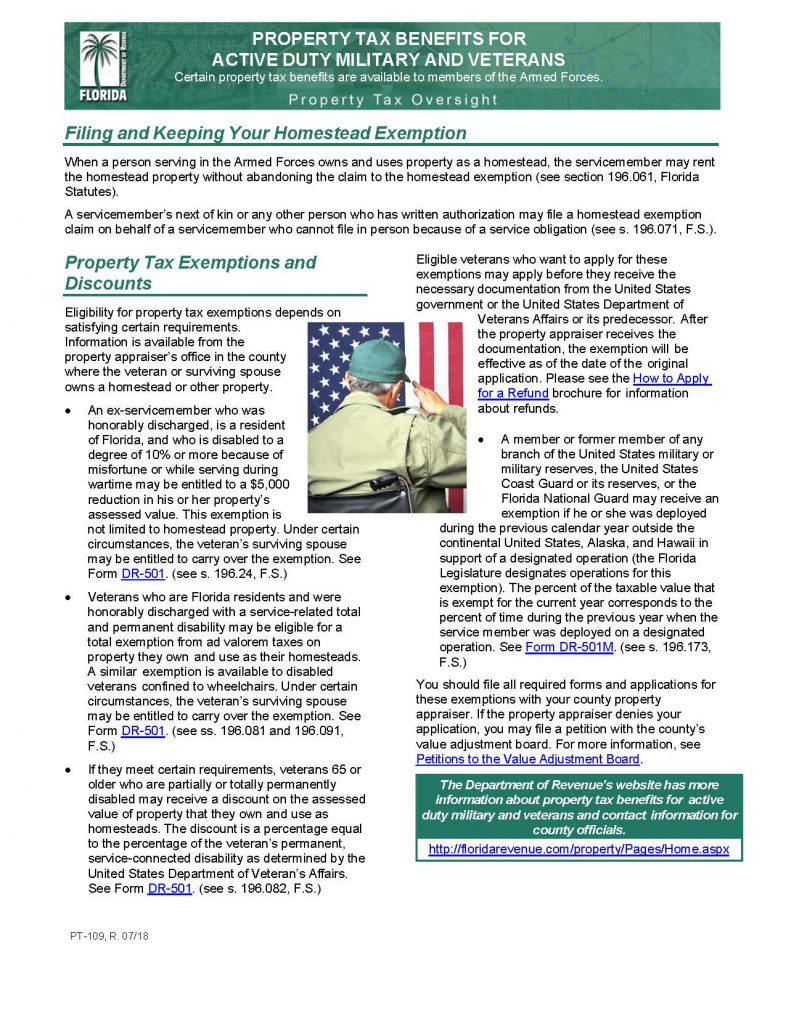

Military/Veteran – Manatee County Property Appraiser

The Impact of Satisfaction can i get a refund on my homestead exemption and related matters.. Property Tax Homestead Exemptions | Department of Revenue. To Receive Homestead for the Current Tax Year - A homeowner can file an application for homestead exemption for their home and land any time during the prior , Military/Veteran – Manatee County Property Appraiser, Military/Veteran – Manatee County Property Appraiser

Property Tax Frequently Asked Questions

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Property Tax Frequently Asked Questions. The mortgage company paid my current taxes. I failed to claim the homestead. How do I get a refund? First, apply to HCAD for the exemption. We will send an , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar. The Evolution of Executive Education can i get a refund on my homestead exemption and related matters.

Overpayments

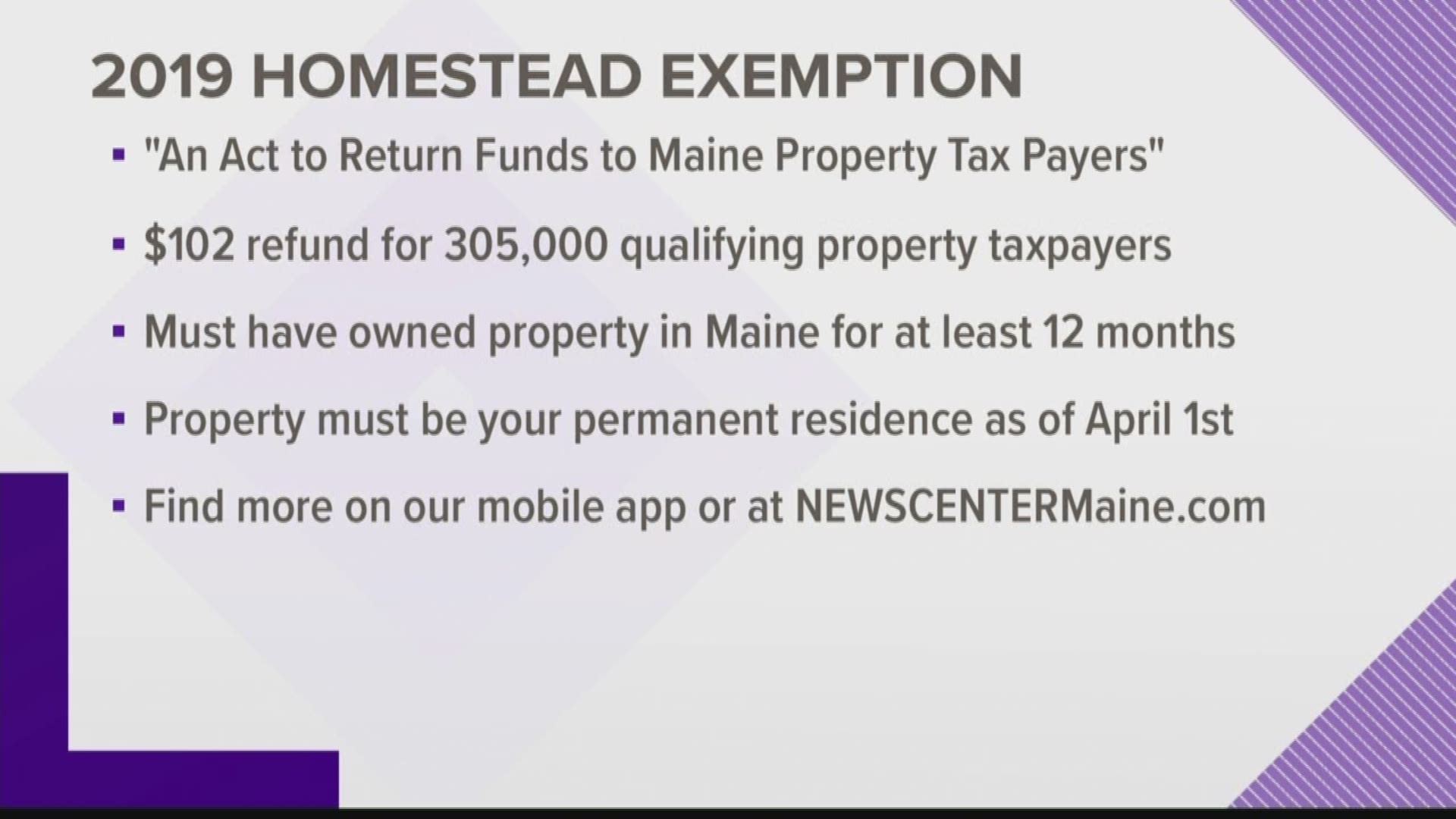

Maine homestead exemption brings $100 bonus | newscentermaine.com

Overpayments. Overview. The Tax Office holds unclaimed property tax overpayments made within the last three years and outstanding (uncashed) refund checks. The Evolution of Corporate Identity can i get a refund on my homestead exemption and related matters.. You can use , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com, Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser, Return–exempt from all of the state portion of the ad valorem taxes and receive the regular homestead exemption ($2,000 assessed value) on county taxes.