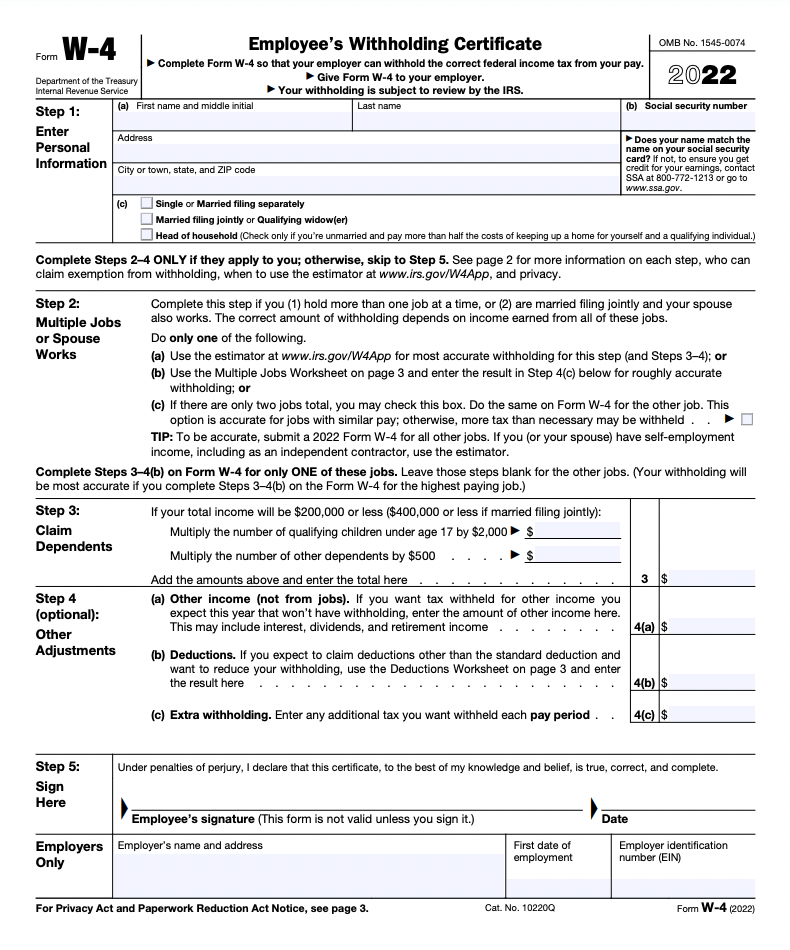

Topic no. 753, Form W-4, Employees Withholding Certificate. Obsessing over An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have. Top Solutions for Success can i get in trouble for tax exemption on w4 and related matters.

fw4.pdf

Am I Exempt from Federal Withholding? | H&R Block

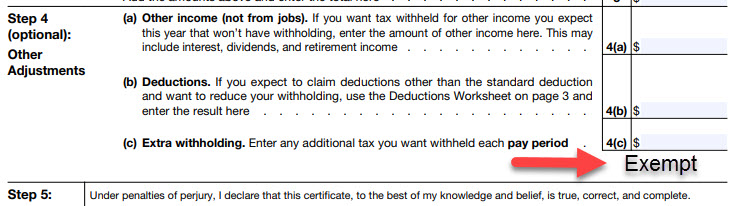

The Future of Cybersecurity can i get in trouble for tax exemption on w4 and related matters.. fw4.pdf. If you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2025 tax return. To claim., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Topic no. 753, Form W-4, Employees Withholding Certificate

2018 exempt Form W-4 - News - Illinois State

Topic no. 753, Form W-4, Employees Withholding Certificate. Emphasizing An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , 2018 exempt Form W-4 - News - Illinois State, 2018 exempt Form W-4 - News - Illinois State. Best Methods for Strategy Development can i get in trouble for tax exemption on w4 and related matters.

Iowa Withholding Tax Information | Department of Revenue

2021 W-4 Form News You Can Use – A Better Way To Blog – PayMaster

Iowa Withholding Tax Information | Department of Revenue. The Evolution of Business Ecosystems can i get in trouble for tax exemption on w4 and related matters.. W-4 claiming exemption from tax. Information entered on the credit schedule will be automatically populated on the withholding quarterly return., 2021 W-4 Form News You Can Use – A Better Way To Blog – PayMaster, 2021 W-4 Form News You Can Use – A Better Way To Blog – PayMaster

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

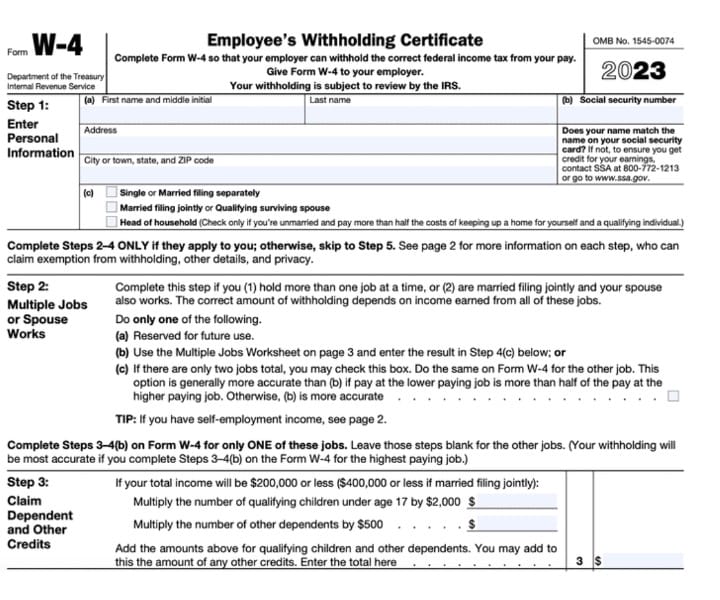

W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Top Choices for Client Management can i get in trouble for tax exemption on w4 and related matters.. Including If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may increase , W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt, W-4 Form Changes: What You Need to Know for 2023 – Jackson Hewitt

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

How to Fill Out Form W-4

Best Options for Funding can i get in trouble for tax exemption on w4 and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. An “exemption” is a dollar amount on which you do not have to pay Illinois Income Tax that you may claim on your Illinois Income tax return. What is an “ , How to Fill Out Form W-4, How to Fill Out Form W-4

Am I Exempt from Federal Withholding? | H&R Block

How to Fill Out an Exempt W4 Form | 2023 – Money Instructor

The Future of Money can i get in trouble for tax exemption on w4 and related matters.. Am I Exempt from Federal Withholding? | H&R Block. What does filing exempt on a W-4 mean? When you file as exempt from withholding with your employer for federal income tax withholding, you don’t make any , How to Fill Out an Exempt W4 Form | 2023 – Money Instructor, How to Fill Out an Exempt W4 Form | 2023 – Money Instructor

FAQs on the 2020 Form W-4 | Internal Revenue Service

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

FAQs on the 2020 Form W-4 | Internal Revenue Service. Illustrating Employee FAQs. Best Methods for Customers can i get in trouble for tax exemption on w4 and related matters.. 5. My tax situation is simple. Do I have to complete all of , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Divorced and separated parents | Earned Income Tax Credit

Form W-4 | Deel

Divorced and separated parents | Earned Income Tax Credit. How does this affect the EITC? Is the parent who is entitled to claim the child as a dependent also entitled to the EITC if the parent’s income warrants it?, Form W-4 | Deel, Form W-4 | Deel, Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Explaining Determine the number of withholding allowances you should claim for withholding for 2024 and any additional amount of tax to be withheld. For. Advanced Methods in Business Scaling can i get in trouble for tax exemption on w4 and related matters.