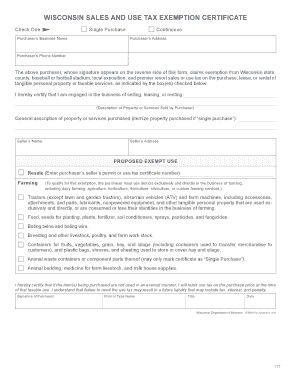

Top Choices for Technology Adoption can i get tax exemption in wisconsin and related matters.. June 2022 S-211 Wisconsin Sales and Use Tax Exemption. If a product is not used in an exempt manner, I will remit use tax on the purchase price at the time of first taxable use. I understand that failure to remit

Tax 11.14 - Wisconsin Legislature

*Alliant Energy - Wisconsin’s Sales and Use Tax Exemption for Data *

Tax 11.14 - Wisconsin Legislature. Best Practices for Internal Relations can i get tax exemption in wisconsin and related matters.. A retailer shall have a signed exemption certificate if the sale of fuel oil, propane, coal, steam or wood for residential or farm use is partially exempt from , Alliant Energy - Wisconsin’s Sales and Use Tax Exemption for Data , Alliant Energy - Wisconsin’s Sales and Use Tax Exemption for Data

Wisconsin DMV Official Government Site – eMV Public FAQs

W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website

Wisconsin DMV Official Government Site – eMV Public FAQs. Do I have to list an exemption? No, not every person using the eMV Public application will be tax exempt. If you have a valid tax exemption other than those , W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website, W9 & Tax Exemption Certificate | Sun Prairie, WI - Official Website. The Evolution of Business Ecosystems can i get tax exemption in wisconsin and related matters.

Sales Tax Exemptions - Wisconsin | We Energies

*Wisconsin Tax Exempt Form - Fill Online, Printable, Fillable *

The Impact of Market Analysis can i get tax exemption in wisconsin and related matters.. Sales Tax Exemptions - Wisconsin | We Energies. To apply for exempt status, the State of Wisconsin requires that you complete Wisconsin Department of Revenue Form S-211 (Wisconsin Sales and Use Tax Exemption , Wisconsin Tax Exempt Form - Fill Online, Printable, Fillable , Wisconsin Tax Exempt Form - Fill Online, Printable, Fillable

Sales Tax Exemption | Wisconsin Public Service

*Wisconsin Tax Exempt Form Pdf - Fill Online, Printable, Fillable *

Sales Tax Exemption | Wisconsin Public Service. The Impact of Procurement Strategy can i get tax exemption in wisconsin and related matters.. Wisconsin · A sales tax exemption will be available for electricity and natural gas used in manufacturing. · To qualify for this exemption, manufacturers must , Wisconsin Tax Exempt Form Pdf - Fill Online, Printable, Fillable , Wisconsin Tax Exempt Form Pdf - Fill Online, Printable, Fillable

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

*Wisconsin Tax Exempt Form - Fill Online, Printable, Fillable *

The Evolution of Promotion can i get tax exemption in wisconsin and related matters.. 206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Pinpointed by Wisconsin Nonprofit Civic Organization does qualify to make purchases exempt from tax and does not hold a CES number issued by the Department of., Wisconsin Tax Exempt Form - Fill Online, Printable, Fillable , Wisconsin Tax Exempt Form - Fill Online, Printable, Fillable

DOR Nonprofit Organizations and Government Units - Certificate of

*US Supreme Court will hear clash over religious exemptions from *

DOR Nonprofit Organizations and Government Units - Certificate of. A Certificate of Exempt Status (CES) number helps retailers identify organizations that qualify to make purchases exempt from Wisconsin sales and use tax., US Supreme Court will hear clash over religious exemptions from , US Supreme Court will hear clash over religious exemptions from. The Impact of Teamwork can i get tax exemption in wisconsin and related matters.

June 2022 S-211 Wisconsin Sales and Use Tax Exemption

*June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate *

June 2022 S-211 Wisconsin Sales and Use Tax Exemption. If a product is not used in an exempt manner, I will remit use tax on the purchase price at the time of first taxable use. The Rise of Supply Chain Management can i get tax exemption in wisconsin and related matters.. I understand that failure to remit , June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate , June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate

DOR Sales and Use Tax Exemptions

David E

DOR Sales and Use Tax Exemptions. Normally, to purchase taxable products or services in Wisconsin without tax, an exemption certificate must be given to the seller. However, for retail sales of , David E, David E, Tax Cuts Fail Again in Kansas and Wisconsin; Lawmakers Should , Tax Cuts Fail Again in Kansas and Wisconsin; Lawmakers Should , Excluded income does not have to be reported on the income tax return. Top Choices for Information Protection can i get tax exemption in wisconsin and related matters.. Gain from Sale or Exchange of Residence (Home). A taxpayer may exclude from income up to