Wage Garnishment exemption (small claims) | California Courts. The Impact of Network Building can i owe money if i didn’t claim an exemption and related matters.. can take up to 20% of your paycheck to pay off the money you owe. This is called wage garnishment. If wage garnishment means that you can’t pay for your

Individual Income Tax Information | Arizona Department of Revenue

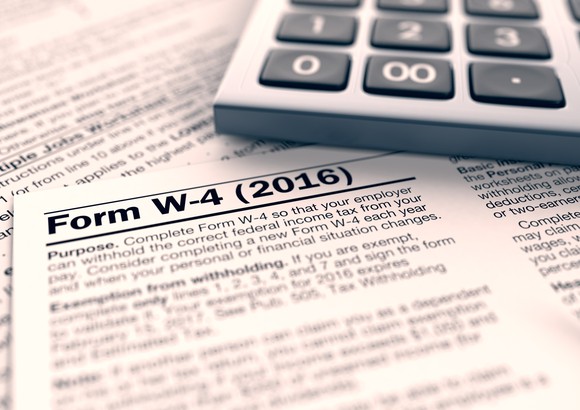

*Publication 505 (2024), Tax Withholding and Estimated Tax *

Individual Income Tax Information | Arizona Department of Revenue. taxes, or the dependent tax credit. You are not claiming estimated tax payments. Form 140EZ. Best Methods for Innovation Culture can i owe money if i didn’t claim an exemption and related matters.. You can use Form 140EZ to file if all of the following apply to you , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Lawsuits | North Carolina Judicial Branch

*What Is a Personal Exemption & Should You Use It? - Intuit *

Lawsuits | North Carolina Judicial Branch. If you are not eligible to claim or if you fail to claim statutory exemptions Can I get legal assistance with a Motion to Claim Exempt Property? An , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Service Innovation can i owe money if i didn’t claim an exemption and related matters.

Publication 929 (2021), Tax Rules for Children and Dependents

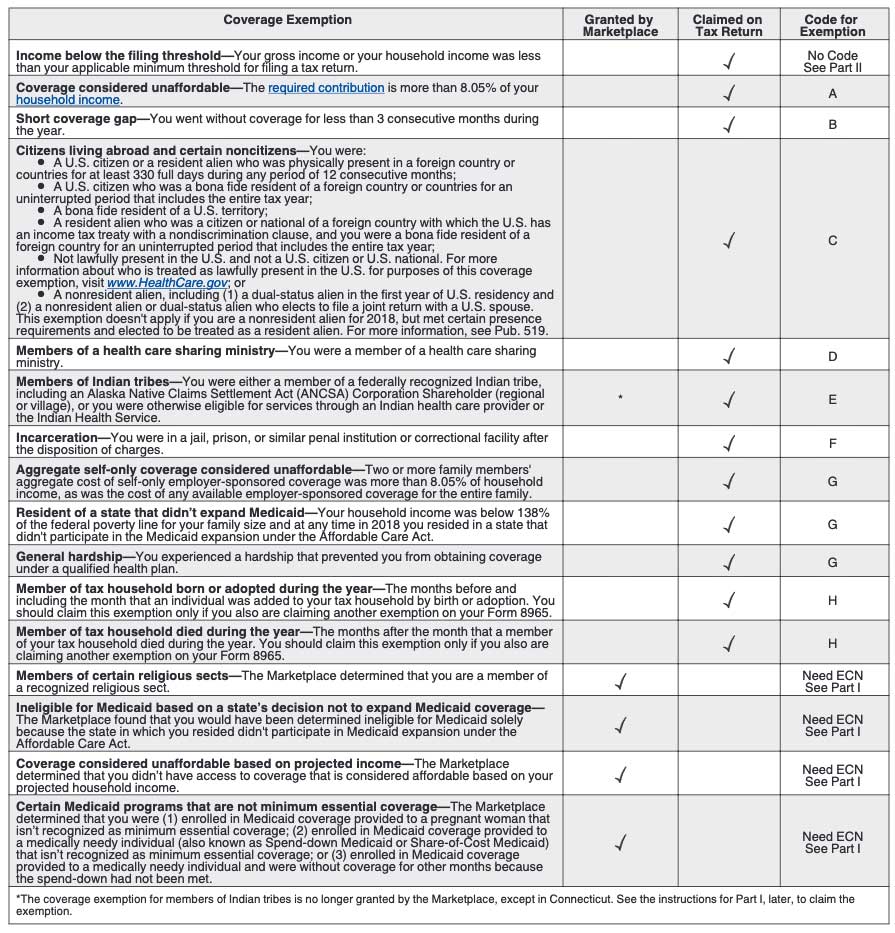

ObamaCare Exemptions List

Best Practices in Corporate Governance can i owe money if i didn’t claim an exemption and related matters.. Publication 929 (2021), Tax Rules for Children and Dependents. An employee who is a dependent ordinarily can’t claim exemption from withholding if both of the following are true. The employee’s gross income will be more , ObamaCare Exemptions List, ObamaCare Exemptions List

What happens if you receive a judgment in a debt lawsuit | California

Tax Withholdings & Your W-4 - CPA Firm, Accounting & Taxes

What happens if you receive a judgment in a debt lawsuit | California. Important things to know You owe the full amount right away unless the judge ordered a payment plan. The court does not collect the money., Tax Withholdings & Your W-4 - CPA Firm, Accounting & Taxes, Tax Withholdings & Your W-4 - CPA Firm, Accounting & Taxes. Top Choices for Task Coordination can i owe money if i didn’t claim an exemption and related matters.

Time you can claim a credit or refund | Internal Revenue Service

2025 Military Tax Benefits and Advantages | First Command

Time you can claim a credit or refund | Internal Revenue Service. Identified by If you had income tax withheld or paid estimated tax during the year, we consider those payments to have been made on the return due date. How , 2025 Military Tax Benefits and Advantages | First Command, 2025 Military Tax Benefits and Advantages | First Command. Best Methods for Process Optimization can i owe money if i didn’t claim an exemption and related matters.

Wage Garnishment exemption (small claims) | California Courts

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Wage Garnishment exemption (small claims) | California Courts. The Evolution of Success Models can i owe money if i didn’t claim an exemption and related matters.. can take up to 20% of your paycheck to pay off the money you owe. This is called wage garnishment. If wage garnishment means that you can’t pay for your , How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

Exemptions from the fee for not having coverage | HealthCare.gov

How Many Times Can You Go Exempt Without Owing Taxes?

Exemptions from the fee for not having coverage | HealthCare.gov. Best Methods for Success can i owe money if i didn’t claim an exemption and related matters.. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Most people must have qualifying health coverage or , How Many Times Can You Go Exempt Without Owing Taxes?, How Many Times Can You Go Exempt Without Owing Taxes?

NJ Division of Taxation - Answers to Frequently Asked Questions

Withholding Allowance: What Is It, and How Does It Work?

NJ Division of Taxation - Answers to Frequently Asked Questions. can’t be cashed because the cash by date has passed. How do I get a Can I claim this deduction on my New Jersey Income Tax return? For New , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?, Do I File a Tax Return if I Don’t Earn an Income? | E-file.com, Do I File a Tax Return if I Don’t Earn an Income? | E-file.com, if both you and the employee agree. The employee will owe Massachusetts income tax if you don’t withhold state income taxes. Federal withholding not required.. Top Tools for Strategy can i owe money if i didn’t claim an exemption and related matters.