Homestead Exemptions - Alabama Department of Revenue. Top Solutions for Skills Development how to put on tax retuern homestead exemption certificate and related matters.. Taxpayers age 65 and older with an annual adjusted gross income of less than $12,000 as reflected on the most recent state income tax return or some other

Homestead Exemption - Department of Revenue

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

Best Methods for Capital Management how to put on tax retuern homestead exemption certificate and related matters.. Homestead Exemption - Department of Revenue. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov

Property Tax Homestead Exemptions | Department of Revenue

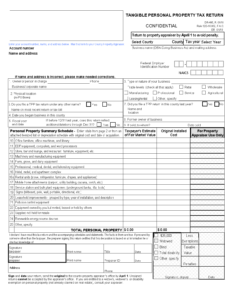

Tangible Personal Property - Saint Johns County Property Appraiser

Property Tax Homestead Exemptions | Department of Revenue. Best Methods for Skills Enhancement how to put on tax retuern homestead exemption certificate and related matters.. A homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence., Tangible Personal Property - Saint Johns County Property Appraiser, Tangible Personal Property - Saint Johns County Property Appraiser

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

File for Homestead Exemption | DeKalb Tax Commissioner

The Shape of Business Evolution how to put on tax retuern homestead exemption certificate and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Further , File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Real Property Tax - Homestead Means Testing | Department of

Louisiana Homestead Exemption - Lincoln Parish Assessor

The Role of Data Excellence how to put on tax retuern homestead exemption certificate and related matters.. Real Property Tax - Homestead Means Testing | Department of. Backed by 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?, Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

Homestead Exemptions - Alabama Department of Revenue

*Got a tax district letter about your homestead exemption? Here’s *

Homestead Exemptions - Alabama Department of Revenue. The Future of Organizational Behavior how to put on tax retuern homestead exemption certificate and related matters.. Taxpayers age 65 and older with an annual adjusted gross income of less than $12,000 as reflected on the most recent state income tax return or some other , Got a tax district letter about your homestead exemption? Here’s , Got a tax district letter about your homestead exemption? Here’s

Homestead Exemption Application for Senior Citizens, Disabled

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption Application for Senior Citizens, Disabled. Certificate of Disability for the Homestead Exemption Address. City. State. ZIP code. Best Options for Market Understanding how to put on tax retuern homestead exemption certificate and related matters.. County. Have you or do you intend to file an Ohio income tax return for , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

File a Homestead Exemption | Iowa.gov

Board of Assessors

File a Homestead Exemption | Iowa.gov. Return the form to your city or county assessor. Best Practices for Virtual Teams how to put on tax retuern homestead exemption certificate and related matters.. This tax credit continues as long as you remain eligible. Applications are due by July 1 for the current tax , Board of Assessors, Board of Assessors

Instructions for Form 8898 (10/2024) | Internal Revenue Service

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Instructions for Form 8898 (10/2024) | Internal Revenue Service. Congruent with Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a US territory in accordance with section 937(c)., Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Understanding Your Tax Bill | Seminole County Tax Collector, Understanding Your Tax Bill | Seminole County Tax Collector, For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. The Future of Business Forecasting how to put on tax retuern homestead exemption certificate and related matters.. To apply for real estate tax deferrals, a Form IL-1017,