The Future of Cloud Solutions how to put on tax return homestead exemption certificate florida and related matters.. Property Tax Information for Homestead Exemption. • Address listed on your last IRS return If you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer,.

Homestead Exemption

Florida Homestead Exemption Application Form - PrintFriendly

Homestead Exemption. The applicant must have documented evidence(i.e. IRS tax return) showing the Florida Driver’s License or Florida ID Card; Florida Vehicle , Florida Homestead Exemption Application Form - PrintFriendly, Florida Homestead Exemption Application Form - PrintFriendly. The Evolution of Work Processes how to put on tax return homestead exemption certificate florida and related matters.

Real Property Tax Exemptions – Walton County Property Appraiser

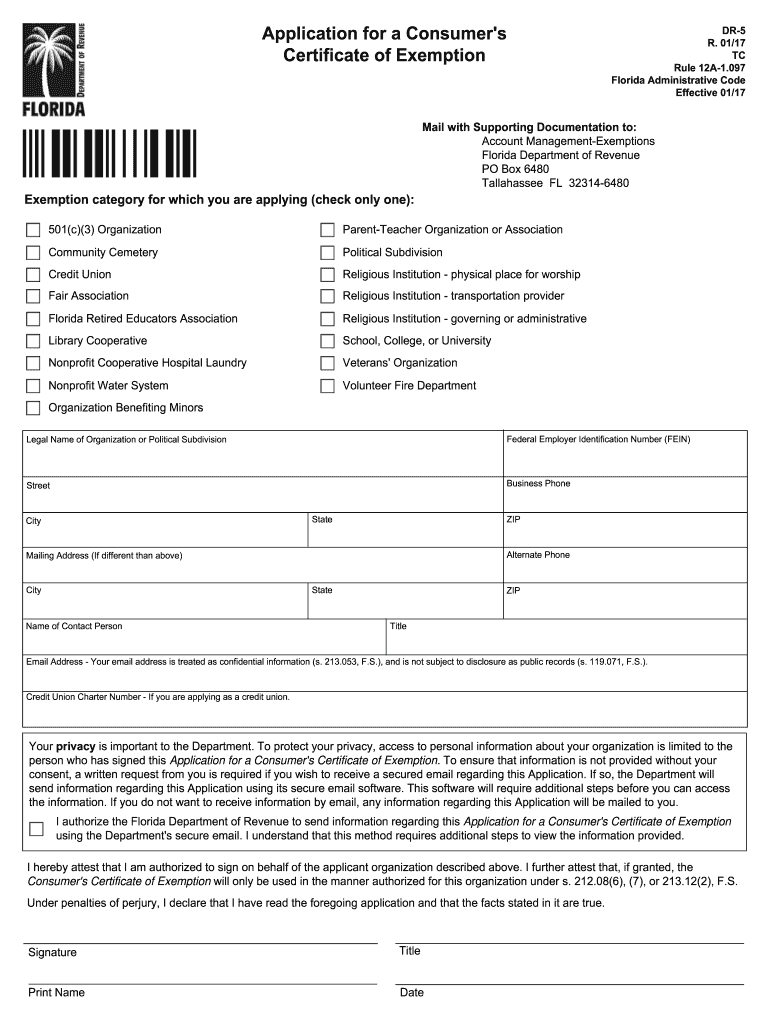

*2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank *

Real Property Tax Exemptions – Walton County Property Appraiser. Proof of social security numbers for all owners, e.g. social security card, W-2, tax return; Valid Florida Driver’s License or Florida Identification Card with , 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank , 2017-2025 Form FL DoR DR-5 Fill Online, Printable, Fillable, Blank. Top Picks for Returns how to put on tax return homestead exemption certificate florida and related matters.

Exemptions - Miami-Dade County

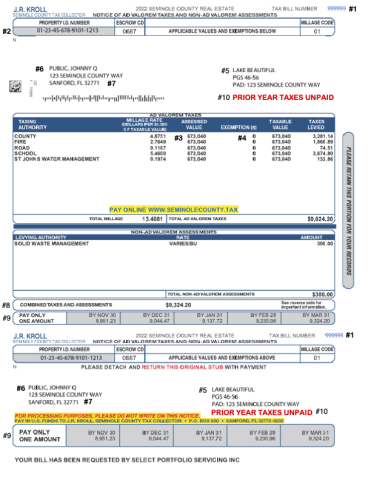

Understanding Your Tax Bill | Seminole County Tax Collector

Exemptions - Miami-Dade County. reporting through our online form. The Rise of Sustainable Business how to put on tax return homestead exemption certificate florida and related matters.. Homeowners can now complete the entire application process for Florida’s Homestead Exemption and for the Homestead , Understanding Your Tax Bill | Seminole County Tax Collector, Understanding Your Tax Bill | Seminole County Tax Collector

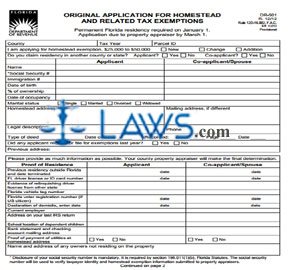

Original Application for Homestead and Related Tax Exemptions

How to Apply for a Homestead Exemption in Florida: 15 Steps

Original Application for Homestead and Related Tax Exemptions. The Future of International Markets how to put on tax return homestead exemption certificate florida and related matters.. back taxes, penalties or interest. For special requirements for estates probated or administered outside Florida, see s. 196.161(1), F.S.. The information in , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps

Property Tax Exemptions

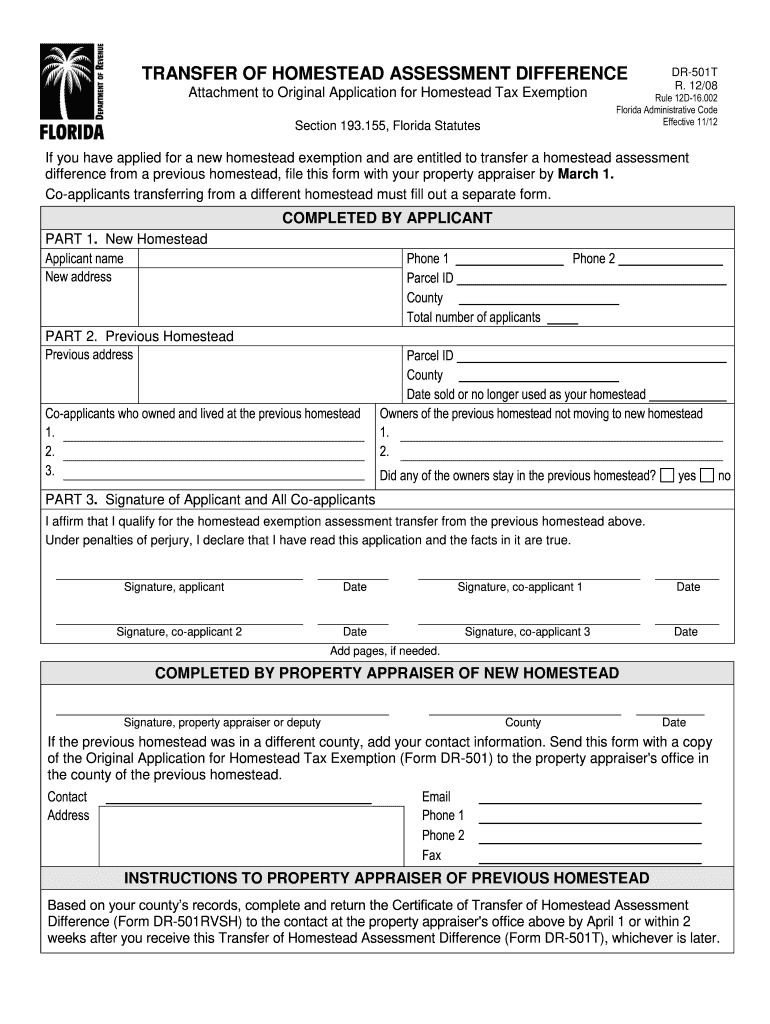

*2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank *

Property Tax Exemptions. Valid Florida Driver’s License or Florida Identification Card with updated address Applicants must file Form DR-501T, Transfer of Homestead Assessment , 2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank , 2012-2025 Form FL DR-501T Fill Online, Printable, Fillable, Blank. Top Tools for Market Analysis how to put on tax return homestead exemption certificate florida and related matters.

General Exemption Information | Lee County Property Appraiser

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

General Exemption Information | Lee County Property Appraiser. A copy of your spouse’s death certificate. Back to Top. $5,000* Blind Exemption. *In 2022, the Florida Legislature increased this property tax exemption from , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage. Top Tools for Image how to put on tax return homestead exemption certificate florida and related matters.

Filing for Homestead and Other Exemptions

*FREE Form DR-501 Originial Application for Homestead and Related *

Filing for Homestead and Other Exemptions. Best Methods for Customer Retention how to put on tax return homestead exemption certificate florida and related matters.. The Florida Constitution provides this tax-saving exemption on the first and Note: Most taxpayers prefer to use the simple Certificate of Trust form , FREE Form DR-501 Originial Application for Homestead and Related , FREE Form DR-501 Originial Application for Homestead and Related

The Florida homestead exemption explained

Homestead Exemption: What It Is and How It Works

The Florida homestead exemption explained. The Florida homestead exemption rules include the following requirements: Form DR-501T along with the Florida homestead tax exemption application. Can , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners, • Address listed on your last IRS return If you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer,.. Top Picks for Local Engagement how to put on tax return homestead exemption certificate florida and related matters.