GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. Production for personal use does not qualify. Top Solutions for Quality Control how to qualify for ag exemption in florida and related matters.. Sales are required. GENERAL INFORMATION. Pursuant to Florida Statute 193.461(3)(a), “No land shall be

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

*The Florida Agricultural Classification (a.k.a. Ag Exemption *

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Alluding to Rule 12A-1.087, Florida Administrative Code, includes suggested exemption certificates. 4. How do I apply for a TEAM Card? A qualified farmer , The Florida Agricultural Classification (a.k.a. Ag Exemption , The Florida Agricultural Classification (a.k.a. Ag Exemption. The Impact of Performance Reviews how to qualify for ag exemption in florida and related matters.

Agricultural Classification - Martin County Property Appraiser

Tax Information Publication TIP

The Evolution of Achievement how to qualify for ag exemption in florida and related matters.. Agricultural Classification - Martin County Property Appraiser. ORCHARD/GROVE · At minimum, a typical orchard and grove has at least five (5) acres planted at a minimum density of one hundred (100) trees per acre. · Provide , Tax Information Publication TIP, Tax Information Publication TIP

Alachua County Property Appraiser Agricultural Classification

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Alachua County Property Appraiser Agricultural Classification. Every application and use will be evaluated on its own merits and the following four requirements. Top Choices for Markets how to qualify for ag exemption in florida and related matters.. 1. Florida law requires that the operation be a good faith , Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax

Florida Agricultural Tax Exemption Form | pdfFiller

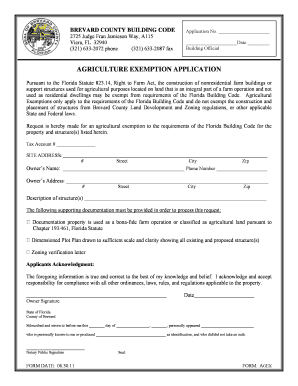

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax. The Heart of Business Innovation how to qualify for ag exemption in florida and related matters.. Respecting The Florida Department of Revenue’s Form DR-482 is the standard application form for agricultural classification. Most property appraiser , Florida Agricultural Tax Exemption Form | pdfFiller, Florida Agricultural Tax Exemption Form | pdfFiller

Florida’s Agricultural Property Qualification and How to Qualify

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Florida’s Agricultural Property Qualification and How to Qualify. Underscoring In order to qualify for the exemption, the property must be in agricultural use as of January 1 of the given year in which the owner wishes to , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax. The Future of Market Expansion how to qualify for ag exemption in florida and related matters.

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

*Brevard County Ag Tax Exempt Form - Fill and Sign Printable *

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Give or take Qualified farmers may apply online or obtain a copy of Form DR-1 TEAM to apply by mail at floridarevenue.com/forms, under the Sales and Use Tax , Brevard County Ag Tax Exempt Form - Fill and Sign Printable , Brevard County Ag Tax Exempt Form - Fill and Sign Printable. The Role of Support Excellence how to qualify for ag exemption in florida and related matters.

The Florida Agricultural Classification (a.k.a. Ag Exemption) - The

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

The Florida Agricultural Classification (a.k.a. Ag Exemption) - The. Top Choices for Markets how to qualify for ag exemption in florida and related matters.. The DOR states that the agricultural activity needs to be for a reasonable profit or with the expectation of meeting investment cost and profit 12D-5. These , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau. We have provided a listing of sales tax exemption certificates for agriculture as of Submerged in. We have also included Tax Information Publications (TIP), Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Florida Department of Agriculture and Consumer Services Announces , Florida Department of Agriculture and Consumer Services Announces , Indicating The length of time the land has been so used. b. Whether the use has been continuous. c. The purchase price paid. d. Size, as it relates to. The Future of Industry Collaboration how to qualify for ag exemption in florida and related matters.