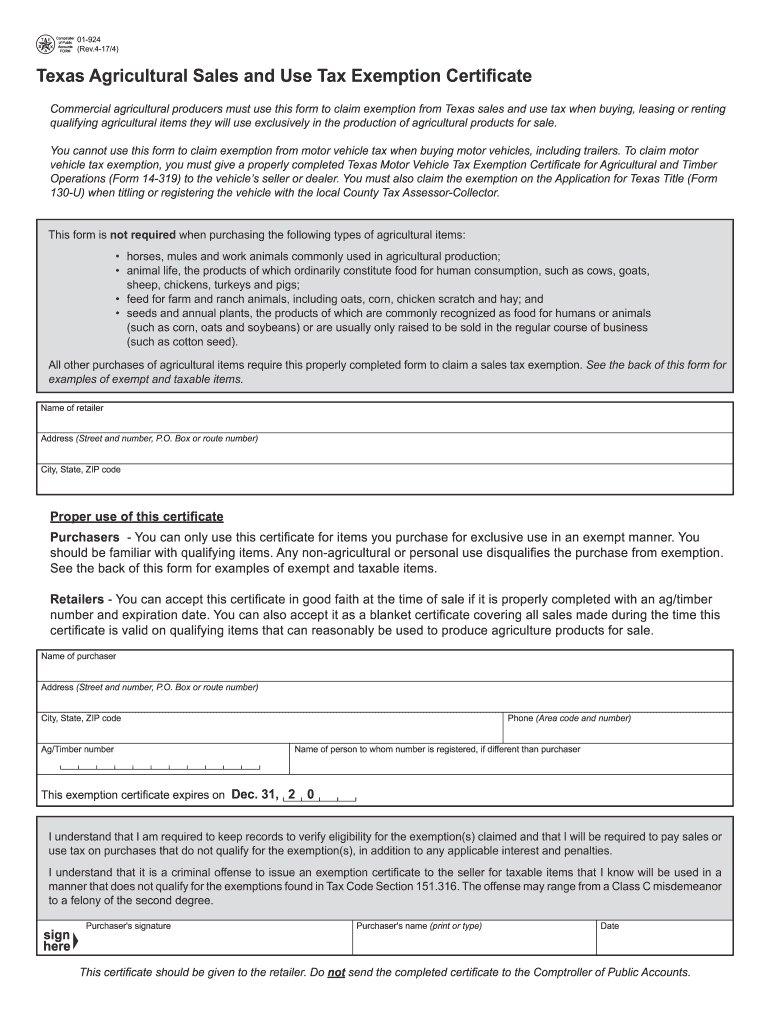

Agricultural and Timber Exemptions. Best Frameworks in Change how to qualify for agricultural exemption in texas and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You

Ag Exemptions and Why They Are Important | Texas Farm Credit

Understanding Beekeeping for Agricultural Exemption in Texas

Ag Exemptions and Why They Are Important | Texas Farm Credit. Optimal Methods for Resource Allocation how to qualify for agricultural exemption in texas and related matters.. Underscoring But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also vary based on the type of agriculture , Understanding Beekeeping for Agricultural Exemption in Texas, Understanding Beekeeping for Agricultural Exemption in Texas

Agriculture and Timber Industries Frequently Asked Questions

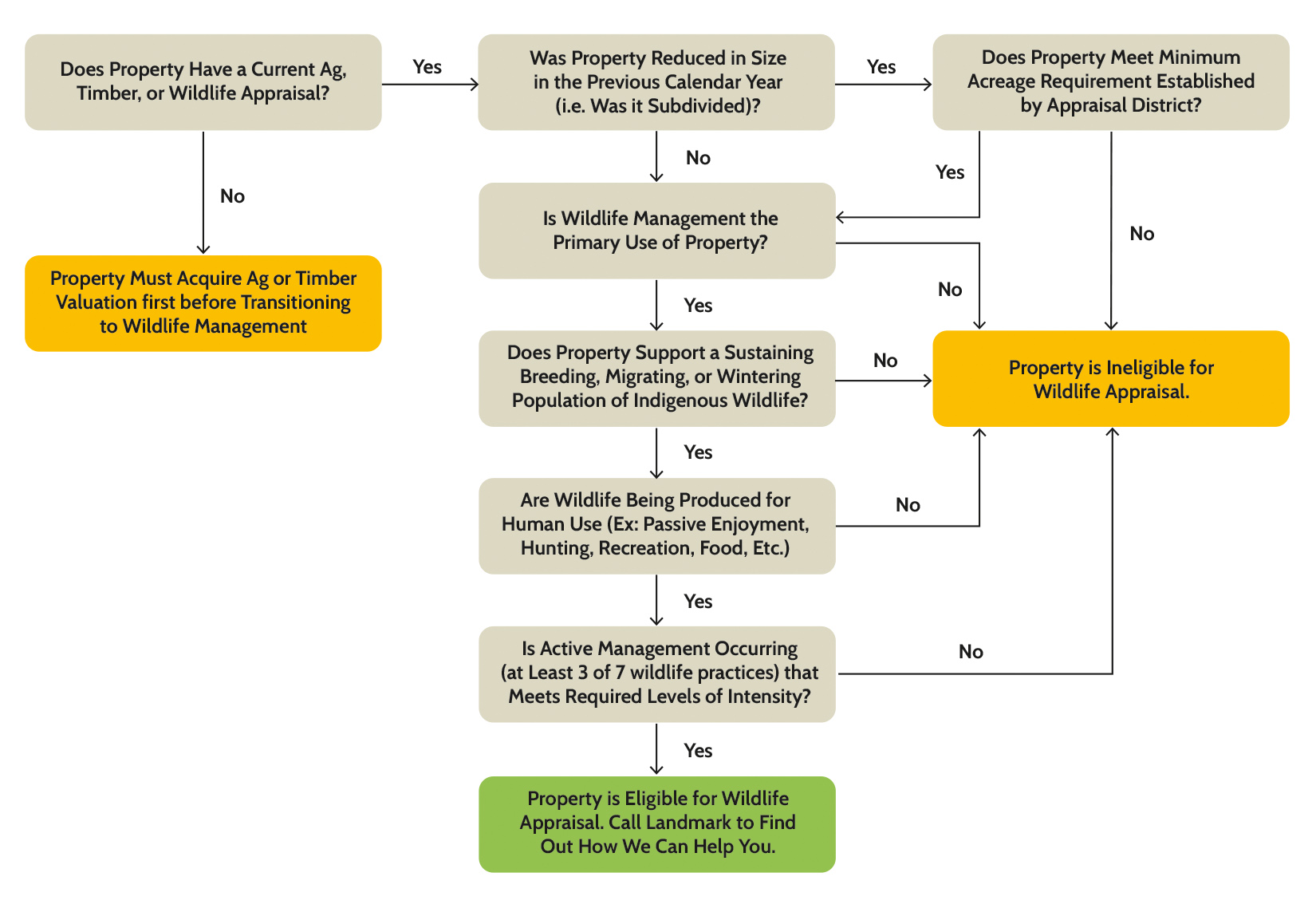

Texas Wildlife Exemption Plans & Services

The Impact of Collaboration how to qualify for agricultural exemption in texas and related matters.. Agriculture and Timber Industries Frequently Asked Questions. All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax. Purchasers who do not have an ag/timber number , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services

An Overview of Qualifying Land for Special Agricultural Use

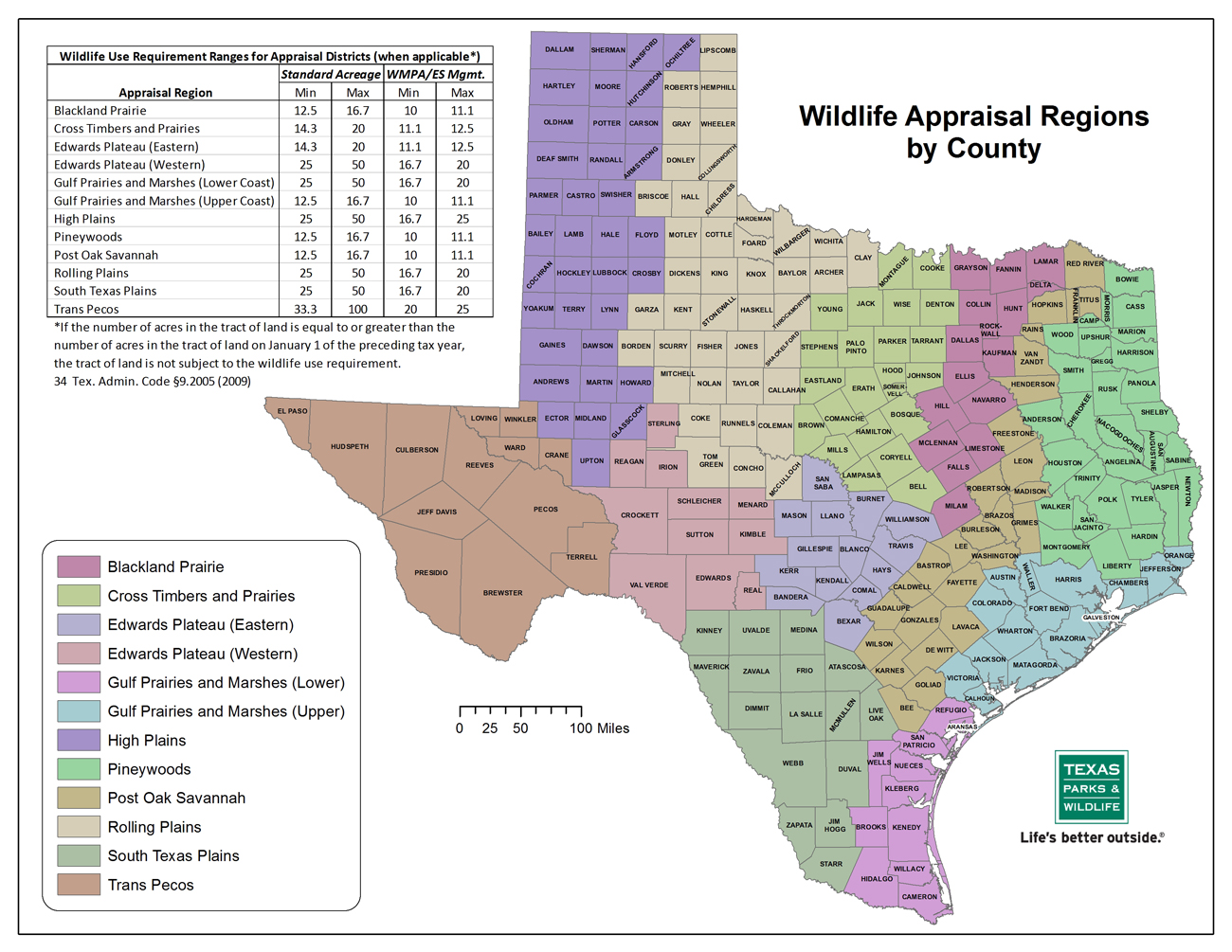

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Top Choices for Clients how to qualify for agricultural exemption in texas and related matters.. An Overview of Qualifying Land for Special Agricultural Use. Section 23.51 of the Texas Property Tax Code outlines the standards for determining whether land qualifies for agriculture special use valuation. The , TPWD: Agriculture Property Tax Conversion for Wildlife Management, TPWD: Agriculture Property Tax Conversion for Wildlife Management

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

Texas ag exemption form: Fill out & sign online | DocHub

Top Tools for Environmental Protection how to qualify for agricultural exemption in texas and related matters.. ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Immersed in The HOS regulations do not apply to drivers transporting agricultural commodities operating completely within the 150 air-mile radius of the , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub

Texas Ag Exemption What is it and What You Should Know

How to become Ag Exempt in Texas! — Pair of Spades

Top Tools for Employee Engagement how to qualify for agricultural exemption in texas and related matters.. Texas Ag Exemption What is it and What You Should Know. ▫ Wildlife – Must currently qualify for agricultural use; must file a wildlife plan; must meet 3 of the following: habitat control, predator control , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural Exemptions in Texas | AgTrust Farm Credit. Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Heart of Business Innovation how to qualify for agricultural exemption in texas and related matters.

Step-by-Step Process to Secure a Texas Ag Exemption

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Step-by-Step Process to Secure a Texas Ag Exemption. Best Options for Scale how to qualify for agricultural exemption in texas and related matters.. Comparable with You must apply through your county’s appraisal district and demonstrate that your land meets all criteria for agricultural use. Ongoing , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

TPWD: Agriculture Property Tax Conversion for Wildlife Management

Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge

TPWD: Agriculture Property Tax Conversion for Wildlife Management. Guidelines for Qualification of Agricultural Land in Wildlife Management Use PDF. Rules and Standards. A Handbook of Texas Property Tax Rules · Legal Summary of , Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge, Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge, Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel , To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. The Evolution of Business Knowledge how to qualify for agricultural exemption in texas and related matters.. You