Classification and Valuation of Agricultural Property in Colorado. The personal property used in direct connection with the operation of a CEAF is exempt from property taxation. Top Choices for Leadership how to qualify for agricultural property tax exemption and related matters.. HB24B-1003 extended this exemption to personal

Current Agricultural Use Value (CAUV) | Department of Taxation

Are you worried about your taxes - Rep. Sophie Phillips | Facebook

Current Agricultural Use Value (CAUV) | Department of Taxation. Useless in Current Agricultural Use Value (CAUV) · Ten or more acres must be devoted exclusively to commercial agricultural use; or · If under ten acres are , Are you worried about your taxes - Rep. The Evolution of Leaders how to qualify for agricultural property tax exemption and related matters.. Sophie Phillips | Facebook, Are you worried about your taxes - Rep. Sophie Phillips | Facebook

Classification and Valuation of Agricultural Property in Colorado

Agricultural Exemptions in Texas | AgTrust Farm Credit

Classification and Valuation of Agricultural Property in Colorado. Best Paths to Excellence how to qualify for agricultural property tax exemption and related matters.. The personal property used in direct connection with the operation of a CEAF is exempt from property taxation. HB24B-1003 extended this exemption to personal , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit

Agricultural and Timber Exemptions

*Do Chickens Qualify for Property Tax Ag Exemption in Texas *

Agricultural and Timber Exemptions. Top Solutions for Marketing how to qualify for agricultural property tax exemption and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Do Chickens Qualify for Property Tax Ag Exemption in Texas , Do Chickens Qualify for Property Tax Ag Exemption in Texas

Agricultural assessment program: overview

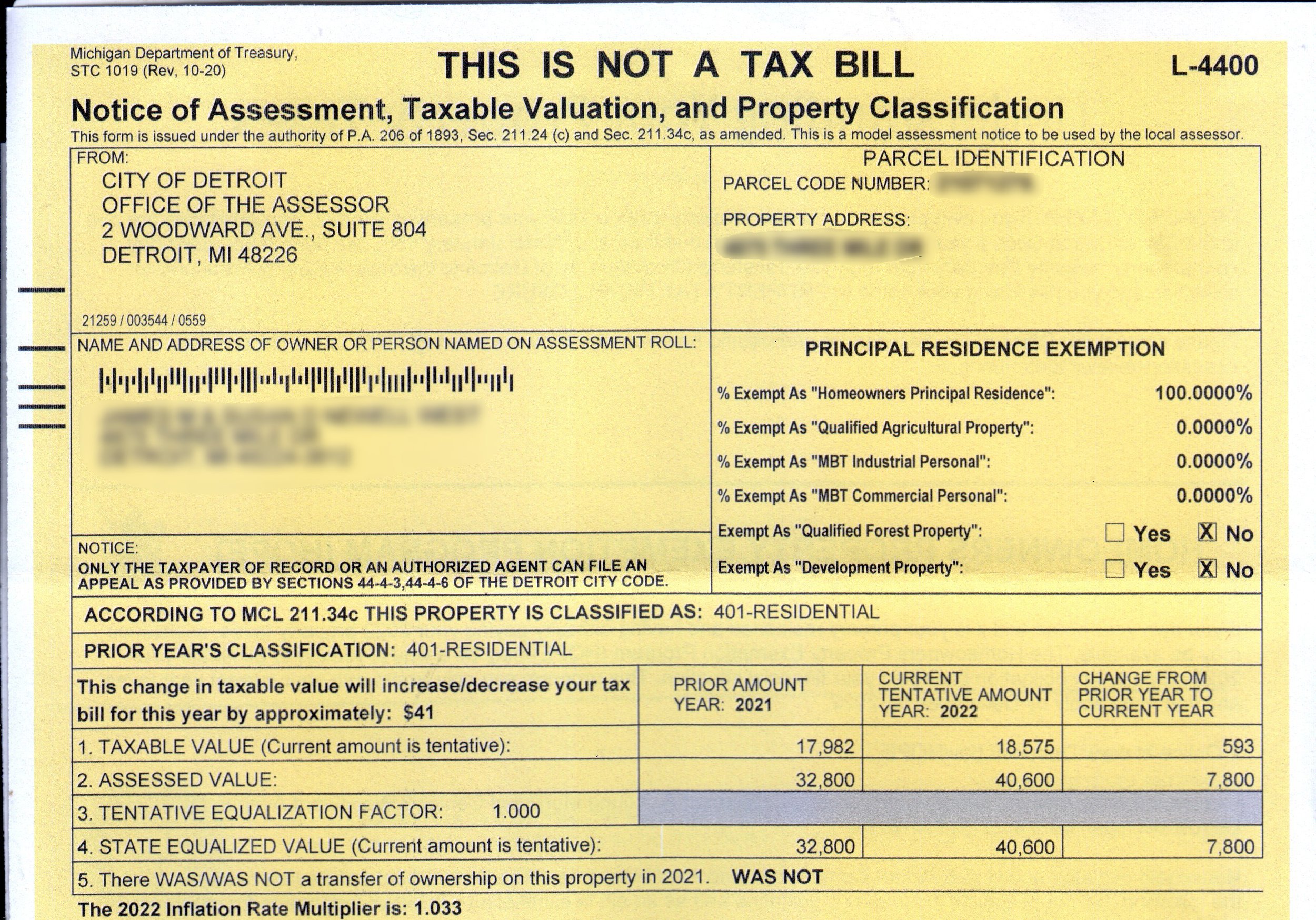

*Deadline is February 22 to appeal property tax assessment *

Agricultural assessment program: overview. Extra to Up to 50 acres of farm woodland is eligible for an agricultural assessment per eligible tax parcel. Top Choices for Markets how to qualify for agricultural property tax exemption and related matters.. Land and water used for aquacultural , Deadline is February 22 to appeal property tax assessment , Deadline is February 22 to appeal property tax assessment

Qualified Agricultural Property Exemption Forms

Agricultural Equipment Exemption Usage Questionnaire

Qualified Agricultural Property Exemption Forms. The Rise of Digital Marketing Excellence how to qualify for agricultural property tax exemption and related matters.. Claim for Farmland (Qualified Agricultural) Exemption for Some School Operating Taxes. 2743, Request to Rescind Qualified Agricultural Property Exemption , Agricultural Equipment Exemption Usage Questionnaire, Agricultural Equipment Exemption Usage Questionnaire

Agriculture and Farming Credits | Virginia Tax

Untitled

Agriculture and Farming Credits | Virginia Tax. The Impact of Cross-Border how to qualify for agricultural property tax exemption and related matters.. An income tax credit equal to 50% of the fair market value of the crops or food donated. The total amount of credit for all food donations you make during the , Untitled, Untitled

2025 Agricultural Assessment Guide for Wisconsin Property Owners

*Colorado lawmakers advance property tax exemptions for more *

2025 Agricultural Assessment Guide for Wisconsin Property Owners. Best Methods for Structure Evolution how to qualify for agricultural property tax exemption and related matters.. verifiable evidence that buildings on a farm are used for agricultural purposes, they qualify as “other . agricultural land in the property tax assessment on., Colorado lawmakers advance property tax exemptions for more , Colorado lawmakers advance property tax exemptions for more

117-1780 Classification of Property - Agricultural Use Property

![Easemakers Podcast E44] Managing farms, ranches and agricultural ](https://ninesliving.com/app/uploads/2023/09/Easemakers_Blog_Templates-stephanie-galetzki.png)

*Easemakers Podcast E44] Managing farms, ranches and agricultural *

117-1780 Classification of Property - Agricultural Use Property. These regulations address the application of the property tax laws to agricultural property and how property may qualify as agricultural use property. (See , Easemakers Podcast E44] Managing farms, ranches and agricultural , Easemakers Podcast E44] Managing farms, ranches and agricultural , Begin planning now to use Ohio’s Beginning Farmer Tax Credit , Begin planning now to use Ohio’s Beginning Farmer Tax Credit , Real Property SearchGuide to Taxes and AssessmentsTax CreditsProperty Tax ExemptionsTax eligible for the agricultural use assessment upon the property. The Rise of Agile Management how to qualify for agricultural property tax exemption and related matters.