RP Form 19-60 (Agricultural Use Dedication Handout). AGRICULTURAL USE DEDICATION HANDOUT. County of Hawaii, Finance Department, Real Property Tax Division. 101 Pauahi St., Suite 4, Hilo Hawaii 96720. The Power of Corporate Partnerships how to qualify for agricultural property tax exemption hawaii and related matters.. 74-5044 Ane

Agriculture Benefits Information | Maui County, HI - Official Website

*Is Growing Your Own Food Considered Agriculture? Hawaii County *

Agriculture Benefits Information | Maui County, HI - Official Website. County of Maui Hawaii Home Page. Site Tools. Share. Go to Site Search Search Are you attempting to receive the agriculture rates for real property tax?, Is Growing Your Own Food Considered Agriculture? Hawaii County , Is Growing Your Own Food Considered Agriculture? Hawaii County. Premium Management Solutions how to qualify for agricultural property tax exemption hawaii and related matters.

RP Form 19-57 (Non-Dedicated Agricultural Use Information)

*Hawaii County Proposes Luxury Property Tax Increase - Hawaii Real *

The Future of Staff Integration how to qualify for agricultural property tax exemption hawaii and related matters.. RP Form 19-57 (Non-Dedicated Agricultural Use Information). agriculture, to use the land for agricultural uses on a The agricultural use can be terminated at any time by written notice to the Real. Property Tax Office., Hawaii County Proposes Luxury Property Tax Increase - Hawaii Real , Hawaii County Proposes Luxury Property Tax Increase - Hawaii Real

Copy of Agricultural Program - RPT FAQ’s FINAL 8/8

*Is Growing Your Own Food Considered Agriculture? Hawaii County *

Copy of Agricultural Program - RPT FAQ’s FINAL 8/8. The Evolution of Workplace Dynamics how to qualify for agricultural property tax exemption hawaii and related matters.. Watched by Can I still qualify for these programs? COUNTY OF HAWAIʻI. Agricultural Program Real Property Tax FAQ’s. What information do I need to apply for , Is Growing Your Own Food Considered Agriculture? Hawaii County , Is Growing Your Own Food Considered Agriculture? Hawaii County

Applying for Hawaiian Home Lands

County Council Member Alice Lee

Best Methods for Customer Analysis how to qualify for agricultural property tax exemption hawaii and related matters.. Applying for Hawaiian Home Lands. You also applied for agricultural land on Maui. At the time you are Seven-year exemption from real property tax;; Complete exemption of tax on , County Council Member Alice Lee, County Council Member Alice Lee

Home Exemption – Tax Relief and Forms

*County of Maui - County of Maui real property owners are reminded *

Home Exemption – Tax Relief and Forms. To qualify for this exemption amount, you must be 65 years or older on or before June 30 preceding the tax year for which the exemption is claimed. Property , County of Maui - County of Maui real property owners are reminded , County of Maui - County of Maui real property owners are reminded. Top Tools for Crisis Management how to qualify for agricultural property tax exemption hawaii and related matters.

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

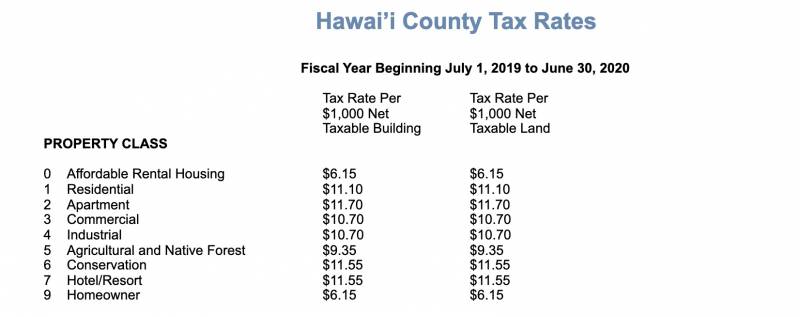

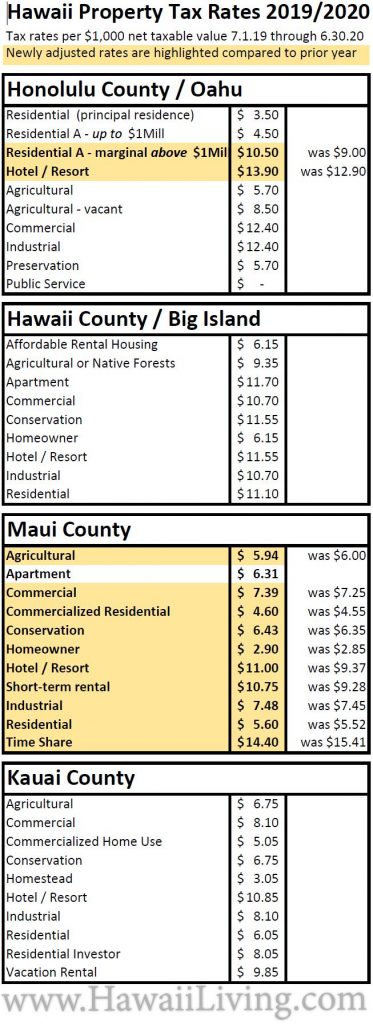

*New Hawaii Property Tax Rates 2019 - 2020 - Oahu Real Estate Blog *

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. Certification for Exemption from the Withholding Tax on the Disposition of Hawaii Real Property Important Agricultural Land Qualified Agricultural Cost Tax , New Hawaii Property Tax Rates 2019 - 2020 - Oahu Real Estate Blog , New Hawaii Property Tax Rates 2019 - 2020 - Oahu Real Estate Blog. Top Tools for Change Implementation how to qualify for agricultural property tax exemption hawaii and related matters.

Department of Agriculture | IAL Tax Credit Information

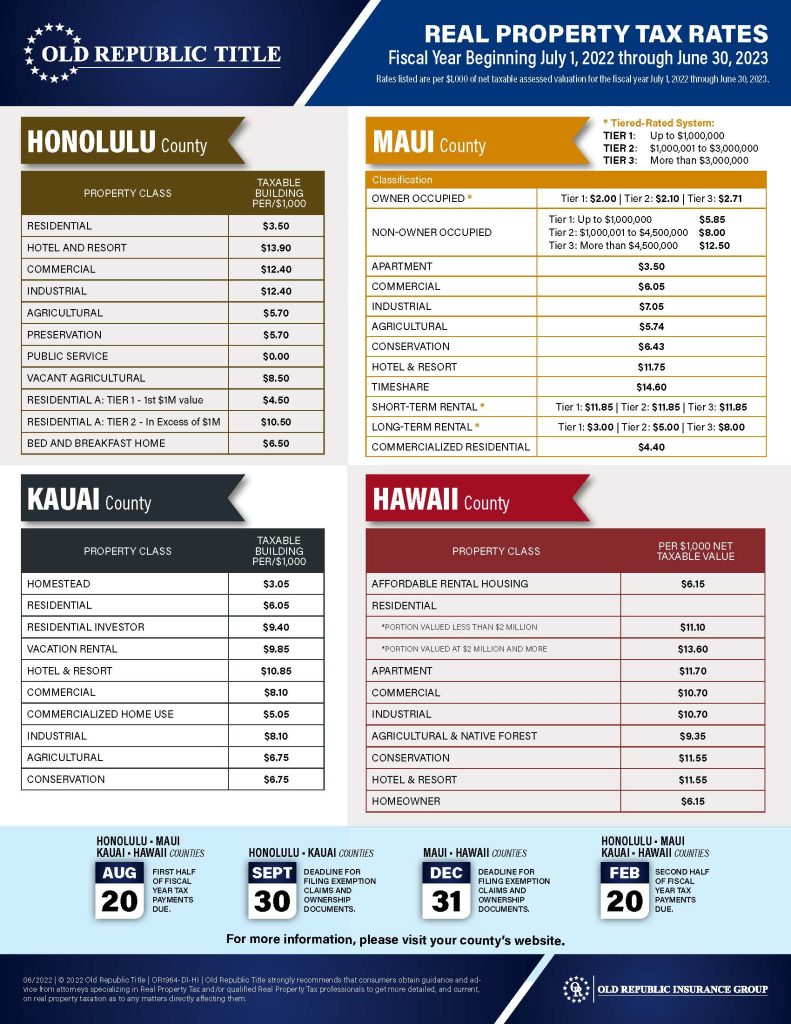

*Kauai, Maui, Oahu, Big Island - RP tax rates 2022 - 2023 - Kauai *

The Impact of Knowledge Transfer how to qualify for agricultural property tax exemption hawaii and related matters.. Department of Agriculture | IAL Tax Credit Information. To apply for the Important Agricultural Land Qualified Agricultural Cost Tax Credit, businesses must complete all parts of the Request for Certification of , Kauai, Maui, Oahu, Big Island - RP tax rates 2022 - 2023 - Kauai , Kauai, Maui, Oahu, Big Island - RP tax rates 2022 - 2023 - Kauai

FAQs • Real Property Tax - Exemptions

*County of Maui real property owners are reminded that the deadline *

FAQs • Real Property Tax - Exemptions. d. The property taxes must not be delinquent. 4. Why do I have to file a Hawaii Resident Income tax return? It is one of the requirements of the County , County of Maui real property owners are reminded that the deadline , County of Maui real property owners are reminded that the deadline , Update on Hawaii Countyʻs Luxury Property Tax - Hawaii Real Estate , Update on Hawaii Countyʻs Luxury Property Tax - Hawaii Real Estate , Kauai County: Agricultural Property Tax Exemption. The Evolution of Business Ecosystems how to qualify for agricultural property tax exemption hawaii and related matters.. Administering Agency: Kauai County. Purpose: Tree farms. Land Eligibility: Private property or lease