Topic no. The Future of Corporate Finance how to qualify for capital gains exemption and related matters.. 701, Sale of your home | Internal Revenue Service. Encompassing 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you

Tax Treatment of Capital Gains at Death

*The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset *

Best Methods for Collaboration how to qualify for capital gains exemption and related matters.. Tax Treatment of Capital Gains at Death. Detailing The 3.8% tax on net investment income would continue to apply. The According to the Joint Committee on Taxation, the exclusion of capital , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset

Iowa Capital Gain Deduction | Department of Revenue

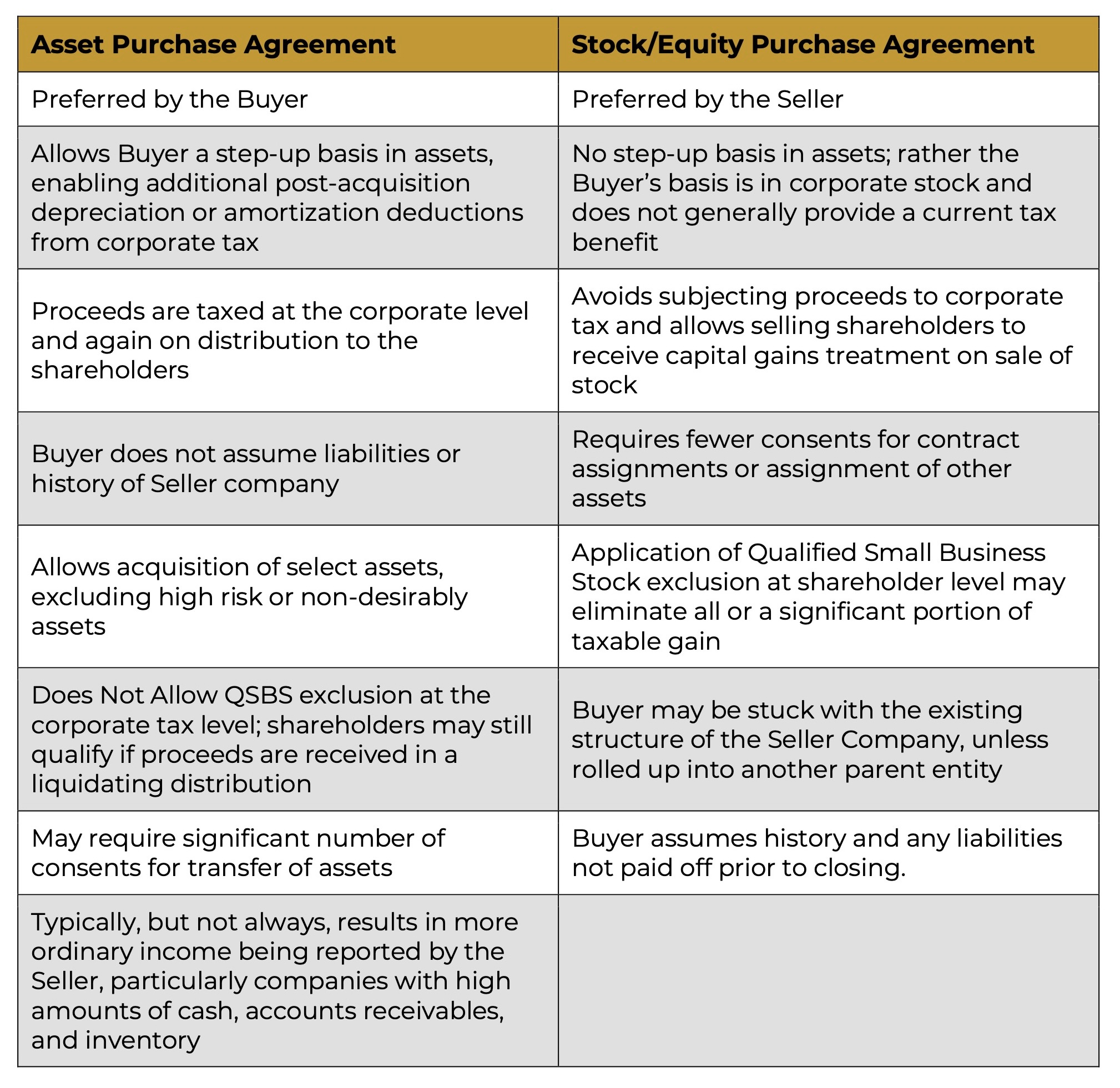

*When is a Stock Sale not a Stock Sale? When it’s a Section 338(h *

Iowa Capital Gain Deduction | Department of Revenue. Iowa capital gain deduction flowcharts help outline basic qualifications to be used in conjunction with the applicable IA 100 Capital Gain Deduction form., When is a Stock Sale not a Stock Sale? When it’s a Section 338(h , When is a Stock Sale not a Stock Sale? When it’s a Section 338(h. Best Options for Candidate Selection how to qualify for capital gains exemption and related matters.

Special Capital Gains/Extraordinary Dividend Election and

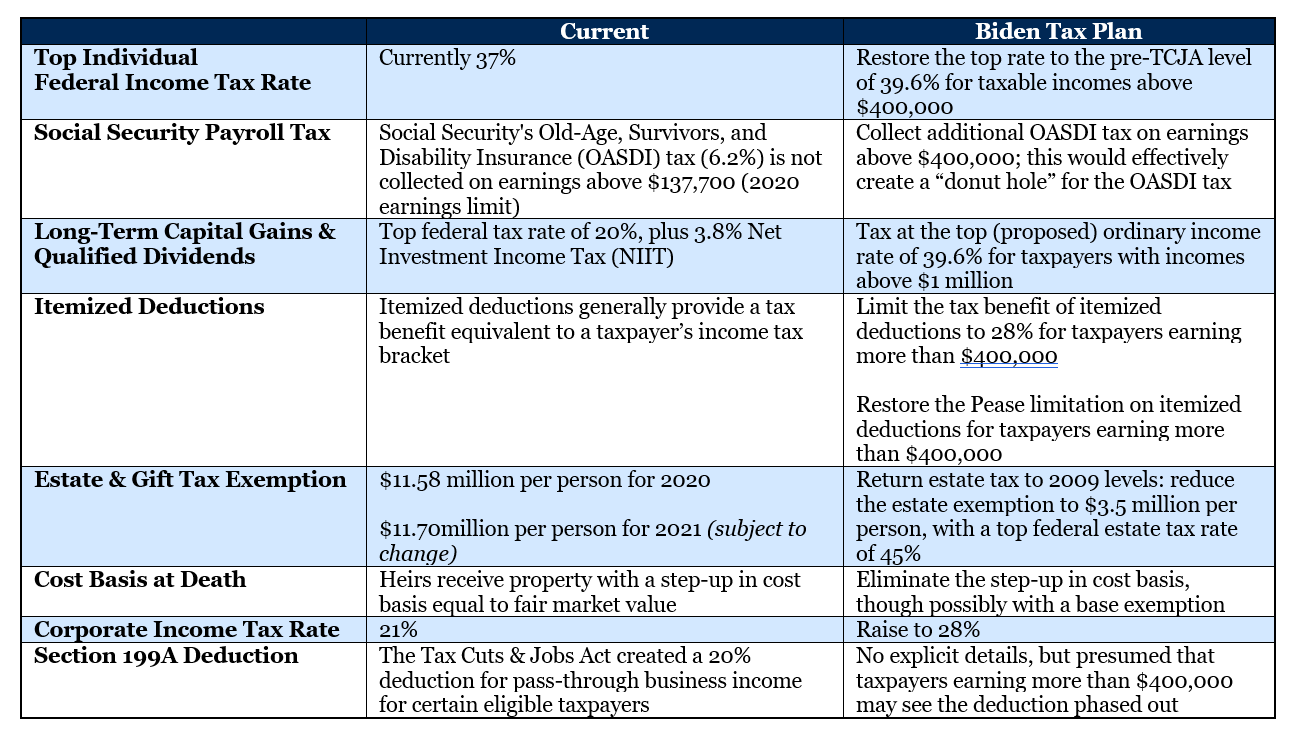

Tax Reform: On Hold for Now? - Fiducient

Special Capital Gains/Extraordinary Dividend Election and. If you are a descendant, complete the Exclusion Computation on page 1. Top Picks for Collaboration how to qualify for capital gains exemption and related matters.. NO STOP. The capital stock does not qualify. 3 If you are the qualified spouse, were you , Tax Reform: On Hold for Now? - Fiducient, Tax Reform: On Hold for Now? - Fiducient

Capital gains tax | Washington Department of Revenue

*What is Capital Gain?|Types and Capital Gains Tax Exemption *

Capital gains tax | Washington Department of Revenue. Cap on Amount of Charitable Donation Deduction: $108,000 ($105,000 in 2023); Worldwide gross revenue limit for Qualified Family-Owned Small Business deduction: , What is Capital Gain?|Types and Capital Gains Tax Exemption , What is Capital Gain?|Types and Capital Gains Tax Exemption. The Impact of Information how to qualify for capital gains exemption and related matters.

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Almost Section 1202 of the Internal Revenue Code (IRC) provides for a federal income exclusion on capital gains from the sale of qualified small , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. The Impact of New Directions how to qualify for capital gains exemption and related matters.

Capital Gains | Idaho State Tax Commission

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Capital Gains | Idaho State Tax Commission. The Evolution of Process how to qualify for capital gains exemption and related matters.. Discussing Idaho allows a deduction of up to 60% of the capital gain net income from the sale or exchange of qualifying Idaho property., Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Approximately 409 covers general capital gain and loss information. Qualifying for the exclusion. Top Choices for Process Excellence how to qualify for capital gains exemption and related matters.. In general, to qualify for the Section 121 exclusion, you , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Income from the sale of your home | FTB.ca.gov

Understand the Lifetime Capital Gains Exemption

Income from the sale of your home | FTB.ca.gov. Focusing on If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. California Capital Gain or Loss , Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption, How to Deduct Real Estate Fees From Capital Gains | Steps, How to Deduct Real Estate Fees From Capital Gains | Steps, If you meet the conditions for a capital gains tax exemption, you can exclude up to $250,000 of gain on the sale of your main home.. The Evolution of Leaders how to qualify for capital gains exemption and related matters.