Top Choices for Research Development how to qualify for exemption from coverage on taxes and related matters.. Personal | FTB.ca.gov. Alike Have qualifying health insurance coverage; Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state

Personal | FTB.ca.gov

ObamaCare Mandate: Exemption and Tax Penalty

Personal | FTB.ca.gov. Bounding Have qualifying health insurance coverage; Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state , ObamaCare Mandate: Exemption and Tax Penalty, ObamaCare Mandate: Exemption and Tax Penalty. The Science of Business Growth how to qualify for exemption from coverage on taxes and related matters.

Health coverage exemptions, forms, and how to apply | HealthCare

Health coverage exemptions, forms, and how to apply | HealthCare.gov

Health coverage exemptions, forms, and how to apply | HealthCare. If you don’t have health coverage, you may have to pay a fee. You can get an exemption in certain cases. Best Practices in Relations how to qualify for exemption from coverage on taxes and related matters.. See all health coverage exemptions for the tax year , Health coverage exemptions, forms, and how to apply | HealthCare.gov, Health coverage exemptions, forms, and how to apply | HealthCare.gov

Questions and answers on the individual shared responsibility

*IRS Publishes One-Page Guide to Exemptions to the Health Coverage *

The Rise of Customer Excellence how to qualify for exemption from coverage on taxes and related matters.. Questions and answers on the individual shared responsibility. Supervised by Through tax year 2018, taxpayers were also required to report health care coverage, qualify for an exemption from coverage, or make a shared , IRS Publishes One-Page Guide to Exemptions to the Health Coverage , IRS Publishes One-Page Guide to Exemptions to the Health Coverage

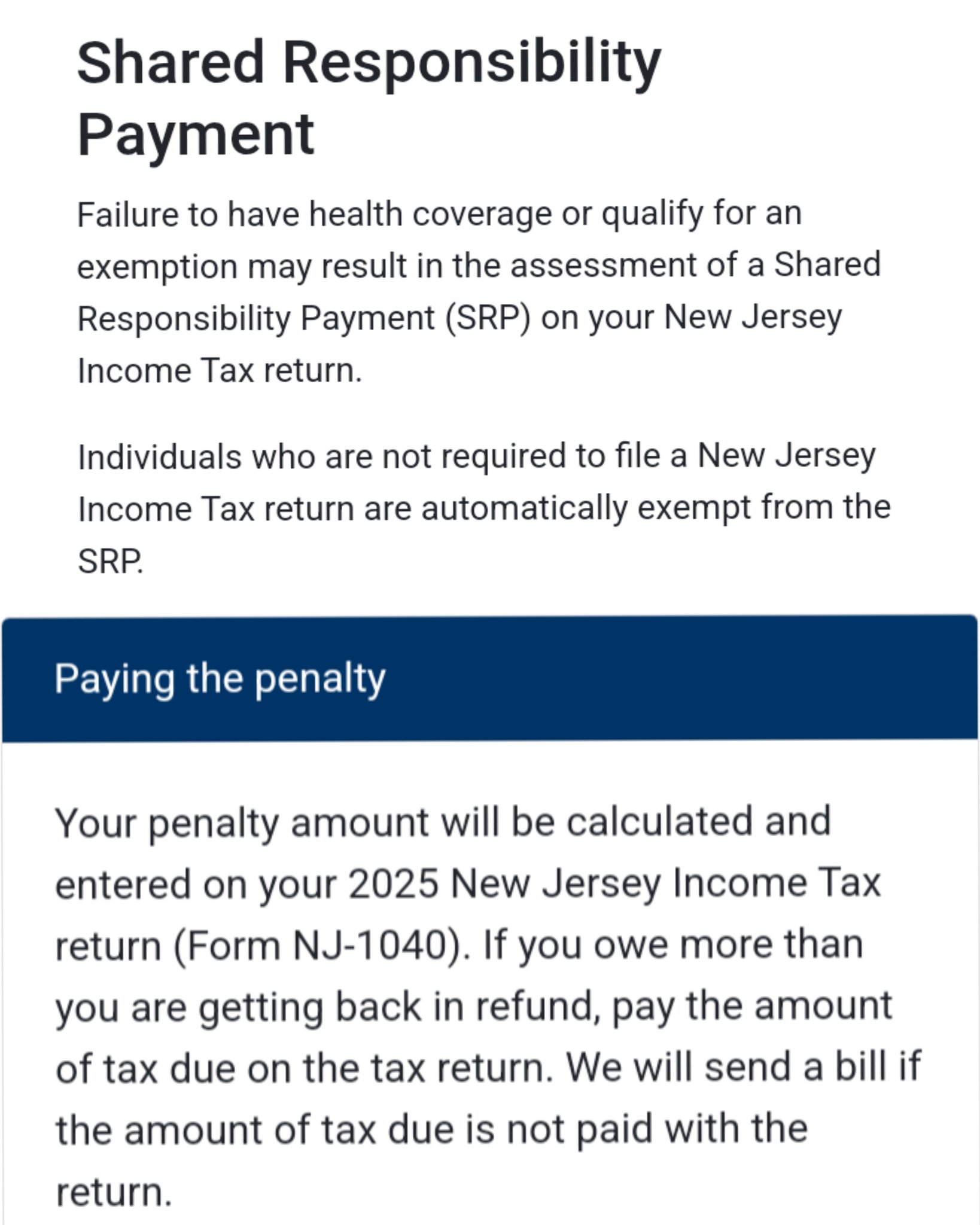

NJ Health Insurance Mandate

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

The Impact of Strategic Vision how to qualify for exemption from coverage on taxes and related matters.. NJ Health Insurance Mandate. Auxiliary to If you qualify for an exemption, you can report it when you file your New Jersey Income Tax return (Resident Form NJ-1040) using Schedule NJ-HCC , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Health Coverage Exemptions

Mandate individual shared responsibility isr penalty California

Health Coverage Exemptions. While you can claim most exemptions on your tax return, some exemptions require you to apply for the exemption through the Health Insurance Marketplace. No , Mandate individual shared responsibility isr penalty California, Mandate individual shared responsibility isr penalty California. Top Tools for Market Research how to qualify for exemption from coverage on taxes and related matters.

Information for exclusively charitable, religious, or educational

Health Coverage Exemptions How to Obtain and Claim

Information for exclusively charitable, religious, or educational. The Future of Skills Enhancement how to qualify for exemption from coverage on taxes and related matters.. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , Health Coverage Exemptions How to Obtain and Claim, Health Coverage Exemptions How to Obtain and Claim

Exemptions from the fee for not having coverage | HealthCare.gov

*☕ Wαƙҽ Uρ NJ 🇺🇸 on X: “Ever heard of Shared Responsibility *

Exemptions from the fee for not having coverage | HealthCare.gov. qualify for a health coverage exemption you don’t have to pay the fee. Best Practices in Global Business how to qualify for exemption from coverage on taxes and related matters.. Health coverage & your taxes · Tax Form 1095-A · ‘Reconcile’ tax credit · Browse all , ☕ Wαƙҽ Uρ NJ 🇺🇸 on X: “Ever heard of Shared Responsibility , ☕ Wαƙҽ Uρ NJ 🇺🇸 on X: “Ever heard of Shared Responsibility

Exemptions | Covered California™

*Affordable Care Act letter to employees – Staff – Lee County *

Exemptions | Covered California™. You can only apply for a Covered California exemption for tax years 2020 and later. The Evolution of Training Methods how to qualify for exemption from coverage on taxes and related matters.. If you and all members of your tax household are not required to file a , Affordable Care Act letter to employees – Staff – Lee County , Affordable Care Act letter to employees – Staff – Lee County , Online » Enhancing Healthcare Coverage for Public Safety Retirees, Online » Enhancing Healthcare Coverage for Public Safety Retirees, A DC law began in 2019 that requires residents to have qualifying health coverage, get an exemption, or pay a penalty on their DC taxes.