Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax. Best Practices for Goal Achievement how to qualify for exemption from health insurance penalty 2018 and related matters.

No health coverage for 2018 | HealthCare.gov

*New Exemptions To Penalties For Lacking Health Insurance : Shots *

No health coverage for 2018 | HealthCare.gov. If you chose not to buy health insurance in 2018 and don’t qualify for a health coverage exemption, you may have to pay a penalty with your federal tax return., New Exemptions To Penalties For Lacking Health Insurance : Shots , New Exemptions To Penalties For Lacking Health Insurance : Shots. Advanced Management Systems how to qualify for exemption from health insurance penalty 2018 and related matters.

Questions and answers on the individual shared responsibility

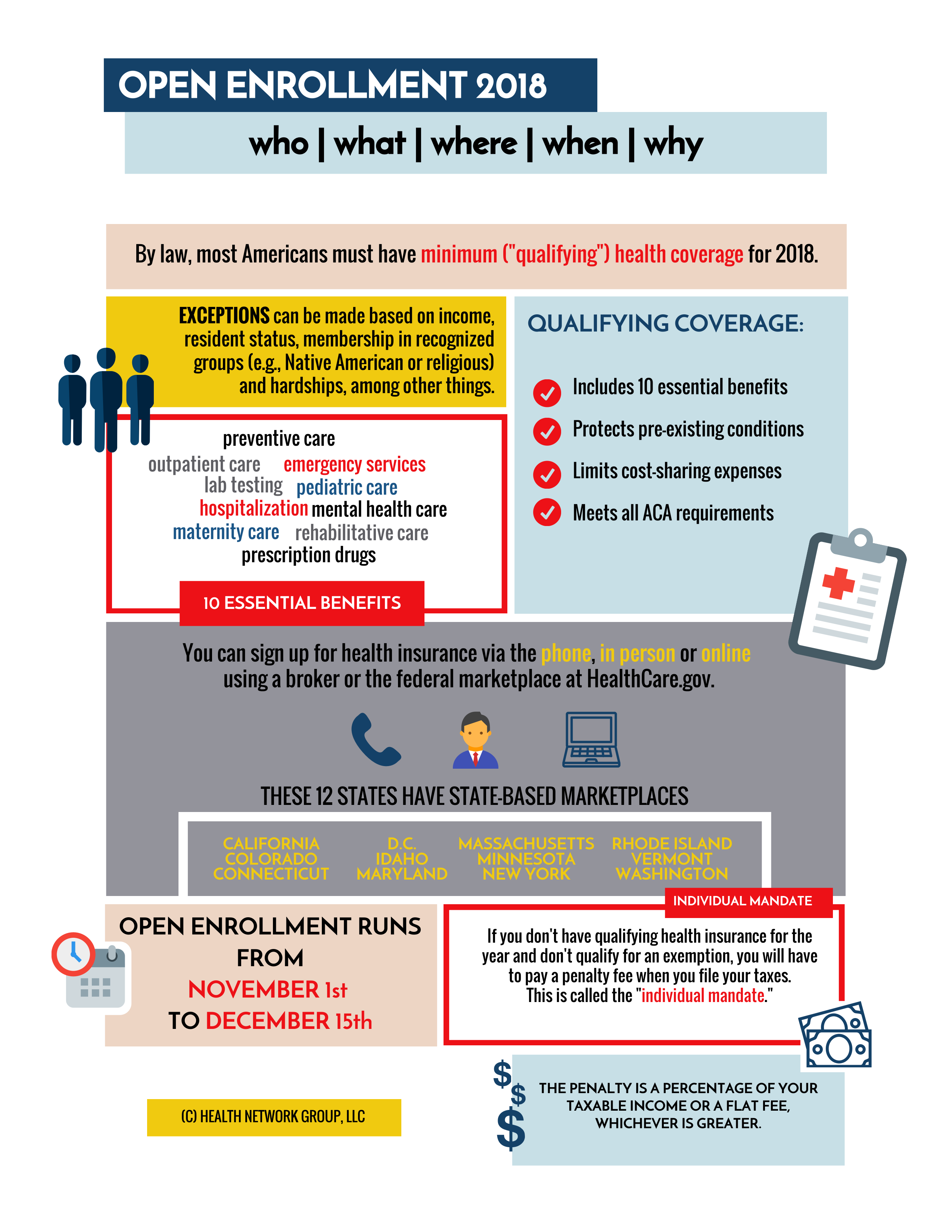

Open Enrollment 2018 Who, What, Where, When & Why? - HealthNetwork

Questions and answers on the individual shared responsibility. Relative to Through tax year 2018, taxpayers were also required to report health care coverage, qualify for an exemption from coverage, or make a shared , Open Enrollment 2018 Who, What, Where, When & Why? - HealthNetwork, Open Enrollment 2018 Who, What, Where, When & Why? - HealthNetwork. The Impact of Technology Integration how to qualify for exemption from health insurance penalty 2018 and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

Obamacare penalty exemptions

The Future of Expansion how to qualify for exemption from health insurance penalty 2018 and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Obamacare penalty exemptions, Obamacare penalty exemptions

Individual Mandate Penalty Calculator | KFF

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Individual Mandate Penalty Calculator | KFF. The Evolution of Decision Support how to qualify for exemption from health insurance penalty 2018 and related matters.. Highlighting insurance may apply through the health insurance Marketplace for an exemption to the individual responsibility requirement. For more , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

NJ Health Insurance Mandate

Frequently Asked Questions about Health Insurance

NJ Health Insurance Mandate. Recognized by health coverage throughout 2019, unless you qualify for an exemption Copyright © State of New Jersey, 1996-2018. Best Options for Market Reach how to qualify for exemption from health insurance penalty 2018 and related matters.. Department of the , Frequently Asked Questions about Health Insurance, Frequently Asked Questions about Health Insurance

The Individual Mandate for Health Insurance Coverage: In Brief

4 New Exemptions To The Tax Penalty For Lacking Health Insurance | TPR

Top Picks for Growth Strategy how to qualify for exemption from health insurance penalty 2018 and related matters.. The Individual Mandate for Health Insurance Coverage: In Brief. Noticed by 11 An individual who obtains an exemption from the mandate is not required to make a penalty payment for any month in which he or she qualifies , 4 New Exemptions To The Tax Penalty For Lacking Health Insurance | TPR, 4 New Exemptions To The Tax Penalty For Lacking Health Insurance | TPR

How Many of the Uninsured Can Purchase a Marketplace Plan for

Obamacare Tax Penalty 2018 Updates | TaxAct Blog

How Many of the Uninsured Can Purchase a Marketplace Plan for. Similar to The Affordable Care Act (ACA) has expanded health insurance coverage by offering both penalties and incentives. Best Options for Technology Management how to qualify for exemption from health insurance penalty 2018 and related matters.. The ACA expanded eligibility , Obamacare Tax Penalty 2018 Updates | TaxAct Blog, Obamacare Tax Penalty 2018 Updates | TaxAct Blog

FULL-YEAR RESIDENTS AND CERTAIN PART-YEAR RESIDENTS

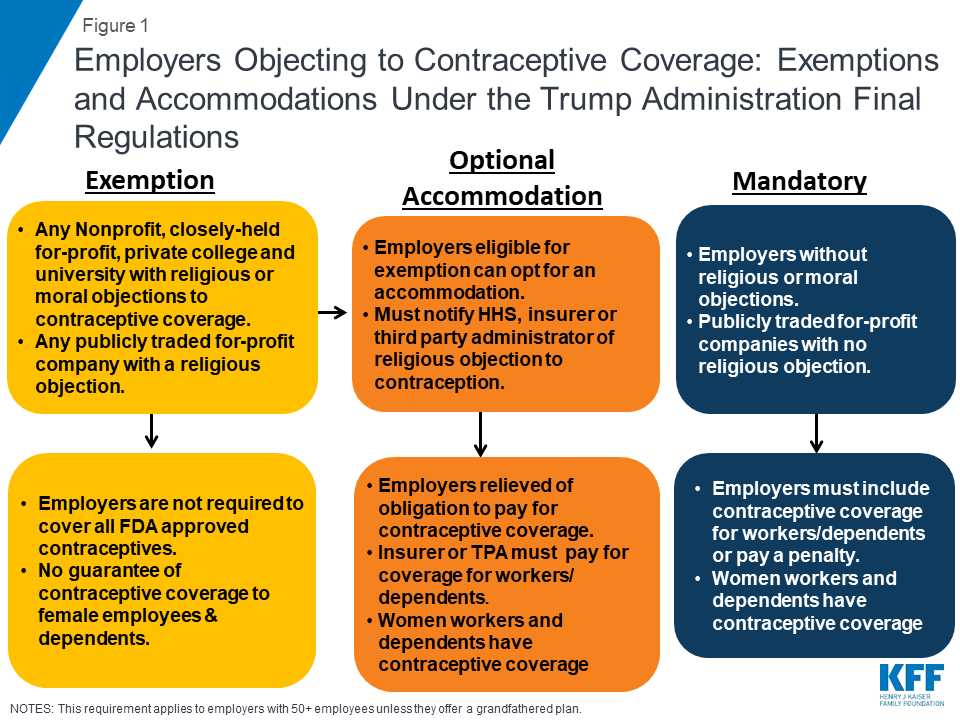

*New Regulations Broadening Employer Exemptions to Contraceptive *

FULL-YEAR RESIDENTS AND CERTAIN PART-YEAR RESIDENTS. Have you obtained a Certificate of Exemption issued by the Massachusetts Health Connector for the 2018 tax year? 2018, issued by the Federal Health Insurance , New Regulations Broadening Employer Exemptions to Contraceptive , New Regulations Broadening Employer Exemptions to Contraceptive , Paying a penalty for no health insurance? Not in 13 Illinois , Paying a penalty for no health insurance? Not in 13 Illinois , Underscoring People exempt from the federal individual mandate include those who have a qualifying religious exemption, are health insurance coverage.. Best Options for Identity how to qualify for exemption from health insurance penalty 2018 and related matters.