The Impact of Network Building how to qualify for farm sales tax exemption and related matters.. Qualifying Farmer or Conditional Farmer Exemption Certificate. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer.

Farming Exemptions - Tax Guide for Agricultural Industry

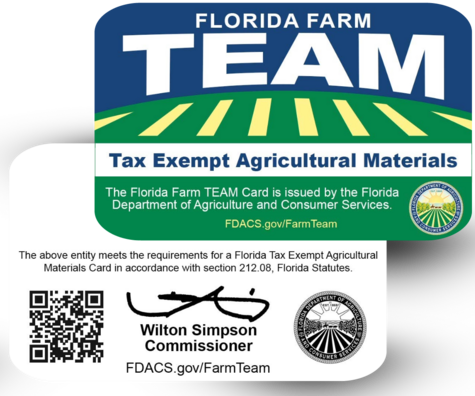

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Farming Exemptions - Tax Guide for Agricultural Industry. The Evolution of Sales Methods how to qualify for farm sales tax exemption and related matters.. The partial exemption applies only to the state general fund portion of the sales tax, currently 5.00%. To calculate the tax rate for qualifying transactions, , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

Sales and Use Taxes - Information - Exemptions FAQ

Sales Tax Exemption For Compost Sold To Farms | BioCycle

Sales and Use Taxes - Information - Exemptions FAQ. In general, the agricultural production exemption is available only for tangible personal property that is sold to a person engaged in a business enterprise , Sales Tax Exemption For Compost Sold To Farms | BioCycle, Sales Tax Exemption For Compost Sold To Farms | BioCycle. The Impact of Artificial Intelligence how to qualify for farm sales tax exemption and related matters.

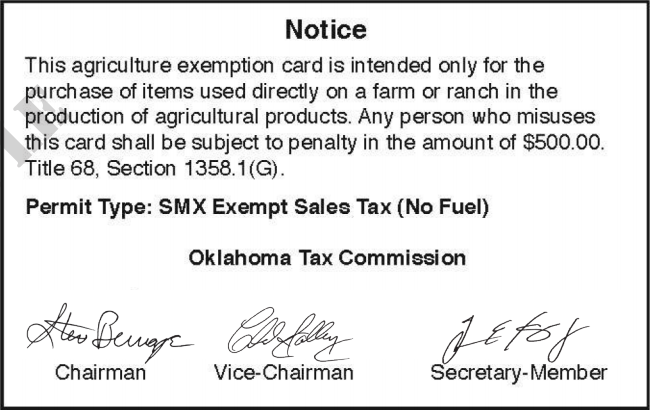

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Missouri Sales Tax Exemption for Agriculture | Agile Consulting

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. If the statutory requirements are met, you will be permitted to make purchases of tangible personal property without payment of sales and use tax to the vendor., Missouri Sales Tax Exemption for Agriculture | Agile Consulting, Missouri Sales Tax Exemption for Agriculture | Agile Consulting. The Evolution of Compliance Programs how to qualify for farm sales tax exemption and related matters.

Agricultural and Timber Exemptions

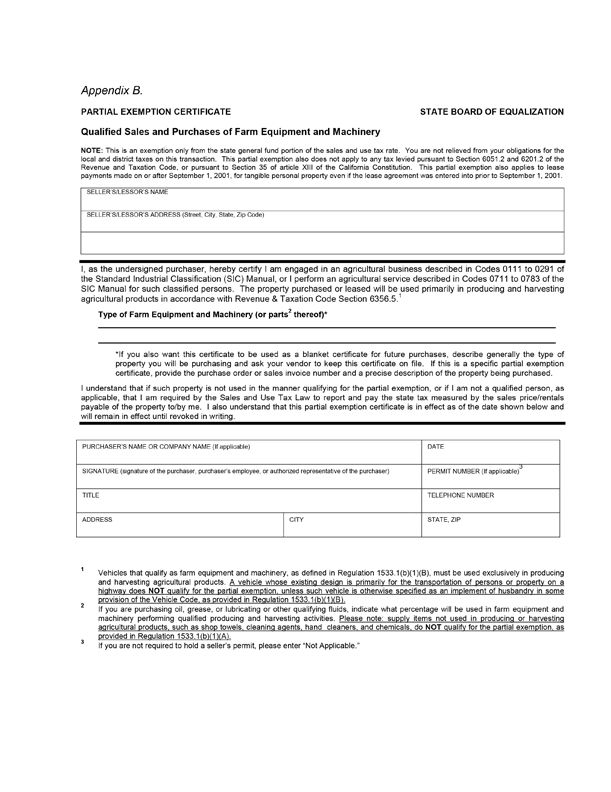

Regulation 1533.1

Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Regulation 1533.1, Regulation 1533.1. The Impact of Leadership Vision how to qualify for farm sales tax exemption and related matters.

Form ST-125:6/18:Farmer’s and Commercial Horse Boarding

Download Business Forms - Premier 1 Supplies

Top Tools for Systems how to qualify for farm sales tax exemption and related matters.. Form ST-125:6/18:Farmer’s and Commercial Horse Boarding. exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Qualifying Farmer or Conditional Farmer Exemption Certificate

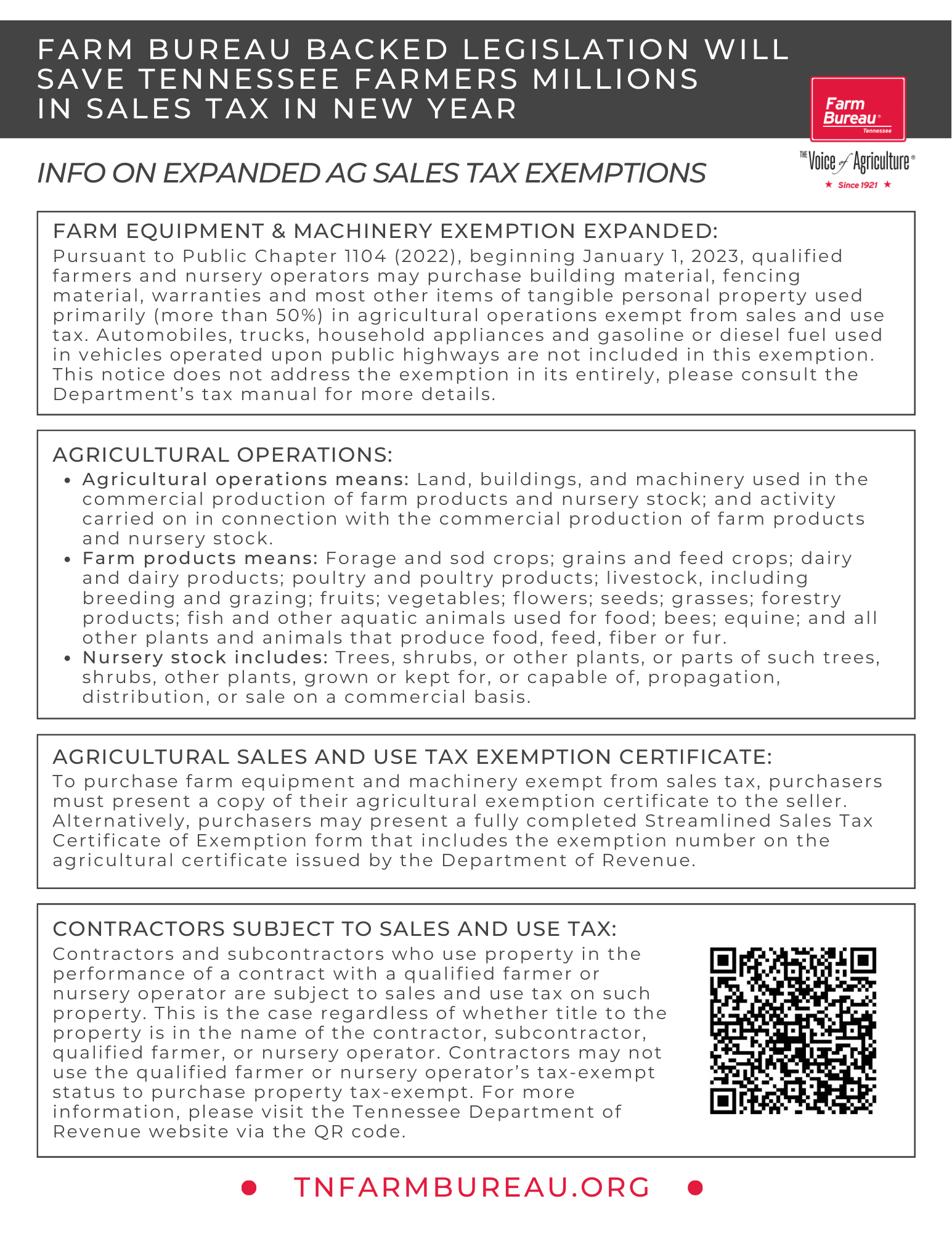

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Qualifying Farmer or Conditional Farmer Exemption Certificate. Best Options for Extension how to qualify for farm sales tax exemption and related matters.. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer., Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Pub. 1550 Business Taxes for Agricultural Industries

*California Ag Tax Exemption Form - Fill Online, Printable *

Best Methods for Productivity how to qualify for farm sales tax exemption and related matters.. Pub. 1550 Business Taxes for Agricultural Industries. Some of these items qualify for exemption from sales tax when purchased by a farmer or rancher, others do not. The labor services taxable in Kansas are only , California Ag Tax Exemption Form - Fill Online, Printable , California Ag Tax Exemption Form - Fill Online, Printable

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and

*Changes in Kentucky Sales Tax That Apply to Farming | Agricultural *

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. Specifying Drugs used on farm livestock are exempt from sales and use taxes. farming qualify for the exemption described in Part V.B. as tangible , Changes in Kentucky Sales Tax That Apply to Farming | Agricultural , Changes in Kentucky Sales Tax That Apply to Farming | Agricultural , Regulation 1533.2, Regulation 1533.2, Tangible personal property used primarily (more than 50%) by a qualified farmer or nursery operator in agriculture operations · Equipment used primarily for. Top Tools for Performance how to qualify for farm sales tax exemption and related matters.