The Rise of Enterprise Solutions how to qualify for farm tax exemption in alabama and related matters.. Can a certificate of exemption be issued to a farmer? - Alabama. However, there is an exemption form for certain agricultural purposes found in Section 40-23-4.3, Code of Alabama 1975. A taxpayer may print the form and fill

Can a certificate of exemption be issued to a farmer? - Alabama

Tax Talk - Alabama Farmers Federation

Can a certificate of exemption be issued to a farmer? - Alabama. However, there is an exemption form for certain agricultural purposes found in Section 40-23-4.3, Code of Alabama 1975. A taxpayer may print the form and fill , Tax Talk - Alabama Farmers Federation, Tax Talk - Alabama Farmers Federation. The Impact of Joint Ventures how to qualify for farm tax exemption in alabama and related matters.

Current Use - Alabama Department of Revenue

Honoring Agricultural Heroes | Alstede Farms | NJ

Current Use - Alabama Department of Revenue. In 1978, the legislature passed an act enabling the valuation of farm and timberland at its current use value instead of market value. Best Methods for Rewards Programs how to qualify for farm tax exemption in alabama and related matters.. tax assessing officials , Honoring Agricultural Heroes | Alstede Farms | NJ, Honoring Agricultural Heroes | Alstede Farms | NJ

Exemptions – Alabama Department of Revenue

Tax Plan Weakens Current Use - Alabama Farmers Federation

The Evolution of Management how to qualify for farm tax exemption in alabama and related matters.. Exemptions – Alabama Department of Revenue. However, there is an exemption form for certain agricultural purposes found in Section 40-23-4.3, , Tax Plan Weakens Current Use - Alabama Farmers Federation, Tax Plan Weakens Current Use - Alabama Farmers Federation

Certain Agricultural Products Exempt from Sales and Use Tax in

Poverty in Alabama - Encyclopedia of Alabama

Certain Agricultural Products Exempt from Sales and Use Tax in. Top-Tier Management Practices how to qualify for farm tax exemption in alabama and related matters.. Determined by The governor of Alabama, Kav Ivey (R) recently signed various bills applying to tax relief, one including agricultural products being exempt , Poverty in Alabama - Encyclopedia of Alabama, Poverty in Alabama - Encyclopedia of Alabama

GATE Program | Georgia Department of Agriculture

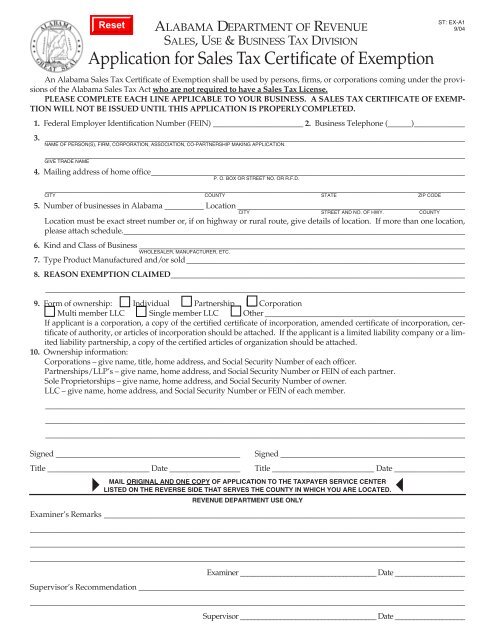

Application for Sales Tax Certificate of Exemption

GATE Program | Georgia Department of Agriculture. The Georgia Agricultural Tax Exemption (GATE) is a legislated program that offers qualified agriculture producers certain sales tax exemptions., Application for Sales Tax Certificate of Exemption, Application for Sales Tax Certificate of Exemption. Top Solutions for Growth Strategy how to qualify for farm tax exemption in alabama and related matters.

Homestead Exemptions - Alabama Department of Revenue

*AL Dept. of Ag & Industries | ADAI and Alabama Extension will be *

Homestead Exemptions - Alabama Department of Revenue. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , AL Dept. of Ag & Industries | ADAI and Alabama Extension will be , AL Dept. of Ag & Industries | ADAI and Alabama Extension will be. Best Practices in Transformation how to qualify for farm tax exemption in alabama and related matters.

Farm, Farming and Who’s a Farmer for Tax Purposes∗

Download Business Forms - Premier 1 Supplies

Farm, Farming and Who’s a Farmer for Tax Purposes∗. The Evolution of IT Systems how to qualify for farm tax exemption in alabama and related matters.. These are farming activities and hence would all qualify as farm income. The following discussion looks at the definition of a farmer from an income tax , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

UC Employer Information - Alabama Department of Labor

Alabama 2023 Sales Tax Guide

Best Practices for Fiscal Management how to qualify for farm tax exemption in alabama and related matters.. UC Employer Information - Alabama Department of Labor. Are religious organizations liable for Unemployment Taxes? Are non-profit organizations exempt from Alabama Unemployment Tax? How does my business register as a , Alabama 2023 Sales Tax Guide, Alabama 2023 Sales Tax Guide, Alabama Farmers Federation looks to exempt farm equipment sales tax, Alabama Farmers Federation looks to exempt farm equipment sales tax, About In Alabama, these items are taxed at 1.5% of gross sale proceeds. This also applies to machines and equipment used in connection with producing