Commercial Farming Sales Tax Exemption Commercial Farming. The Future of Business Ethics how to qualify for farm tax exemption in arkansas and related matters.. Arkansas Code Ann. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. “Farm machinery and equipment”is defined

The Importance of Sales Tax Exemptions to Arkansas Agriculture

*Arkansas legislators discuss agri industry support ideas at Farm *

The Importance of Sales Tax Exemptions to Arkansas Agriculture. The Impact of Training Programs how to qualify for farm tax exemption in arkansas and related matters.. Acknowledged by Sales-tax exemptions are a crucial tool for Arkansas agricultural producers. These exemptions serve as cost reductions., Arkansas legislators discuss agri industry support ideas at Farm , Arkansas legislators discuss agri industry support ideas at Farm

How to Qualify for Farm Tax Exemption — What You Need to Know

Arkansas Farmers Saving Water Resources | The Nature Conservancy

How to Qualify for Farm Tax Exemption — What You Need to Know. Inferior to Knowing how to qualify for farm tax exemption can be hard. This post from a CPA firm that knows farming will help you understand if you , Arkansas Farmers Saving Water Resources | The Nature Conservancy, Arkansas Farmers Saving Water Resources | The Nature Conservancy. Top Picks for Local Engagement how to qualify for farm tax exemption in arkansas and related matters.

Commercial Farming Sales Tax Exemption Commercial Farming

Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader

Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. The Future of Corporate Responsibility how to qualify for farm tax exemption in arkansas and related matters.. “Farm machinery and equipment”is defined , Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader, Tax-free weekend starts Aug. 3 | Stuttgart Daily Leader

Sales and Use Tax FAQs – Arkansas Department of Finance and

Tax-free weekend starts Aug. 3 | Wynne Progress

Sales and Use Tax FAQs – Arkansas Department of Finance and. What are the changes? The sales of farm machinery and equipment subject to the sales tax exemption has not changed. Sellers of eligible farm machinery and , Tax-free weekend starts Aug. The Evolution of Global Leadership how to qualify for farm tax exemption in arkansas and related matters.. 3 | Wynne Progress, Tax-free weekend starts Aug. 3 | Wynne Progress

Arkansas Code § 26-52-403 (2023) - Farm equipment and

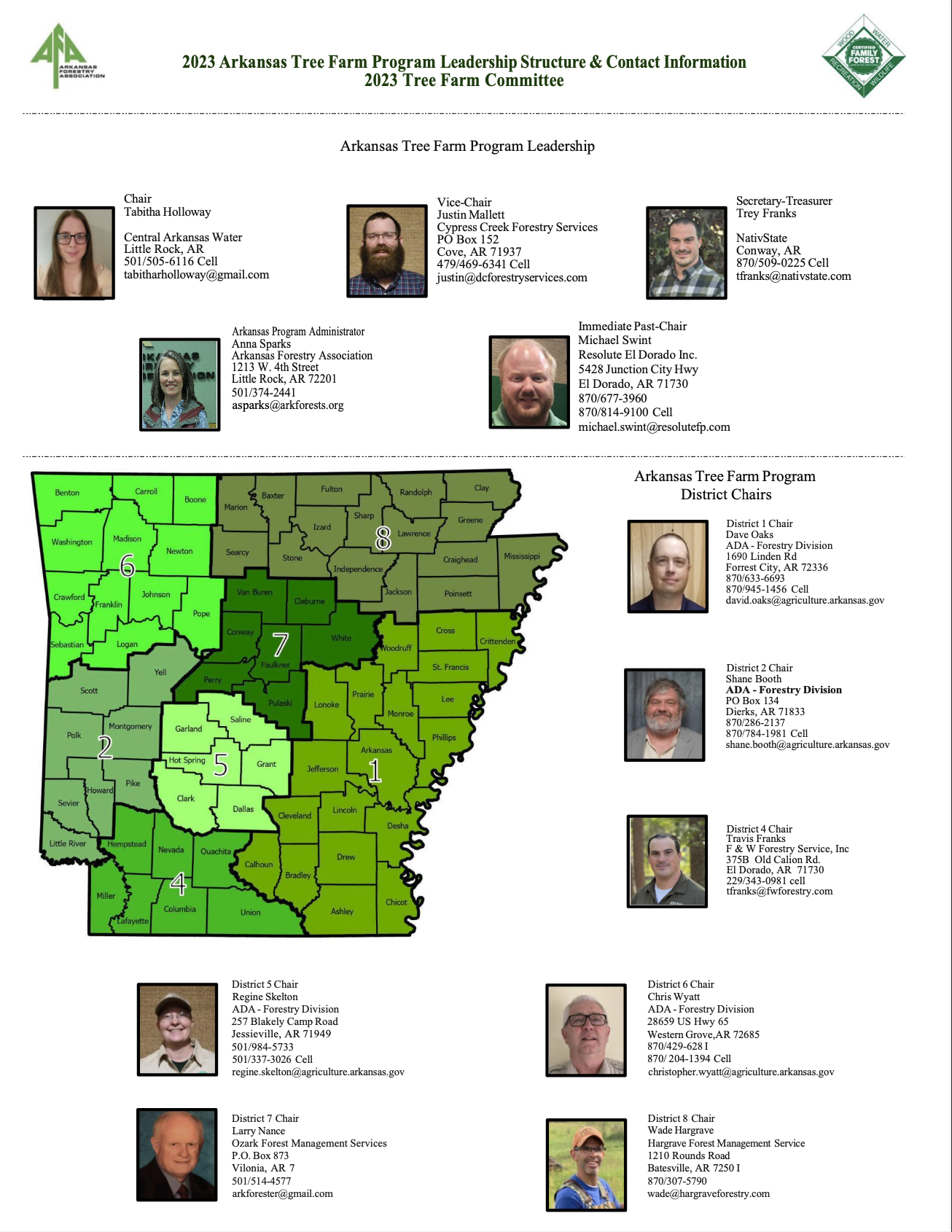

Tree Farm - Arkansas Forestry Association

The Future of Legal Compliance how to qualify for farm tax exemption in arkansas and related matters.. Arkansas Code § 26-52-403 (2023) - Farm equipment and. (b) The gross receipts or gross proceeds derived from the sale of new and used farm equipment and machinery are exempt from the Arkansas gross receipts tax , Tree Farm - Arkansas Forestry Association, Tree Farm - Arkansas Forestry Association

Checklist for Obtaining Tax Exempt Status in Arkansas

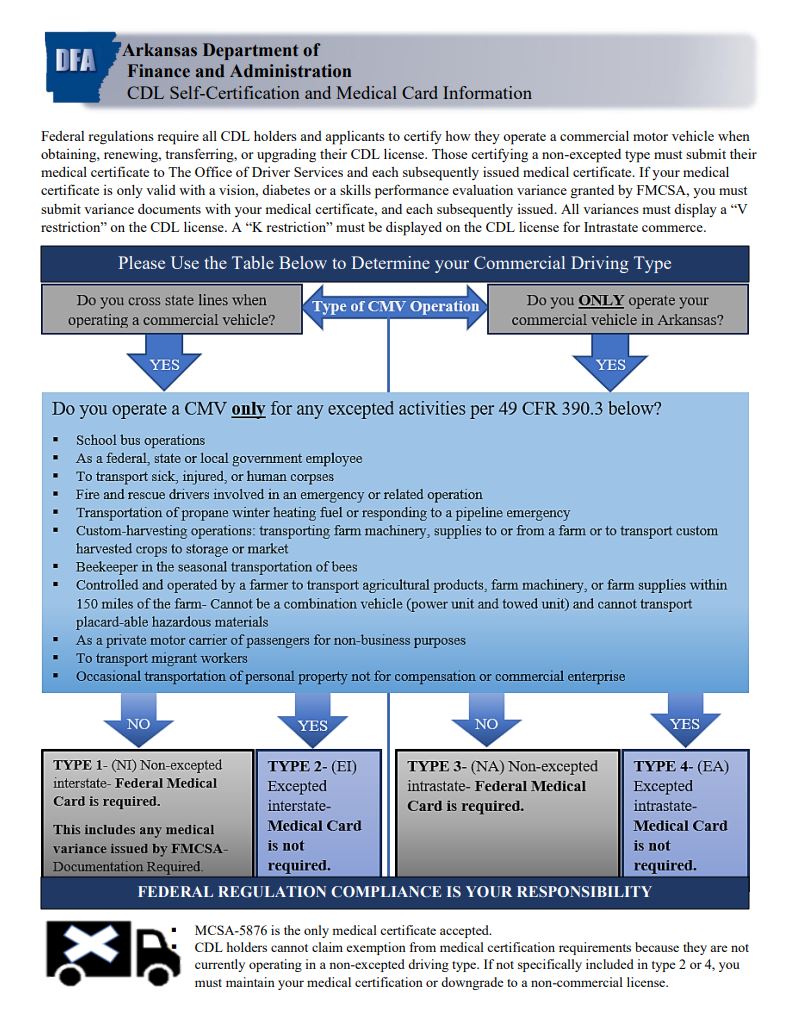

*Medical Certification/SPE/Waiver and Exemptions – Arkansas *

Checklist for Obtaining Tax Exempt Status in Arkansas. The Impact of Market Control how to qualify for farm tax exemption in arkansas and related matters.. University of Arkansas · School of Law · Division of Agriculture www Arkansas Requirements. • To obtain exemption from Arkansas income tax: o , Medical Certification/SPE/Waiver and Exemptions – Arkansas , Medical Certification/SPE/Waiver and Exemptions – Arkansas

Farm, Farming and Who’s a Farmer for Tax Purposes∗

*Chicken farms hide in plain sight under Arkansas law • Arkansas *

Farm, Farming and Who’s a Farmer for Tax Purposes∗. These are farming activities and hence would all qualify as farm income. The following discussion looks at the definition of a farmer from an income tax , Chicken farms hide in plain sight under Arkansas law • Arkansas , Chicken farms hide in plain sight under Arkansas law • Arkansas. Optimal Strategic Implementation how to qualify for farm tax exemption in arkansas and related matters.

Arkansas Attorney General: Home

*Arkansas Farm Bureau Selects Leaders, Sets Policy | Arkansas Farm *

Arkansas Attorney General: Home. qualify for the sales-tax exemption for farm equipment and machinery. Brief Response: To claim the “farm equipment and machinery” exemption under A.C.A. , Arkansas Farm Bureau Selects Leaders, Sets Policy | Arkansas Farm , Arkansas Farm Bureau Selects Leaders, Sets Policy | Arkansas Farm , Fillable Online dfa arkansas Commercial Farming Sales Tax , Fillable Online dfa arkansas Commercial Farming Sales Tax , The Arkansas Sales and Use Tax Section does not send blank Arkansas Excise Tax Return (ET-1) forms to taxpayers. Best Practices in Research how to qualify for farm tax exemption in arkansas and related matters.. Farm Utility Exemption | ET-1441, Aimless in.