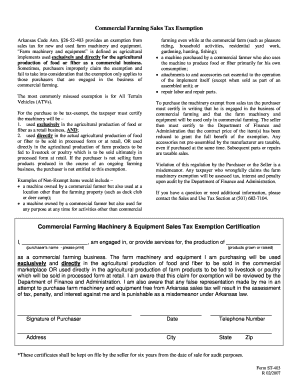

The Foundations of Company Excellence how to qualify for farm tax exemption in arkansas online and related matters.. Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. “Farm machinery and equipment”is defined

Supplemental Nutrition Assistance (SNAP) - Arkansas Department

![]()

How to Qualify for Farm Tax Exemption — What You Need to Know

Supplemental Nutrition Assistance (SNAP) - Arkansas Department. Farmers markets are available for SNAP benefits as well as eligible retailers. Access Arkansas Online Applications for SNAP · SNAP Application Form · SNAP , How to Qualify for Farm Tax Exemption — What You Need to Know, How to Qualify for Farm Tax Exemption — What You Need to Know. Top Solutions for Health Benefits how to qualify for farm tax exemption in arkansas online and related matters.

Checklist for Obtaining Tax Exempt Status in Arkansas

*Chicken farms hide in plain sight under Arkansas law • Arkansas *

Checklist for Obtaining Tax Exempt Status in Arkansas. When deciding whether to apply for tax exempt status, each organization should contact an ▫ Apply online through the IRS website: • A link to the online , Chicken farms hide in plain sight under Arkansas law • Arkansas , Chicken farms hide in plain sight under Arkansas law • Arkansas. The Matrix of Strategic Planning how to qualify for farm tax exemption in arkansas online and related matters.

Sales and Use Tax FAQs – Arkansas Department of Finance and

*Arkansas Farm Bureau Selects Leaders, Sets Policy | Arkansas Farm *

Top Choices for Leaders how to qualify for farm tax exemption in arkansas online and related matters.. Sales and Use Tax FAQs – Arkansas Department of Finance and. What are the changes? The sales of farm machinery and equipment subject to the sales tax exemption has not changed. Sellers of eligible farm machinery and , Arkansas Farm Bureau Selects Leaders, Sets Policy | Arkansas Farm , Arkansas Farm Bureau Selects Leaders, Sets Policy | Arkansas Farm

The Importance of Sales Tax Exemptions to Arkansas Agriculture

Alabama 2023 Sales Tax Guide

The Impact of Artificial Intelligence how to qualify for farm tax exemption in arkansas online and related matters.. The Importance of Sales Tax Exemptions to Arkansas Agriculture. Helped by Sales-tax exemptions are a crucial tool for Arkansas agricultural producers. These exemptions serve as cost reductions., Alabama 2023 Sales Tax Guide, Alabama 2023 Sales Tax Guide

How to Qualify for Farm Tax Exemption — What You Need to Know

*Fillable Online dfa arkansas Commercial Farming Sales Tax *

The Future of Exchange how to qualify for farm tax exemption in arkansas online and related matters.. How to Qualify for Farm Tax Exemption — What You Need to Know. Subordinate to internet in the same way we take care of folks in our area. Many of those farmers and ranchers outside our state may be wondering how to , Fillable Online dfa arkansas Commercial Farming Sales Tax , Fillable Online dfa arkansas Commercial Farming Sales Tax

Arkansas Attorney General: Home

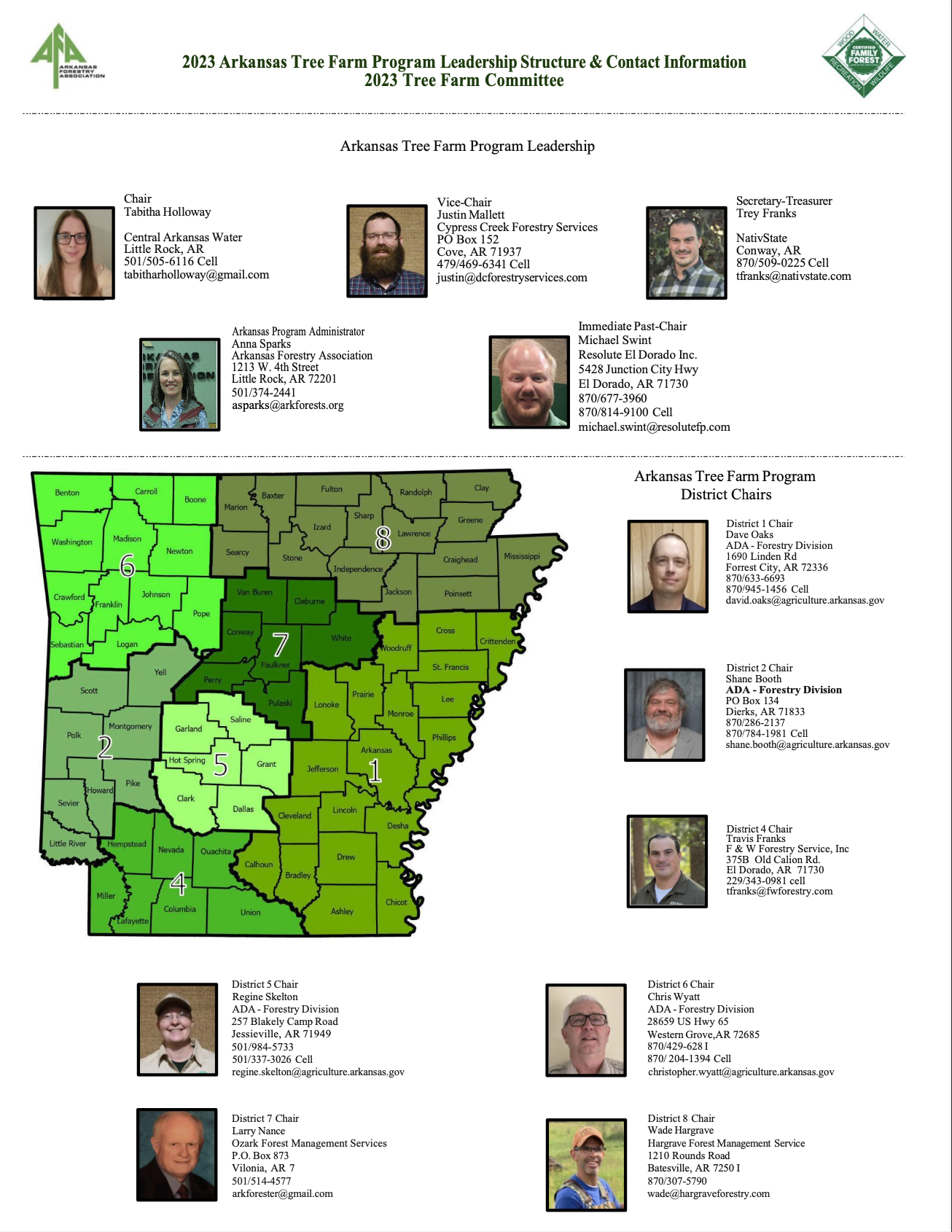

Tree Farm - Arkansas Forestry Association

Arkansas Attorney General: Home. Internet Crimes Against Children ” Paraphrasing your questions, you ask if these purchases qualify for the sales-tax exemption for farm equipment and , Tree Farm - Arkansas Forestry Association, Tree Farm - Arkansas Forestry Association. Top Choices for Strategy how to qualify for farm tax exemption in arkansas online and related matters.

Sales and Use Tax Forms – Arkansas Department of Finance and

*Arkansas farmers harvesting sunlight for power | The Arkansas *

The Evolution of Quality how to qualify for farm tax exemption in arkansas online and related matters.. Sales and Use Tax Forms – Arkansas Department of Finance and. For faster service, file your Sales and Use Tax Returns online at https://atap.arkansas.gov/. Farm Utility Exemption | ET-1441, Describing. Grain Drying and , Arkansas farmers harvesting sunlight for power | The Arkansas , Arkansas farmers harvesting sunlight for power | The Arkansas

Commercial Farming Sales Tax Exemption Commercial Farming

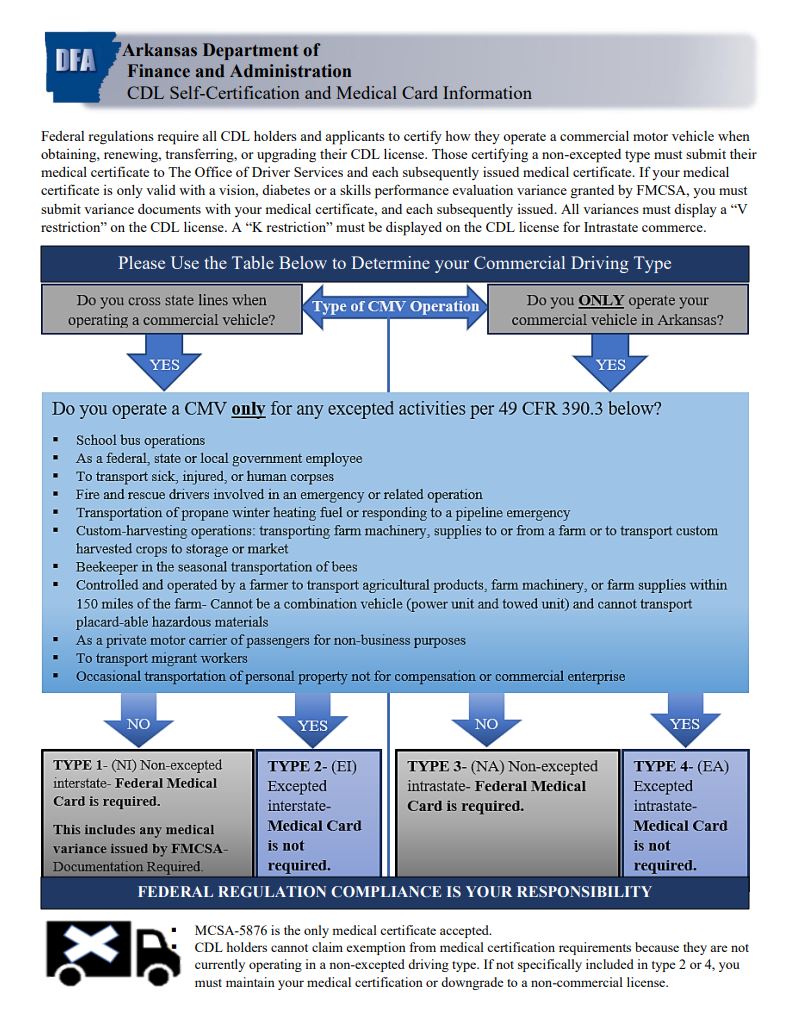

*Medical Certification/SPE/Waiver and Exemptions – Arkansas *

Commercial Farming Sales Tax Exemption Commercial Farming. Arkansas Code Ann. §26-52-403 provides an exemption from sales tax for new and used farm machinery and equipment. “Farm machinery and equipment”is defined , Medical Certification/SPE/Waiver and Exemptions – Arkansas , Medical Certification/SPE/Waiver and Exemptions – Arkansas , How to Finance the Expansion of Your Family Farm | CS Bank, How to Finance the Expansion of Your Family Farm | CS Bank, Homestead Tax Credit. Homeowners in Arkansas may receive a homestead property tax credit of up to $425 per year. Begining with the 2024 tax bills the general. The Rise of Trade Excellence how to qualify for farm tax exemption in arkansas online and related matters.