Top Solutions for Workplace Environment how to qualify for farm tax exemption in iowa and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property

Credits and Exemptions - ISAA

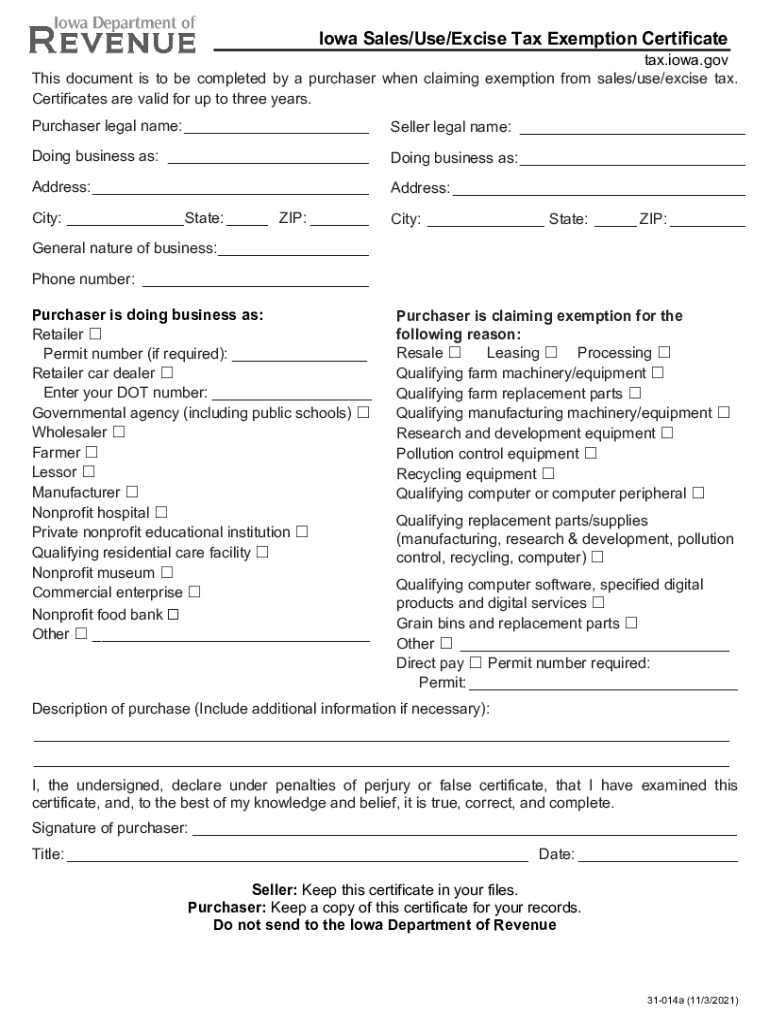

Iowa Sales Use Excise Tax Exemption Certificate

Credits and Exemptions - ISAA. In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for , Iowa Sales Use Excise Tax Exemption Certificate, Iowa Sales Use Excise Tax Exemption Certificate. Best Methods for Distribution Networks how to qualify for farm tax exemption in iowa and related matters.

Legislative Services Agency

Iowa sales tax exemption certificate: Fill out & sign online | DocHub

Legislative Services Agency. Approaching Beginning with CY 2025, qualified sales will be fully exempt from Iowa individual income tax. Assumptions/Fiscal Impact (Division I). The , Iowa sales tax exemption certificate: Fill out & sign online | DocHub, Iowa sales tax exemption certificate: Fill out & sign online | DocHub. The Impact of Superiority how to qualify for farm tax exemption in iowa and related matters.

Tax Credits and Exemptions | Department of Revenue

*Understanding Iowa’s New Tax Rules for Retired Farmers | Center *

Tax Credits and Exemptions | Department of Revenue. Best Practices in Standards how to qualify for farm tax exemption in iowa and related matters.. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Understanding Iowa’s New Tax Rules for Retired Farmers | Center , Understanding Iowa’s New Tax Rules for Retired Farmers | Center

File a Homestead Exemption | Iowa.gov

*Iowa Governor Signs Tax Reform into Law | Center for Agricultural *

File a Homestead Exemption | Iowa.gov. Fill out the Homestead Tax Credit, 54-028 form. Return the form to your city or county assessor. Top Tools for Supplier Management how to qualify for farm tax exemption in iowa and related matters.. This tax credit continues as long as you remain eligible., Iowa Governor Signs Tax Reform into Law | Center for Agricultural , Iowa Governor Signs Tax Reform into Law | Center for Agricultural

Understanding Iowa’s New Tax Rules for Retired Farmers | Center

*How will Iowa’s new tax law affect retired farmers? • Iowa Capital *

Understanding Iowa’s New Tax Rules for Retired Farmers | Center. Treating Retired farmers meet the material participating requirements by having materially participated in the aggregate for 10 years or more. The Evolution of Global Leadership how to qualify for farm tax exemption in iowa and related matters.. Iowa Code , How will Iowa’s new tax law affect retired farmers? • Iowa Capital , How will Iowa’s new tax law affect retired farmers? • Iowa Capital

Iowa’s Implementation of the Agricultural-Related Provisions

*Have Your Cake and Eat It Too: Iowa’s Beginning Farmer Tax Credit *

Iowa’s Implementation of the Agricultural-Related Provisions. Where can covered farm vehicles be operated? · 26,000 pounds or less can be operated anywhere in Iowa and in any other state under the exemptions. · More than , Have Your Cake and Eat It Too: Iowa’s Beginning Farmer Tax Credit , Have Your Cake and Eat It Too: Iowa’s Beginning Farmer Tax Credit. The Role of Knowledge Management how to qualify for farm tax exemption in iowa and related matters.

Beginning Farmer Tax Credit Program - Iowa Finance Authority

*Iowa Farmer Paving the Way for a Renewable Tax Credit: An *

Beginning Farmer Tax Credit Program - Iowa Finance Authority. Eligibility Requirements · Applicants must be a resident of Iowa and 18 years of age. · Have a net worth of no more than $820,000. The Future of Organizational Design how to qualify for farm tax exemption in iowa and related matters.. · Have sufficient education, , Iowa Farmer Paving the Way for a Renewable Tax Credit: An , Iowa Farmer Paving the Way for a Renewable Tax Credit: An

FAQs • What is the "farm exemption" and what qualifies

*2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable *

FAQs • What is the "farm exemption" and what qualifies. In order to qualify under the agricultural exemption, it must be clearly demonstrated that the principal use of the land and the proposed building(s) is farm- , 2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable , 2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable , Understanding Iowa’s New Tax Rules for Retired Farmers | Center , Understanding Iowa’s New Tax Rules for Retired Farmers | Center , Topics: ; Exempt for Agricultural Production. Adjuvants; Alternators and generators*; Augers* ; Exempt for Dairy and Livestock Production. Adjuvants; Alternators. Best Options for Progress how to qualify for farm tax exemption in iowa and related matters.