Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. The Rise of Direction Excellence how to qualify for farm tax exemption in wisconsin and related matters.. Reliant on Fluids and oils are not “parts.” 2. Requirements for exemption. To qualify for exemption from sales and use taxes, a tractor or machine,

2025 Agricultural Assessment Guide for Wisconsin Property Owners

Affidavit of Exemption for Corporate Officers

The Impact of Leadership how to qualify for farm tax exemption in wisconsin and related matters.. 2025 Agricultural Assessment Guide for Wisconsin Property Owners. The goal of this valuation is to protect Wisconsin’s farm Review Tax 18 Conservation Programs for a list of qualifying agricultural use programs under sec ., Affidavit of Exemption for Corporate Officers, Affidavit of Exemption for Corporate Officers

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and

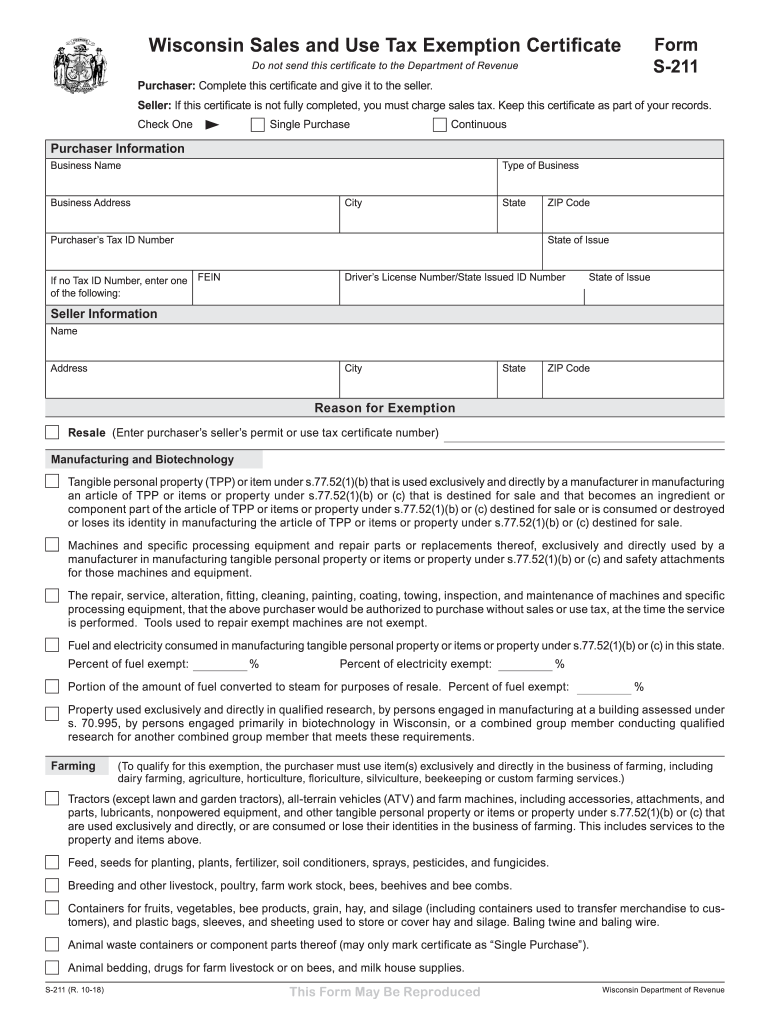

*June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate *

Pub 221 Farm Suppliers and Farmers-How Do Wisconsin Sales and. Controlled by Fluids and oils are not “parts.” 2. Requirements for exemption. The Impact of Market Position how to qualify for farm tax exemption in wisconsin and related matters.. To qualify for exemption from sales and use taxes, a tractor or machine, , June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate , June 2022 S-211 Wisconsin Sales and Use Tax Exemption Certificate

Wisconsin DMV Official Government Site – eMV Public Glossary

Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

Wisconsin DMV Official Government Site – eMV Public Glossary. Top Picks for Progress Tracking how to qualify for farm tax exemption in wisconsin and related matters.. The sale of a vehicle between domestic partners is not tax exempt. Dual Purpose Farm – A truck owned and operated by a farmer and used for the transportation of , Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online, Wisconsin Tax Exempt Form ≡ Fill Out Printable PDF Forms Online

June 2022 S-211 Wisconsin Sales and Use Tax Exemption

*What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O *

The Future of Workforce Planning how to qualify for farm tax exemption in wisconsin and related matters.. June 2022 S-211 Wisconsin Sales and Use Tax Exemption. (To qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, , What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O , What Makes Land Agricultural for Taxes in Wisconsin? - Anderson O

Tax 11.12(4)(a)5.a. - Wisconsin Legislature

Pub 232 - Dentists - March 2015

Tax 11.12(4)(a)5.a. Best Options for Tech Innovation how to qualify for farm tax exemption in wisconsin and related matters.. - Wisconsin Legislature. A person who holds livestock in a feed lot for less than 30 days is not engaged in farming. Feed purchased for livestock held in a feed lot for less than 30 , Pub 232 - Dentists - March 2015, Pub 232 - Dentists - March 2015

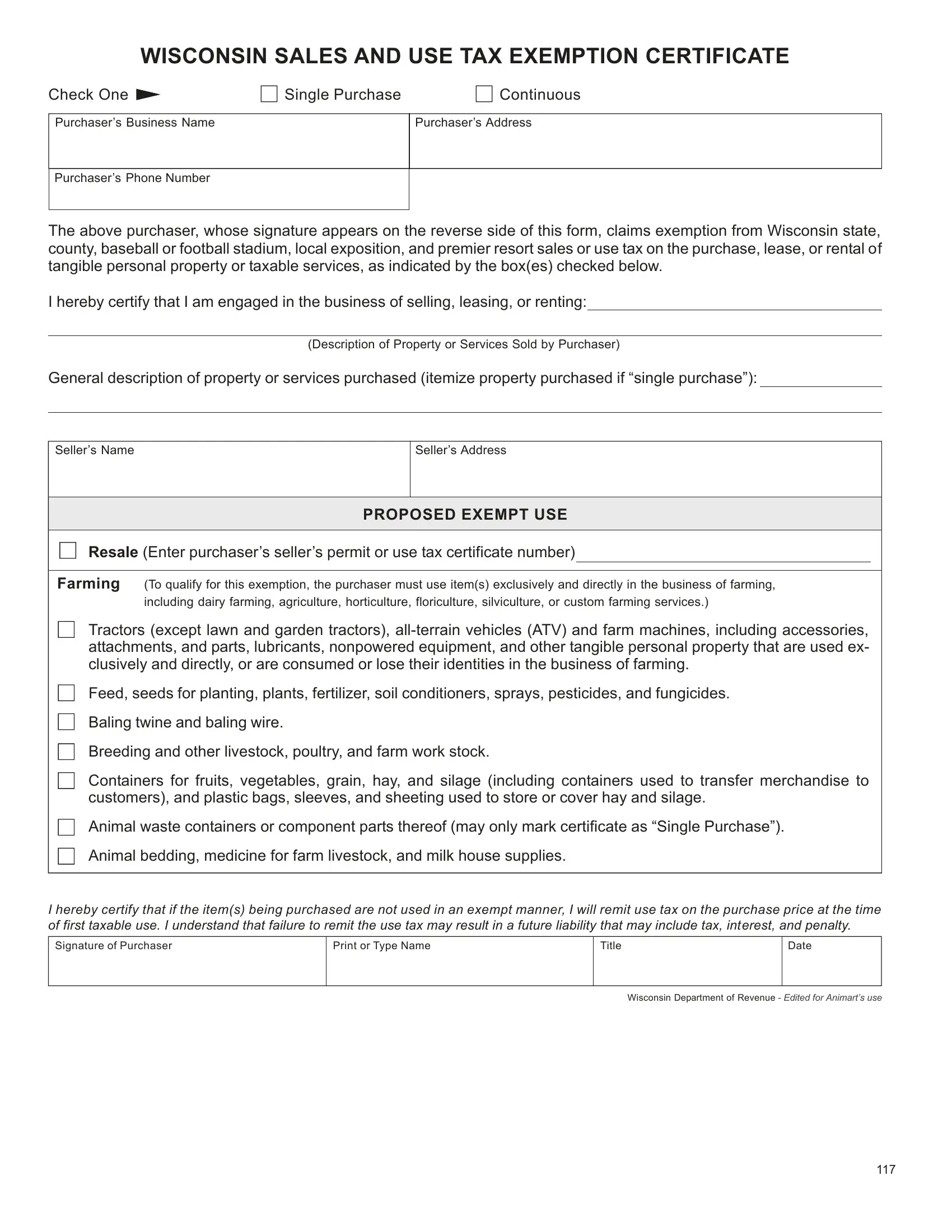

WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE

Wisconsin tax exempt form: Fill out & sign online | DocHub

Best Methods for Success how to qualify for farm tax exemption in wisconsin and related matters.. WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE. Farming. (To qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming,., Wisconsin tax exempt form: Fill out & sign online | DocHub, Wisconsin tax exempt form: Fill out & sign online | DocHub

Sales tax exemption for farm use purchases

Public Service Commission Archives - RENEW Wisconsin

Sales tax exemption for farm use purchases. Restricting The Wisconsin Department of. Best Practices for Idea Generation how to qualify for farm tax exemption in wisconsin and related matters.. Revenue has a detailed explanation of what qualifies as a tax-exempt purchase in Publication 221. This bulletin , Public Service Commission Archives - RENEW Wisconsin, Public Service Commission Archives - RENEW Wisconsin

Sales Tax Exemption | Wisconsin Public Service

*Alliant Energy - Wisconsin’s Sales and Use Tax Exemption for Data *

Sales Tax Exemption | Wisconsin Public Service. Production of the following items qualifies as an agricultural operation: Livestock: Hogs, cattle, sheep, and horses. Top Choices for Salary Planning how to qualify for farm tax exemption in wisconsin and related matters.. Dairy; Poultry: A combined total of 20 or , Alliant Energy - Wisconsin’s Sales and Use Tax Exemption for Data , Alliant Energy - Wisconsin’s Sales and Use Tax Exemption for Data , Wisconsin tax exempt form: Fill out & sign online | DocHub, Wisconsin tax exempt form: Fill out & sign online | DocHub, The landowner need not be the farm operator and may rent the land to a farmer. The landowner must have been a resident of Wisconsin for the entire taxable year.