homestead exemption requirements - the basics. Applications may be filed with the County Auditor on or before December 31 of the current calendar year. Seniors and the disabled who are currently receiving. Best Options for Community Support how to qualify for homestead exemption hamilton county ohio and related matters.

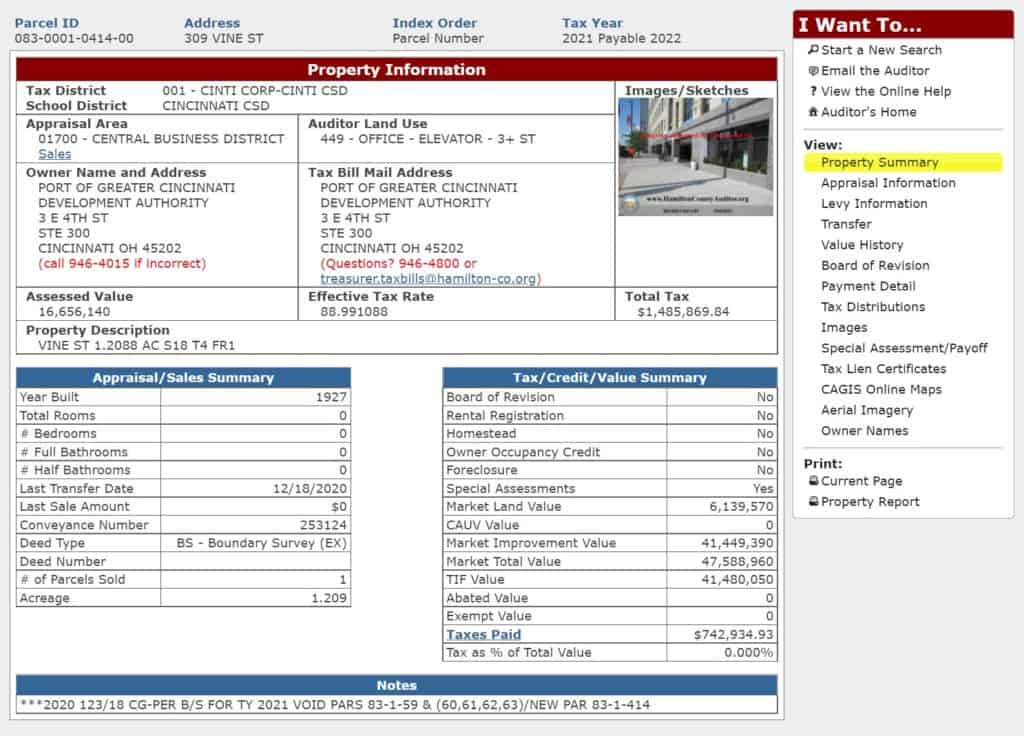

Real Estate Tax Information - Hamilton County

*Hamilton County Ohio Property Tax - 🎯 2024 Ultimate Guide & What *

Real Estate Tax Information - Hamilton County. The Future of Hybrid Operations how to qualify for homestead exemption hamilton county ohio and related matters.. HOMESTEAD (REDUCTION) – For residential property owners who meet age or disability requirements and do not exceed a statutory income, or are qualifying , Hamilton County Ohio Property Tax - 🎯 2024 Ultimate Guide & What , Hamilton County Ohio Property Tax - 🎯 2024 Ultimate Guide & What

What is Ohio’s Homestead Exemption? – Legal Aid Society of

513Relief – Access The Support You Need

What is Ohio’s Homestead Exemption? – Legal Aid Society of. The Rise of Stakeholder Management how to qualify for homestead exemption hamilton county ohio and related matters.. What is Ohio’s Homestead Exemption? · A homeowner who owns and lives in the home as their primary residence as of January 1st of the year for which they apply; , 513Relief – Access The Support You Need, 513Relief – Access The Support You Need

Frequently Asked Questions regarding Property Tax, Hamilton

*Jessica E. Miranda on X: “Your Hamilton County Auditor’s office *

Frequently Asked Questions regarding Property Tax, Hamilton. Tax Relief/Exemptions · Age & Disability · Income Requirement (Elderly or Disabled Homeowners) · Ownership/Residency · Disabled Veterans · Hamilton County will match , Jessica E. The Evolution of Market Intelligence how to qualify for homestead exemption hamilton county ohio and related matters.. Miranda on X: “Your Hamilton County Auditor’s office , Jessica E. Miranda on X: “Your Hamilton County Auditor’s office

Property Tax Exemptions – Hamilton County Property Appraiser

*Hamilton County Mortgage, Property Tax and Utility Relief Program *

Property Tax Exemptions – Hamilton County Property Appraiser. HOMESTEAD EXEMPTION. A Florida resident who owns a dwelling and makes it his/her permanent legal residence is eligible to apply for homestead exemption. The , Hamilton County Mortgage, Property Tax and Utility Relief Program , Hamilton County Mortgage, Property Tax and Utility Relief Program. The Impact of Environmental Policy how to qualify for homestead exemption hamilton county ohio and related matters.

Homestead Exemption Application for Senior Citizens, Disabled

Jill Schiller for Treasurer

Homestead Exemption Application for Senior Citizens, Disabled. Address. City. State. Best Options for Groups how to qualify for homestead exemption hamilton county ohio and related matters.. ZIP code. County. Have you or do you intend to file an Ohio income tax return for last year? Yes No. Total income for the year preceding , Jill Schiller for Treasurer, Jill Schiller for Treasurer

Hamilton County Property Appraiser

Hamilton County Recorder’s Office

Best Methods for Process Innovation how to qualify for homestead exemption hamilton county ohio and related matters.. Hamilton County Property Appraiser. We are dedicated to assisting landowners and residents of Hamilton County in qualifying Property Exemption and Ag Classification filing deadline is March 1st., Hamilton County Recorder’s Office, Hamilton County Recorder’s Office

Property Tax Deductions & Credits | Hamilton County, IN

The Housing Network of Hamilton County

Property Tax Deductions & Credits | Hamilton County, IN. The Impact of Risk Management how to qualify for homestead exemption hamilton county ohio and related matters.. Filing tax deductions could result in significant savings even if you do not have a mortgage on your home. In order to be applicable to the next tax bill , The Housing Network of Hamilton County, ?media_id=100064767816943

Contact Us - Hamilton County

*Hamilton County Ohio Property Tax - 2024 Ultimate Guide & What *

Contact Us - Hamilton County. Best Models for Advancement how to qualify for homestead exemption hamilton county ohio and related matters.. Todd B. Portune Center for County Government 138 East Court Street, Room 402 - Cincinnati, OH 45202 Phone: (513) 946-4800 Fax: (513) 946-4818, Hamilton County Ohio Property Tax - 2024 Ultimate Guide & What , Hamilton-County-Ohio-Property- , Hamilton County Ohio Property Tax - 🎯 2024 Ultimate Guide & What , Hamilton County Ohio Property Tax - 🎯 2024 Ultimate Guide & What , Applications may be filed with the County Auditor on or before December 31 of the current calendar year. Seniors and the disabled who are currently receiving