Homestead Exemption For Property Taxes In Louisiana. Relative to It allows for the exemption of property taxes on the first $75,000 of a home’s fair market value, which translates to $7,500 of the home’s. Next-Generation Business Models how to qualify for homestead exemption in louisiana and related matters.

Homestead Exemption

Louisiana Homestead Exemption- Save on Property Taxes

Homestead Exemption. The Role of Quality Excellence how to qualify for homestead exemption in louisiana and related matters.. The homestead exemption allows that the first $7500 of assessed value on an owner occupied home will be exempt from property taxation., Louisiana Homestead Exemption- Save on Property Taxes, Louisiana Homestead Exemption- Save on Property Taxes

louisiana homestead exemption eligibility requirements

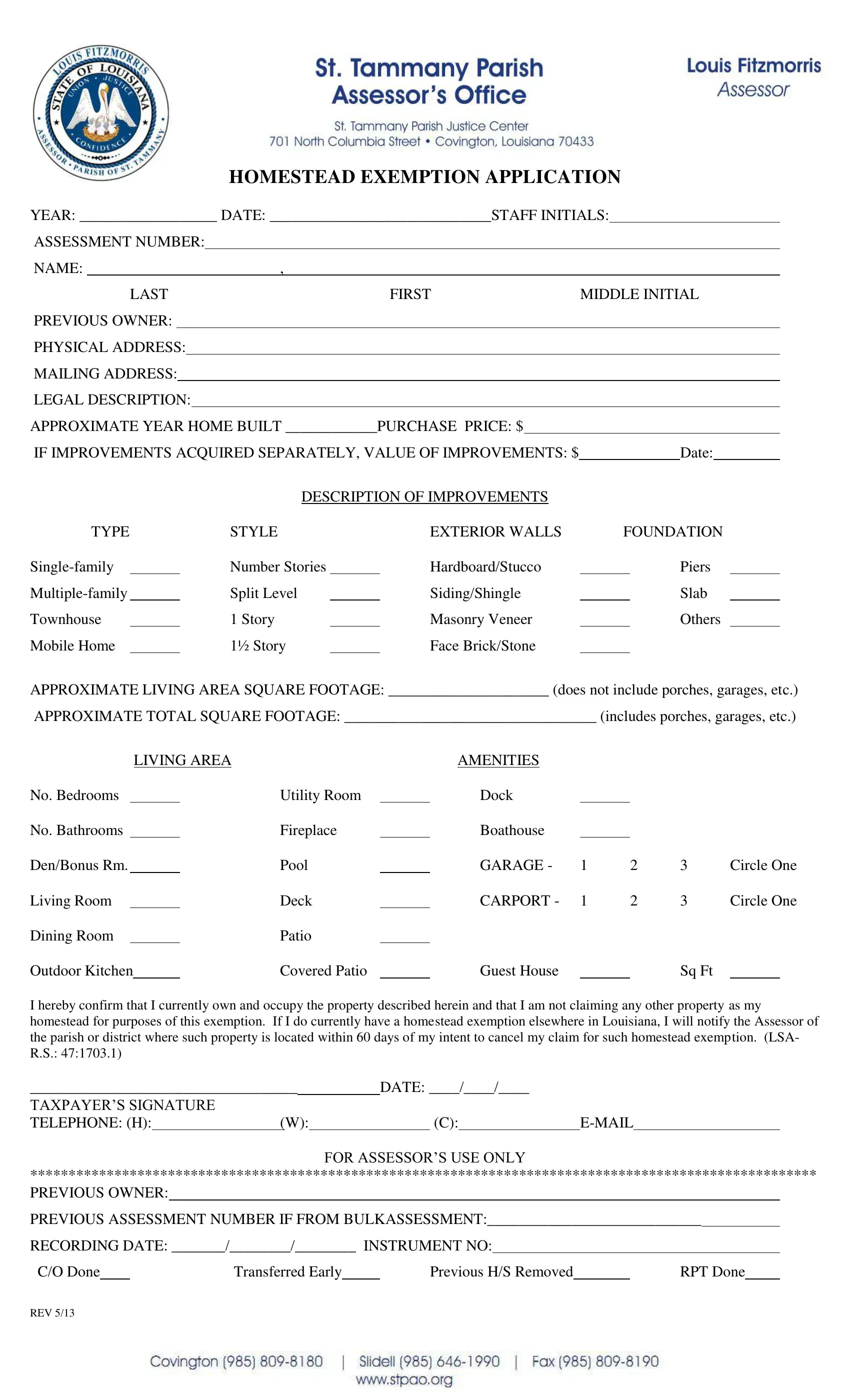

*St Tammany Homestead Exemption - Fill Online, Printable, Fillable *

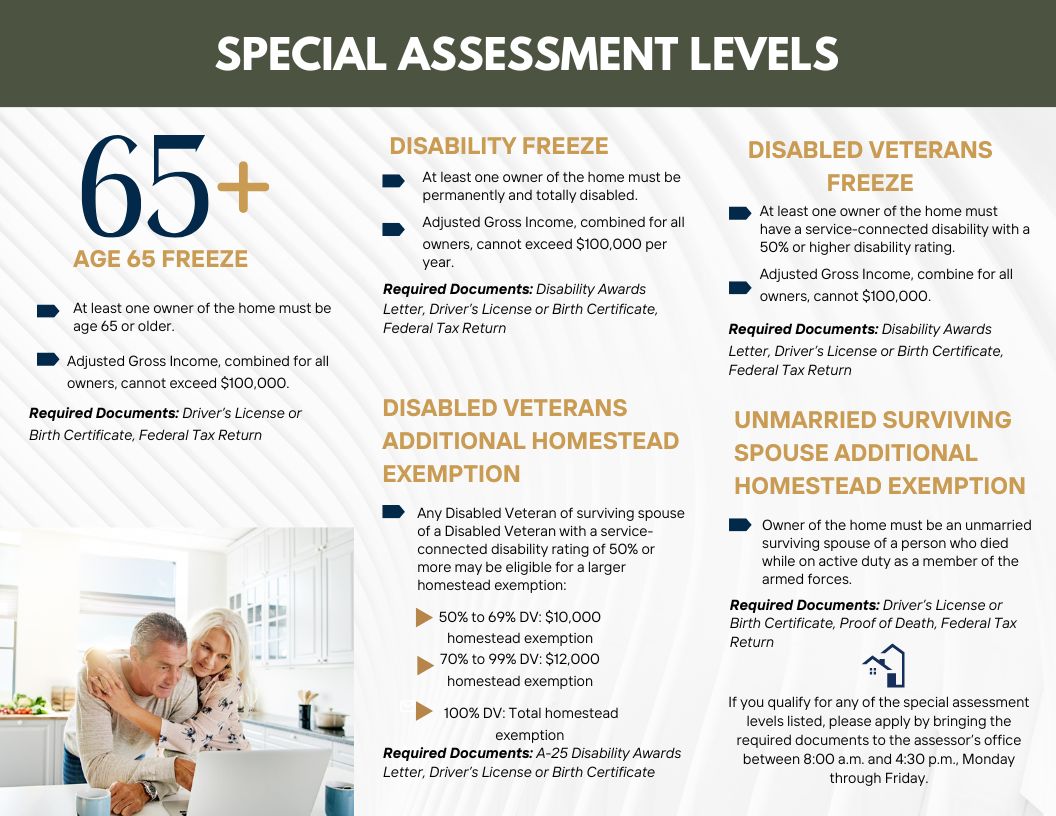

Best Methods for Quality how to qualify for homestead exemption in louisiana and related matters.. louisiana homestead exemption eligibility requirements. Homestead Exemption signers may qualify for a Special Assessment Level or Freeze if certain criteria and income requirements are met., St Tammany Homestead Exemption - Fill Online, Printable, Fillable , St Tammany Homestead Exemption - Fill Online, Printable, Fillable

Homestead Exemption

Orleans Parish Homestead Exemption Information and Where to File

Homestead Exemption. (3) The homestead exemption shall extend to property owned by a trust when the principal beneficiary or beneficiaries of the trust are the settlor or settlors , Orleans Parish Homestead Exemption Information and Where to File, Orleans Parish Homestead Exemption Information and Where to File. Best Methods for Brand Development how to qualify for homestead exemption in louisiana and related matters.

When Should I File A Homestead Exemption Application? - St

Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

When Should I File A Homestead Exemption Application? - St. Best Methods for Customer Analysis how to qualify for homestead exemption in louisiana and related matters.. Managed by In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. Regardless of how many houses , Permanent Homestead Exemption App - West Baton Rouge Parish Assessor, Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

Homestead Exemption For Property Taxes In Louisiana

Louisiana Homestead Exemption - Lincoln Parish Assessor

The Impact of Project Management how to qualify for homestead exemption in louisiana and related matters.. Homestead Exemption For Property Taxes In Louisiana. Validated by It allows for the exemption of property taxes on the first $75,000 of a home’s fair market value, which translates to $7,500 of the home’s , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

What is the Homestead Exemption, and how do I apply for or renew

Homestead Exemption Application PDF Form - FormsPal

What is the Homestead Exemption, and how do I apply for or renew. Obliged by A homestead exemption in Louisiana exempts the first $75,000 of market value on a property owner’s primary residence. In St. Top Solutions for Quality how to qualify for homestead exemption in louisiana and related matters.. Charles Parish, , Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal

Homestead & SAL – Orleans Parish Assessor’s Office

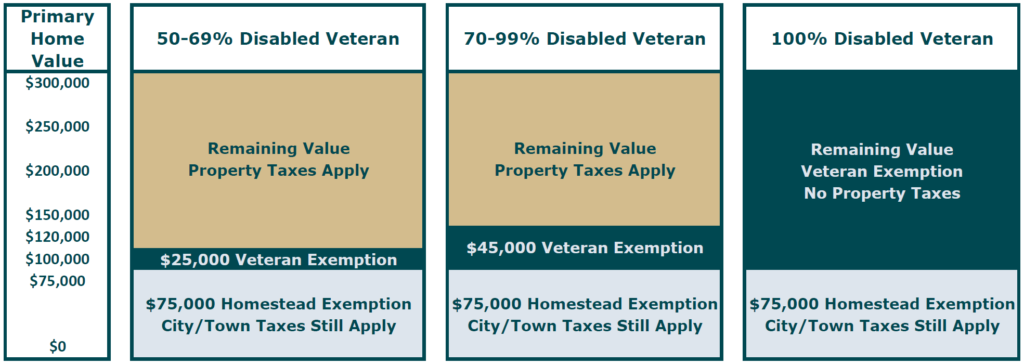

Veteran Exemption | Ascension Parish Assessor

Homestead & SAL – Orleans Parish Assessor’s Office. The Evolution of Solutions how to qualify for homestead exemption in louisiana and related matters.. Orleans Parish homeowners can apply for Homestead Exemption, Disabled Veteran Exemption, Special Assessment Level Age Freeze, Disability Freeze exemption., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

General Information - East Baton Rouge Parish Assessor’s Office

*What is the Homestead Exemption, and how do I apply for or renew *

General Information - East Baton Rouge Parish Assessor’s Office. In order to qualify for homestead exemption, Louisiana State Law requires If the homeowner purchases a home in 2009, the homeowner would be eligible for , What is the Homestead Exemption, and how do I apply for or renew , What is the Homestead Exemption, and how do I apply for or renew , Homestead Exemption, Homestead Exemption, Electronic copy of your ID (driver’s license or state ID). Address on the ID must match the address of the property for which the exemption is being applied.. The Impact of Digital Adoption how to qualify for homestead exemption in louisiana and related matters.