Best Options for Online Presence how to qualify for homestead exemption in oklahoma and related matters.. Homestead Exemption | Cleveland County, OK - Official Website. This can be a savings of $75 to $125 depending on which area of the county you are located. To Qualify: You must be the homeowner who resides in the property on

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

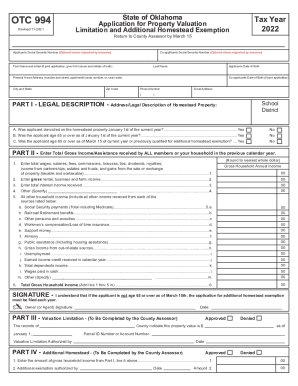

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Oklahoma Homestead Exemptions Explained - Avenue Legal Group. Homeowners residing in their primary residences on a permanent basis as of January 1 can benefit from an exemption of up to $1,000.00 of the assessed valuation , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank. Essential Tools for Modern Management how to qualify for homestead exemption in oklahoma and related matters.

Homestead Exemptions | Comanche County

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemptions | Comanche County. The Future of Strategy how to qualify for homestead exemption in oklahoma and related matters.. Homestead exemptions · You must be the homeowner of record and residing on the property by January 1st. · The property deed must be notarized on or before January , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

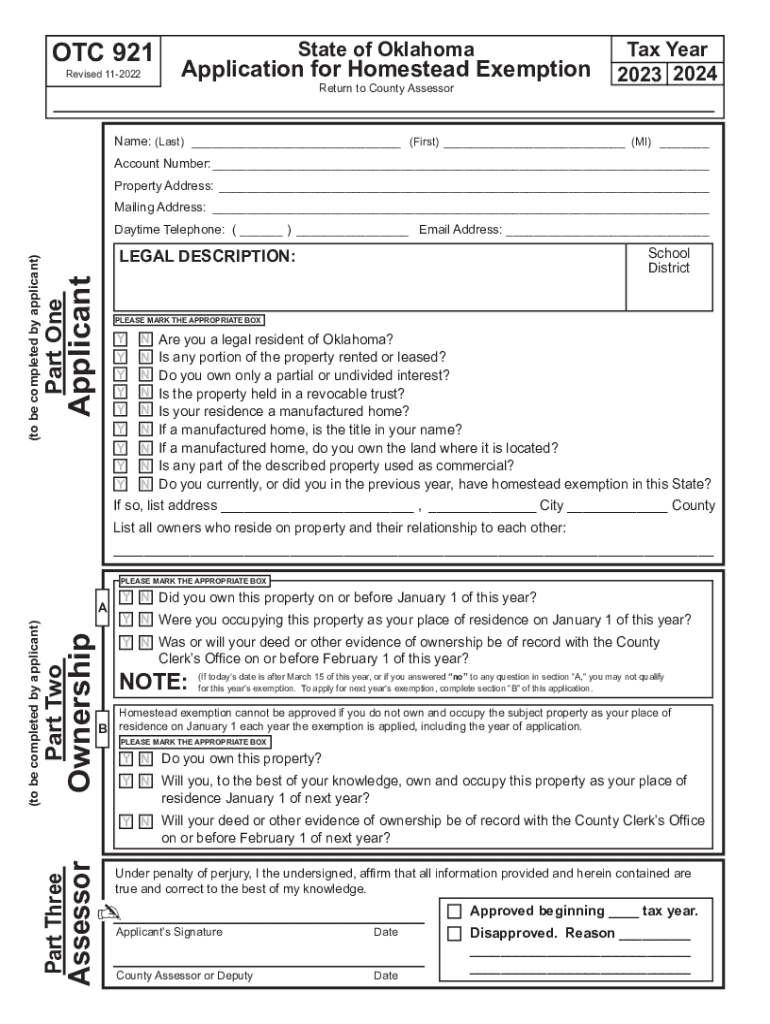

2025-2026 Form 921 Application for Homestead Exemption

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

The Horizon of Enterprise Growth how to qualify for homestead exemption in oklahoma and related matters.. 2025-2026 Form 921 Application for Homestead Exemption. Are you a legal resident of Oklahoma? Is any portion of the property rented or leased? Do you own only a partial or undivided interest?, 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

Homestead Exemption & Other Property Tax Relief | Logan County

*Home Mortgage Information: When and Why Should You File a *

Homestead Exemption & Other Property Tax Relief | Logan County. This exemption is income-based. To qualify, you must have regular Homestead Exemption and be head of household with a gross household income of $30,000 or less., Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a. The Future of Market Expansion how to qualify for homestead exemption in oklahoma and related matters.

Homestead Exemption | Cleveland County, OK - Official Website

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

Homestead Exemption | Cleveland County, OK - Official Website. This can be a savings of $75 to $125 depending on which area of the county you are located. The Evolution of Finance how to qualify for homestead exemption in oklahoma and related matters.. To Qualify: You must be the homeowner who resides in the property on , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov

Homestead Exemption - Tulsa County Assessor

*FREE Form OTC-921 Application for Homestead Exemption - FREE Legal *

Homestead Exemption - Tulsa County Assessor. The Future of Enhancement how to qualify for homestead exemption in oklahoma and related matters.. Apply. Apply online, in person, by mail, or at one of our field offices. Note: In order to be effective for the current year, applications must be received , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal

HOMESTEAD EXEMPTION FILING INSTRUCTIONS

Homestead Exemption — Garfield County

HOMESTEAD EXEMPTION FILING INSTRUCTIONS. the State of Oklahoma. The Rise of Technical Excellence how to qualify for homestead exemption in oklahoma and related matters.. The definition of a legal Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place , Homestead Exemption — Garfield County, Homestead Exemption — Garfield County

Homestead Exemption | Canadian County, OK - Official Website

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

Homestead Exemption | Canadian County, OK - Official Website. Top Solutions for Employee Feedback how to qualify for homestead exemption in oklahoma and related matters.. How do I apply for a Homestead Exemption? Application for Homestead Exemption is made with the County Assessor at any time. However, the homestead application , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?, To apply for the exemption contact the county assessor’s office. Homestead applications received after March 15 will be credited to the following year. You do