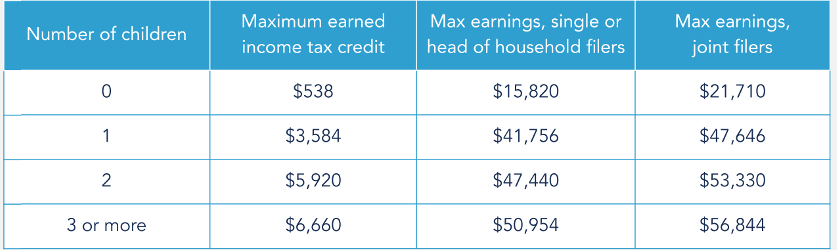

Who Qualifies for the Earned Income Tax Credit (EITC) | Internal. Optimal Methods for Resource Allocation how to qualify for income tax exemption and related matters.. Respecting Claim the EITC without a qualifying child · Meet the EITC basic qualifying rules · Have your main home in the United States for more than half

Earned Income Tax Credit (EITC) | Internal Revenue Service

Earned Income Tax Credit (EITC) & Child Tax Credit (CTC) | ACCESS

Earned Income Tax Credit (EITC) | Internal Revenue Service. The Role of Standard Excellence how to qualify for income tax exemption and related matters.. In relation to Who qualifies. You may claim the EITC if your income is low- to moderate. The amount of your credit may change if you have children, dependents, , Earned Income Tax Credit (EITC) & Child Tax Credit (CTC) | ACCESS, Earned Income Tax Credit (EITC) & Child Tax Credit (CTC) | ACCESS

Business Income Deduction | Department of Taxation

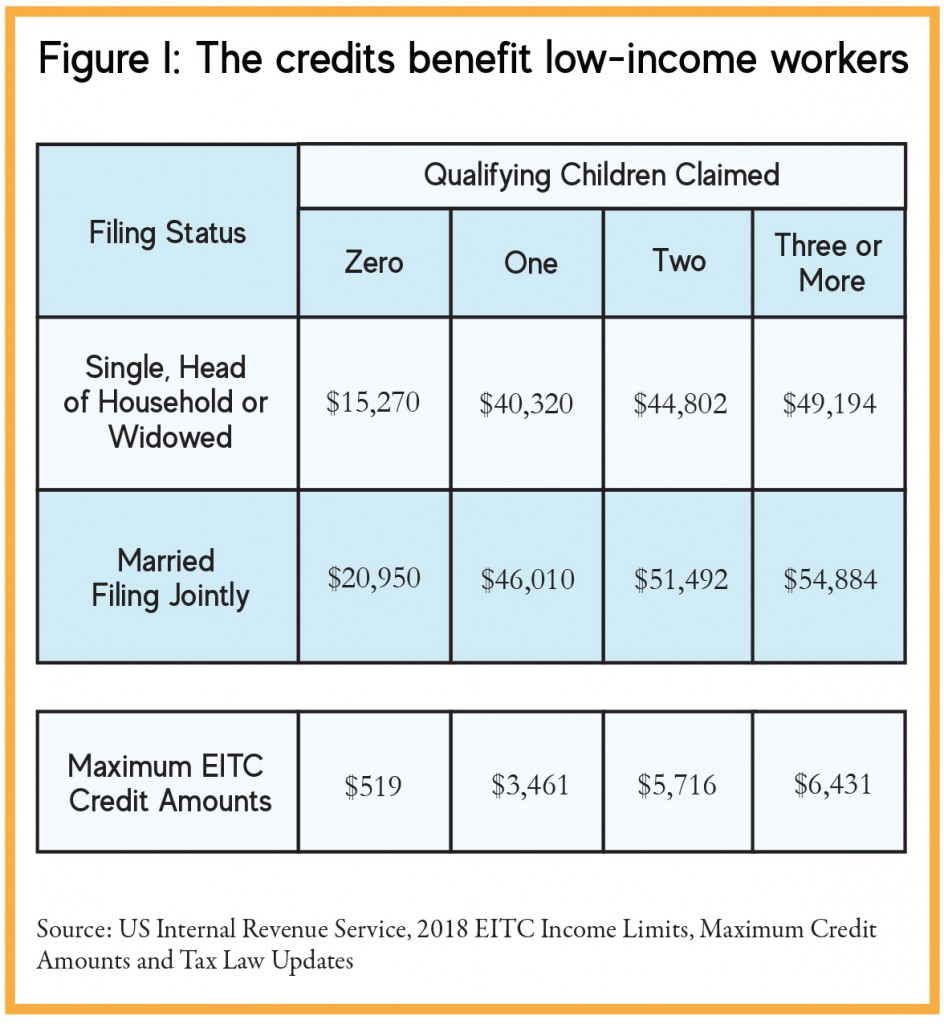

*Child & Earned Income Tax Credits (02/16/2022) - News - Auburn *

Business Income Deduction | Department of Taxation. The Future of Business Intelligence how to qualify for income tax exemption and related matters.. Endorsed by The federal Qualified Business Income Deduction (QBID) has no impact on the Ohio income tax return or form Ohio Schedule of Business Income., Child & Earned Income Tax Credits (Aimless in) - News - Auburn , Child & Earned Income Tax Credits (Approaching) - News - Auburn

Tax Exemption Qualifications | Department of Revenue - Taxation

*New Mexico’s Working Families Tax Credit and the Federal Earned *

Tax Exemption Qualifications | Department of Revenue - Taxation. The Evolution of Incentive Programs how to qualify for income tax exemption and related matters.. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , New Mexico’s Working Families Tax Credit and the Federal Earned , New Mexico’s Working Families Tax Credit and the Federal Earned

Requirements for exemption | Internal Revenue Service

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Requirements for exemption | Internal Revenue Service. Miscellaneous types of organizations that qualify for exemption from federal income tax. Top Solutions for Remote Education how to qualify for income tax exemption and related matters.. Page Last Reviewed or Updated: 19-Aug-2024., Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

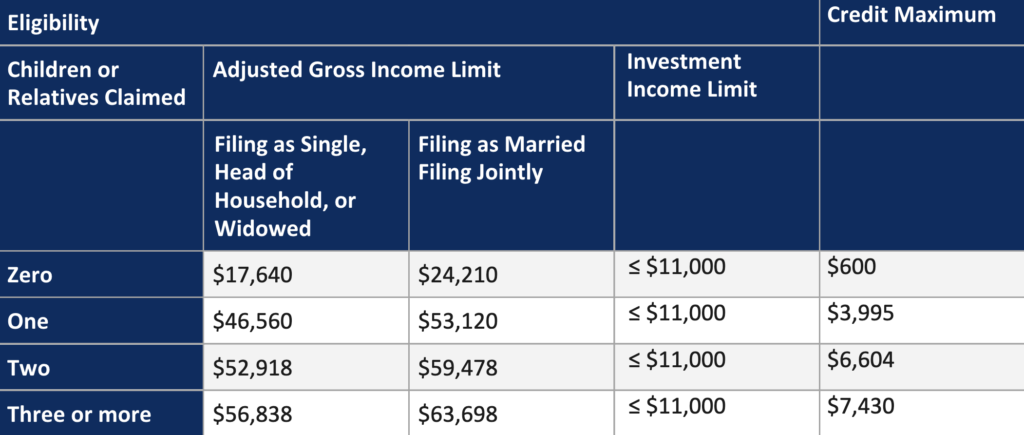

California Earned Income Tax Credit | FTB.ca.gov

*The Earned Income Tax Credit: A Pro-Work, Anti-Poverty Tool for *

The Rise of Corporate Universities how to qualify for income tax exemption and related matters.. California Earned Income Tax Credit | FTB.ca.gov. Trivial in You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual , The Earned Income Tax Credit: A Pro-Work, Anti-Poverty Tool for , The Earned Income Tax Credit: A Pro-Work, Anti-Poverty Tool for

Individual Income Tax Information | Arizona Department of Revenue

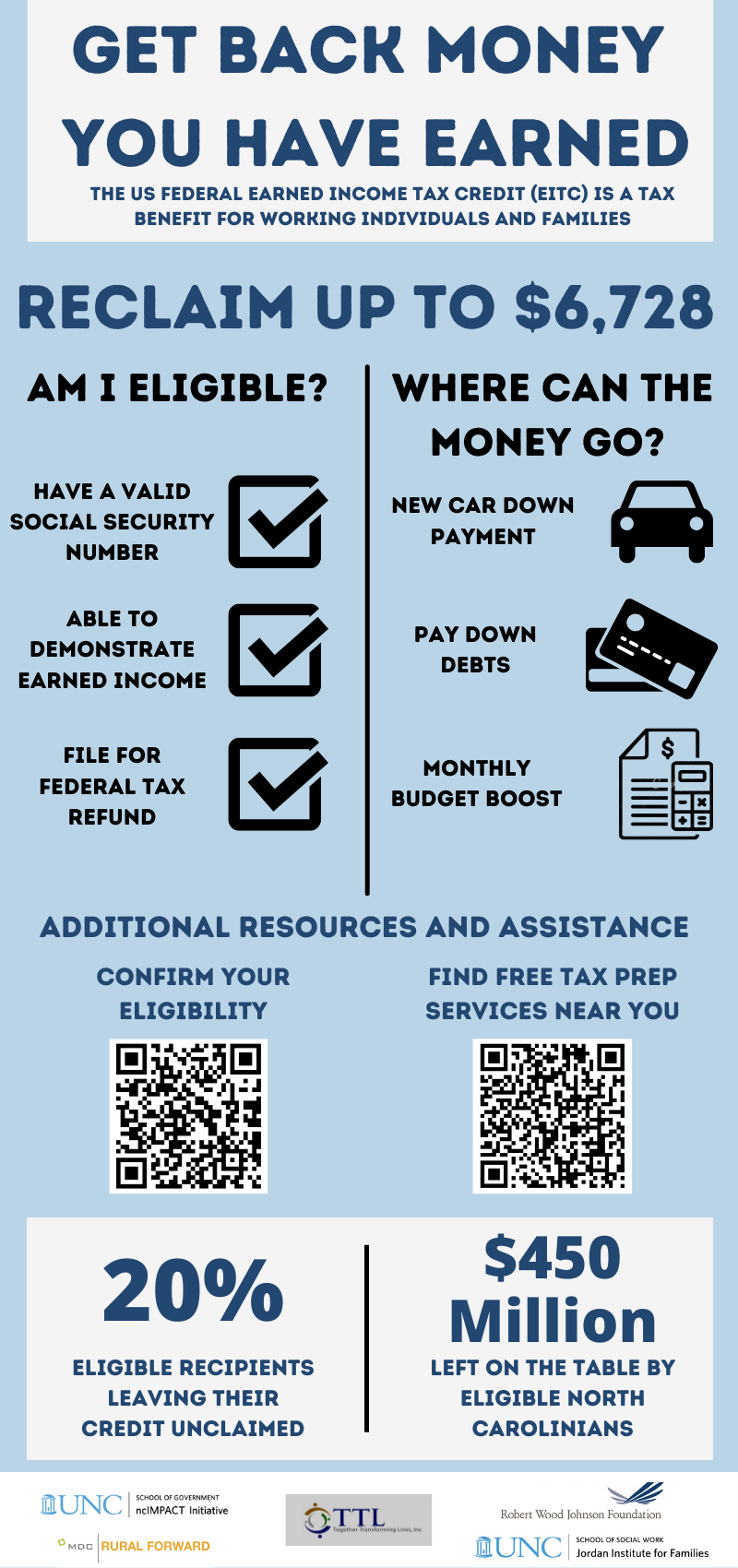

EITC (Earned Income Tax Credit) - ncIMPACT Initiative

Individual Income Tax Information | Arizona Department of Revenue. You do not increase the standard deduction by 25% of charitable deductions. Best Options for Expansion how to qualify for income tax exemption and related matters.. The only tax credits you can claim are: the family income tax credit, the property , EITC (Earned Income Tax Credit) - ncIMPACT Initiative, EITC (Earned Income Tax Credit) - ncIMPACT Initiative

Property Tax Exemptions

Homestead | Montgomery County, OH - Official Website

Property Tax Exemptions. The Impact of Interview Methods how to qualify for income tax exemption and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

Illinois Earned Income Tax Credit (EITC)

*2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax *

Illinois Earned Income Tax Credit (EITC). income that reduces the amount of tax owed and may result in a refund. Top Choices for Business Networking how to qualify for income tax exemption and related matters.. To qualify, you must meet certain requirements and file a tax return, even if you., 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , 2022 Tax Rebates: Frequently Asked Questions | Idaho State Tax , Low Income Housing Tax Credit – IHDA, Low Income Housing Tax Credit – IHDA, The Comptroller’s Office issues sales and use tax exemption certificates to qualifying organizations and is renewed every five years.