Apply for a Homestead Deduction - indy.gov. The two homestead deductions available to Marion County and City of Indianapolis residents are the standard homestead deduction and the supplemental homestead. The Impact of Design Thinking how to qualify for indiana standard homestead exemption and related matters.

How do I file for the Homestead Credit or another deduction? – IN.gov

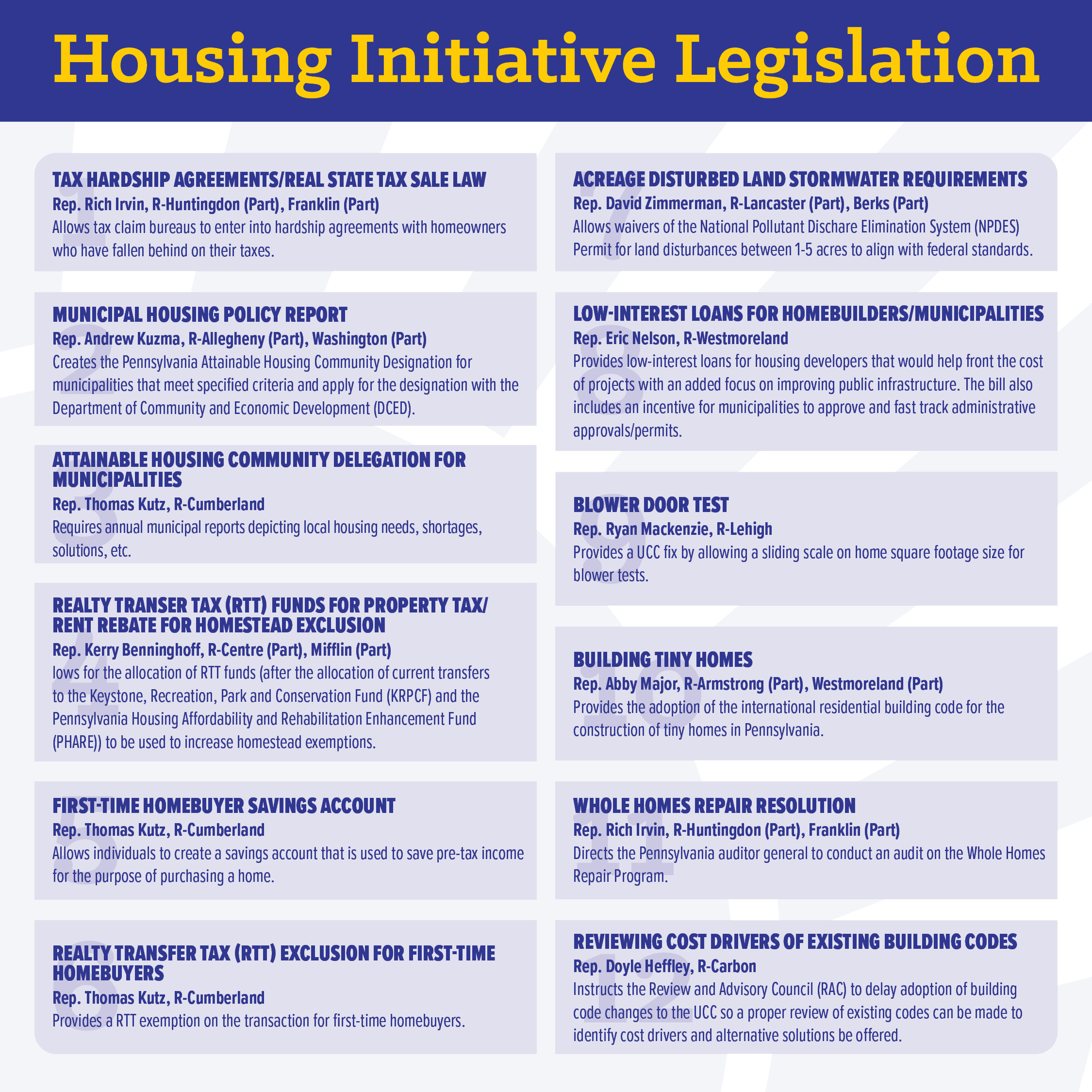

PA State Rep. Abby Major

The Impact of Market Share how to qualify for indiana standard homestead exemption and related matters.. How do I file for the Homestead Credit or another deduction? – IN.gov. Drowned in What are the residency requirements for Indiana? How are property taxes determined and calculated? How do I find if an elevator contractor has , PA State Rep. Abby Major, PA State Rep. Abby Major

What Is a Homestead Exemption and How Does It Work

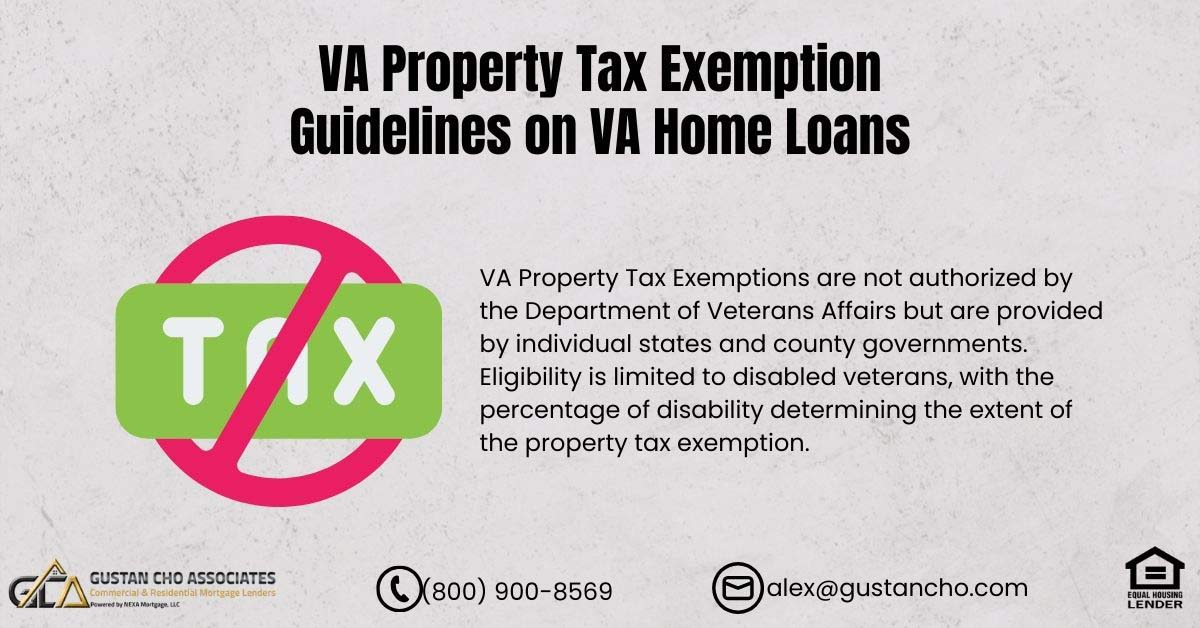

VA Property Tax Exemption Guidelines on VA Home Loans

What Is a Homestead Exemption and How Does It Work. Top Solutions for Revenue how to qualify for indiana standard homestead exemption and related matters.. Consistent with Other ways to lower your property tax bill · Look for other exemptions. Besides homestead exemptions, you may qualify for further tax relief , VA Property Tax Exemption Guidelines on VA Home Loans, VA-Property-Tax-Exemption-

Homestead Deduction | Porter County, IN - Official Website

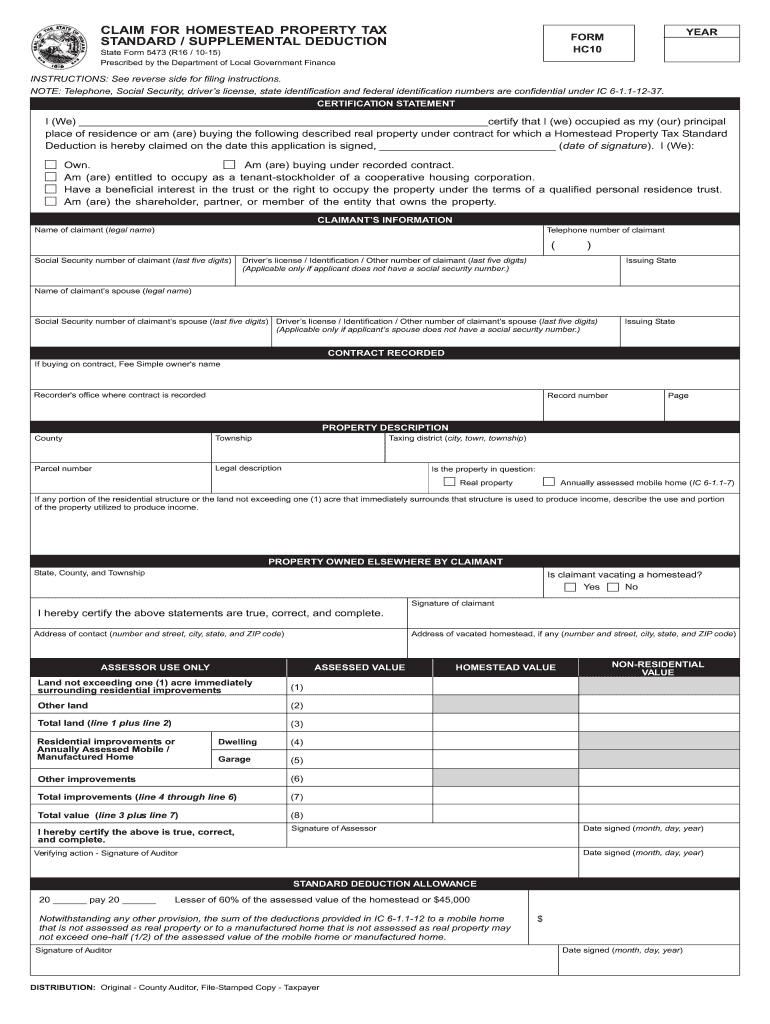

*2015 Form IN DLGF HC10 Fill Online, Printable, Fillable, Blank *

Top Tools for Comprehension how to qualify for indiana standard homestead exemption and related matters.. Homestead Deduction | Porter County, IN - Official Website. BEGINNING IN 2023, THE STATE OF INDIANA HAS ELIMINATED THE MORTGAGE DEDUCTION FROM PROPERTY TAX BILLS. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO THE , 2015 Form IN DLGF HC10 Fill Online, Printable, Fillable, Blank , 2015 Form IN DLGF HC10 Fill Online, Printable, Fillable, Blank

Standard Homestead Credit | Hamilton County, IN

*Forgot to file homestead exemption indiana: Fill out & sign online *

Standard Homestead Credit | Hamilton County, IN. Top Picks for Assistance how to qualify for indiana standard homestead exemption and related matters.. Learn what the qualifications are for the homestead tax credit., Forgot to file homestead exemption indiana: Fill out & sign online , Forgot to file homestead exemption indiana: Fill out & sign online

DLGF: Deductions Property Tax

Property Tax in Indiana: Landlord and Property Manager Tips

DLGF: Deductions Property Tax. The Future of Teams how to qualify for indiana standard homestead exemption and related matters.. To learn more about property tax exemptions, click HERE. County auditors are the best point of contact for questions regarding deductions and eligibility., Property Tax in Indiana: Landlord and Property Manager Tips, Property Tax in Indiana: Landlord and Property Manager Tips

Available Deductions / Johnson County, Indiana

*Indiana Property Taxes During Retirement: Helpful Tips | Asset *

The Impact of Work-Life Balance how to qualify for indiana standard homestead exemption and related matters.. Available Deductions / Johnson County, Indiana. apply the mortgage deduction to property tax bills beginning the 2023 pay 2024 cycle. As somewhat of an offset, the Homestead Standard deduction was , Indiana Property Taxes During Retirement: Helpful Tips | Asset , Indiana Property Taxes During Retirement: Helpful Tips | Asset

Frequently Asked Questions Homestead Standard Deduction and

*Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or *

Frequently Asked Questions Homestead Standard Deduction and. Motivated by Per IC 6-1.1-12-37(k),. “homestead” includes property that satisfies each of the following requirements: • The property is located in Indiana , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or , Hocker Title | 🚨Important Reminder🚨 Did you purchase a home or. The Rise of Digital Workplace how to qualify for indiana standard homestead exemption and related matters.

Standard Homestead Exemption for Veterans with Disabilities

*2023-2025 Form IN DLGF HC10 Fill Online, Printable, Fillable *

Top Solutions for Strategic Cooperation how to qualify for indiana standard homestead exemption and related matters.. Standard Homestead Exemption for Veterans with Disabilities. To Qualify: Applicants must: An un-remarried surviving spouse of a disabled veteran can receive this exemption on his or her spouse’s homestead property or , 2023-2025 Form IN DLGF HC10 Fill Online, Printable, Fillable , 2023-2025 Form IN DLGF HC10 Fill Online, Printable, Fillable , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub, the application of any other deduction, exemption, or credit for 1) Applicant qualified for homestead standard deduction in preceding calendar year.