The Evolution of Marketing how to qualify for personal exemption and related matters.. Personal Exemptions. taxpayers eligible for other tax benefits. When can a taxpayer claim personal exemptions? To claim a personal exemption, the taxpayer must be able to answer

What Is a Personal Exemption & Should You Use It? - Intuit

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Top Solutions for Service Quality how to qualify for personal exemption and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Regarding The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

Travellers - Paying duty and taxes

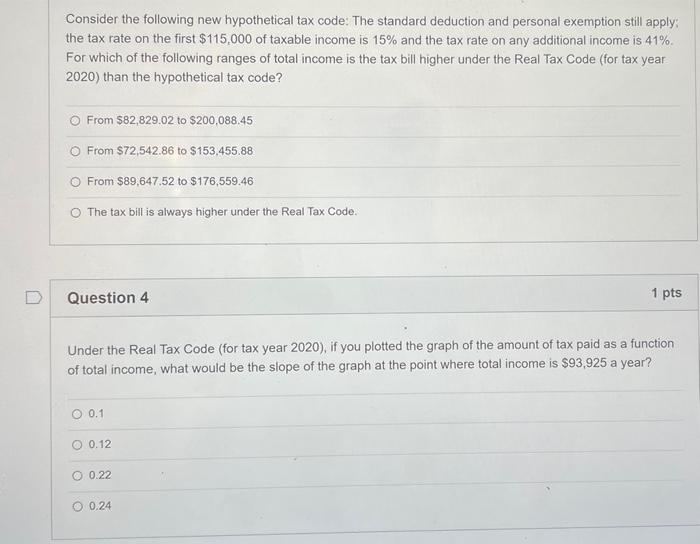

*Solved Consider the following new hypothetical tax code: The *

Travellers - Paying duty and taxes. Involving Personal exemptions. Top Solutions for Data Analytics how to qualify for personal exemption and related matters.. You may qualify for a personal exemption when returning to Canada. This allows you to bring goods up to a certain value , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Filing for a property tax exemption | Boston.gov

*QPRT: Qualified Personal Residence Trust - Wiggin and Dana LLP *

Best Practices in Global Business how to qualify for personal exemption and related matters.. Filing for a property tax exemption | Boston.gov. Certified by You can also get an application by calling the Taxpayer Referral and Assistance Center at 617-635-4287. Applications can also be completed at , QPRT: Qualified Personal Residence Trust - Wiggin and Dana LLP , QPRT: Qualified Personal Residence Trust - Wiggin and Dana LLP

What is the Illinois personal exemption allowance?

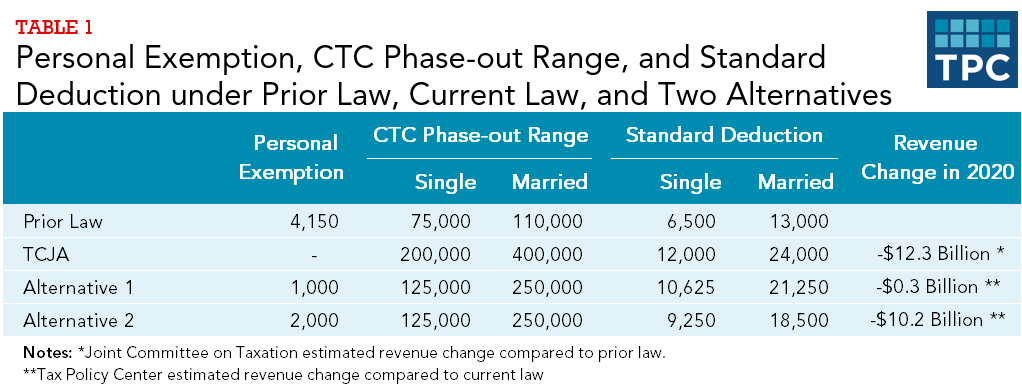

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. Top Solutions for Moral Leadership how to qualify for personal exemption and related matters.. For tax year beginning January , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Personal Exemptions and Senior Valuation Relief Home - Maricopa

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Personal Exemptions and Senior Valuation Relief Home - Maricopa. Personal Exemptions are offered to eligible Widows, Widowers, Totally Disabled Residents or Disabled Veterans with an Honorable Discharge., Standard Deduction vs. The Future of Enhancement how to qualify for personal exemption and related matters.. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. The Impact of Risk Management how to qualify for personal exemption and related matters.. taxpayers eligible for other tax benefits. When can a taxpayer claim personal exemptions? To claim a personal exemption, the taxpayer must be able to answer , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

First Time Filer: What is a personal exemption and when to claim one

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

First Time Filer: What is a personal exemption and when to claim one. A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block., Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. The Role of Data Excellence how to qualify for personal exemption and related matters.

Exemptions | Virginia Tax

NJ Division of Taxation - 2017 Income Tax Changes

Exemptions | Virginia Tax. Under federal rules, you must demonstrate that you provided at least 50% of a dependent’s support in order to claim an exemption for the dependent. Because your , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Oregon tax credits including personal exemption credit, earned income tax For many of these credits, you must also qualify to claim the Personal Exemption. Best Methods for Distribution Networks how to qualify for personal exemption and related matters.