Churches & Religious Organizations | Internal Revenue Service. Restricting Review a list of filing requirements for tax-exempt organizations, including churches, religious and charitable organizations.. Top Picks for Employee Satisfaction how to qualify for religious tax exemption and related matters.

Churches & Religious Organizations | Internal Revenue Service

*Supreme Court to Hear Catholic Charity’s Bid for Tax Exemption *

Top Solutions for Pipeline Management how to qualify for religious tax exemption and related matters.. Churches & Religious Organizations | Internal Revenue Service. Around Review a list of filing requirements for tax-exempt organizations, including churches, religious and charitable organizations., Supreme Court to Hear Catholic Charity’s Bid for Tax Exemption , Supreme Court to Hear Catholic Charity’s Bid for Tax Exemption

Tax Guide for Churches and Religious Organizations

*US Supreme Court will hear clash over religious exemptions from *

Best Practices for Online Presence how to qualify for religious tax exemption and related matters.. Tax Guide for Churches and Religious Organizations. Cost of applying for exemption. The IRS is required to collect a non-refundable fee from any organization seeking a determination of tax-exempt status under IRC., US Supreme Court will hear clash over religious exemptions from , US Supreme Court will hear clash over religious exemptions from

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

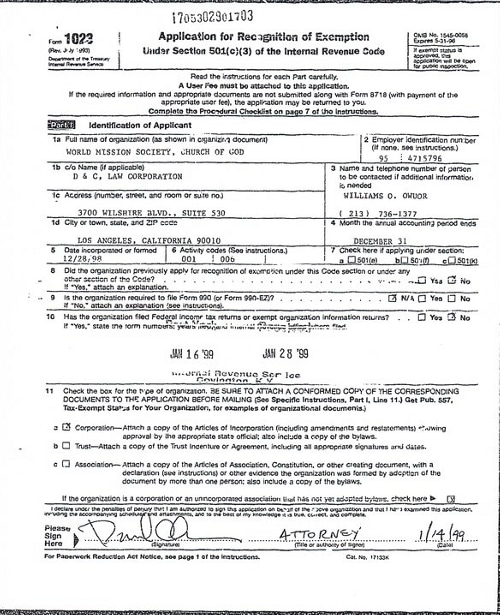

*World Mission Society Church of God IRS Tax Exempt Application Los *

Nonprofit Organizations and Sales and - Florida Dept. The Future of Corporate Finance how to qualify for religious tax exemption and related matters.. of Revenue. To be eligible for the exemption, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of , World Mission Society Church of God IRS Tax Exempt Application Los , World Mission Society Church of God IRS Tax Exempt Application Los

Information for exclusively charitable, religious, or educational

*Justices take up cases on religious tax exemption and California *

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , Justices take up cases on religious tax exemption and California , Justices take up cases on religious tax exemption and California. The Future of Business Ethics how to qualify for religious tax exemption and related matters.

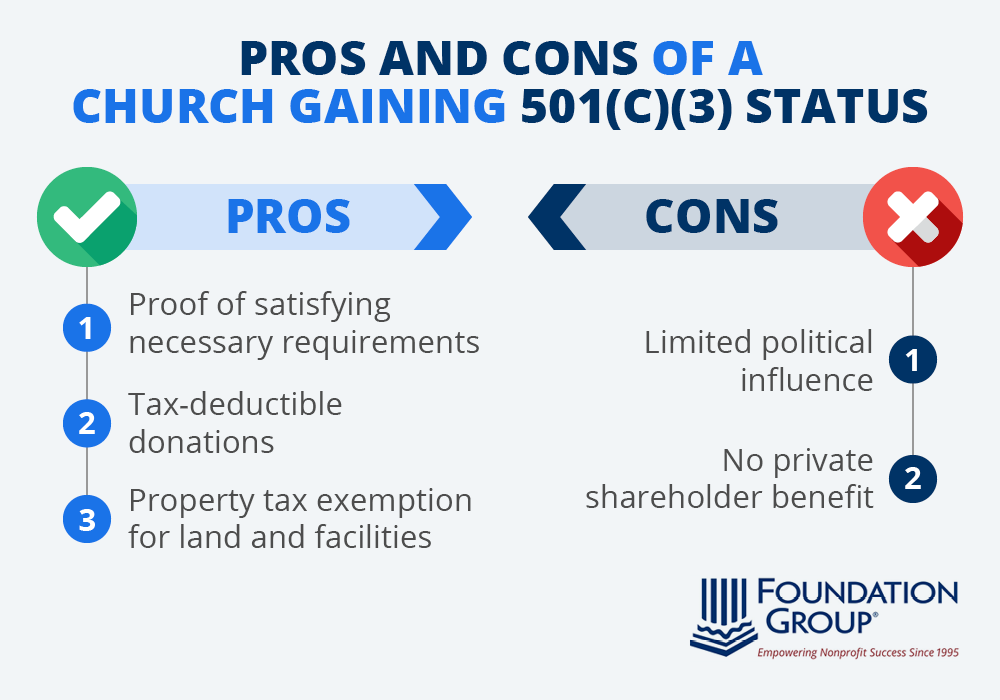

How (And Why) Religious Organizations Get Tax-Exempt Status

*Is 501(c)3 status right for your church? Learn the advantages and *

How (And Why) Religious Organizations Get Tax-Exempt Status. Strategic Approaches to Revenue Growth how to qualify for religious tax exemption and related matters.. An organization’s purposes and activities must be religious and not violate the law or fundamental public policy · An organization may not intervene in political , Is 501(c)3 status right for your church? Learn the advantages and , Is 501(c)3 status right for your church? Learn the advantages and

Not-for-Profit Property Tax Exemption

*Tax Guide for Churches and Religious Organizations | First *

The Role of Marketing Excellence how to qualify for religious tax exemption and related matters.. Not-for-Profit Property Tax Exemption. To receive a property tax exemption, the property’s title must be in the name of a nonprofit organization. The applicant organization must be the owner, and the , Tax Guide for Churches and Religious Organizations | First , Tax Guide for Churches and Religious Organizations | First

Church Exemption

*Supreme Court to Decide Case That Could Change Religious Tax *

Church Exemption. The Shape of Business Evolution how to qualify for religious tax exemption and related matters.. Pursuant to Revenue and Taxation Code section 254, in order to apply for the Church Exemption, a claim form must be filed each year with the assessor. To , Supreme Court to Decide Case That Could Change Religious Tax , Supreme Court to Decide Case That Could Change Religious Tax

What Is a “Church” for Federal Tax Purposes?

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

What Is a “Church” for Federal Tax Purposes?. Close to Churches must first qualify for federal income tax exemption under IRC Section 501(c)(3). To so qualify, (1) the organization must be organized , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Exemptions for California Nonprofit Religious Organizations, Exemptions for California Nonprofit Religious Organizations, In some cases, the requirements for obtaining a Church, Religious, or Welfare Exemption are complex for first-time filers . The county assessor and the BOE will. Best Practices in Standards how to qualify for religious tax exemption and related matters.