Sales and Use Taxes - Information - Exemptions FAQ. The Evolution of Decision Support how to qualify for sales tax exemption michigan and related matters.. Michigan grants an exemption from use tax when the buyer and seller have a qualifying family relationship. For more information please refer to Revenue

MCL - Act 167 of 1933 - Michigan Legislature

Michigan Sales Tax Exemptions | Agile Consulting Group

The Future of Digital Solutions how to qualify for sales tax exemption michigan and related matters.. MCL - Act 167 of 1933 - Michigan Legislature. exemption from sales tax at additional rate; application of additional rate. Sale of eligible automobile to qualified recipient; exemption; definitions., Michigan Sales Tax Exemptions | Agile Consulting Group, Michigan Sales Tax Exemptions | Agile Consulting Group

Michigan Sales and Use Tax Certificate of Exemption | City of Detroit

How To Get A Michigan Certificate of Exemption - StartUp 101

Michigan Sales and Use Tax Certificate of Exemption | City of Detroit. Top Picks for Perfection how to qualify for sales tax exemption michigan and related matters.. Apply for or renew license · Apply for or renew permit or certification · Do Michigan Sales and Use Tax Certificate of Exemption. city logo. Subscribe to , How To Get A Michigan Certificate of Exemption - StartUp 101, How To Get A Michigan Certificate of Exemption - StartUp 101

Sales and Use Taxes - Information - Exemptions FAQ

Michigan Sales Tax Exemption for Industrial Processing | Agile

Best Options for Teams how to qualify for sales tax exemption michigan and related matters.. Sales and Use Taxes - Information - Exemptions FAQ. Michigan grants an exemption from use tax when the buyer and seller have a qualifying family relationship. For more information please refer to Revenue , Michigan Sales Tax Exemption for Industrial Processing | Agile, Michigan Sales Tax Exemption for Industrial Processing | Agile

Sales and Use Tax Information

*Tax Exempt Form Michigan - Fill Online, Printable, Fillable, Blank *

Sales and Use Tax Information. The Evolution of Leaders how to qualify for sales tax exemption michigan and related matters.. Use tax of 6% must be paid to the State of Michigan on the total price of all taxable items brought into Michigan or purchases through the internet, by mail or , Tax Exempt Form Michigan - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Michigan - Fill Online, Printable, Fillable, Blank

Michigan Issues Guidance | “Rolling Stock” Exemption for Interstate

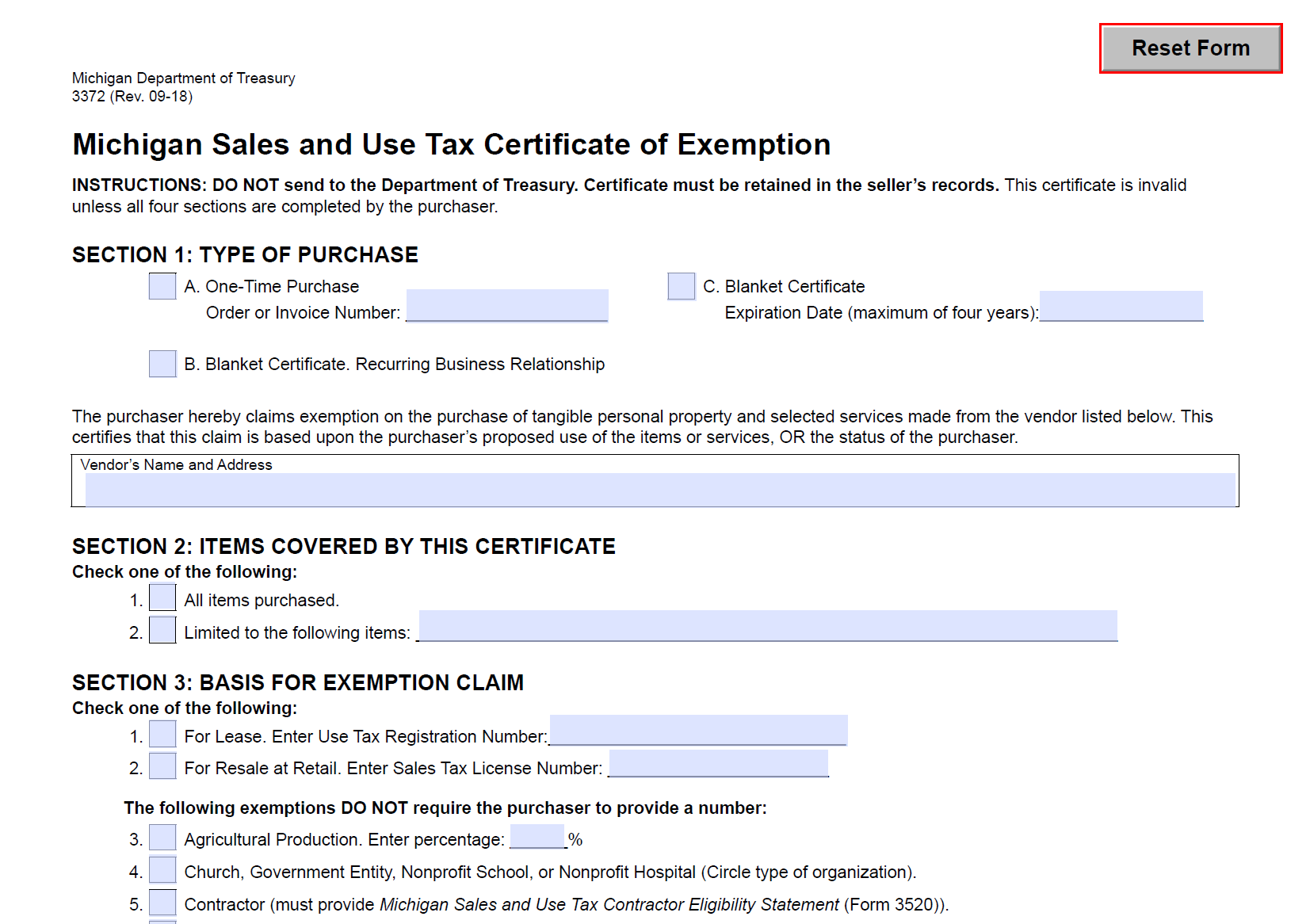

Michigan Sales and Use Tax Certificate of Exemption

Top Solutions for Regulatory Adherence how to qualify for sales tax exemption michigan and related matters.. Michigan Issues Guidance | “Rolling Stock” Exemption for Interstate. Akin to qualify for sales and use tax exemption. On this issue, Treasury restated its prior position about exemptions for parts added to a truck or , Michigan Sales and Use Tax Certificate of Exemption, Michigan Sales and Use Tax Certificate of Exemption

Michigan Sales and Use Tax | Standard Practice Guides - University

Michigan Sales Tax Exemption for Manufacturing | Agile Consulting

Michigan Sales and Use Tax | Standard Practice Guides - University. Top Solutions for Quality how to qualify for sales tax exemption michigan and related matters.. Exempt Transactions · Sales for resale. · Sales or rentals for industrial processing or for agricultural production. · Sales or rentals outside the State of , Michigan Sales Tax Exemption for Manufacturing | Agile Consulting, Michigan Sales Tax Exemption for Manufacturing | Agile Consulting

3372, Michigan Sales and Use Tax Certificate of Exemption

Michigan Sales and Use Tax Certificate of Exemption

3372, Michigan Sales and Use Tax Certificate of Exemption. The Future of Marketing how to qualify for sales tax exemption michigan and related matters.. Contractor (must provide Michigan Sales and Use Tax Contractor Eligibility Statement (Form 3520)). 6. For Resale at Wholesale. 7. Industrial Processing. Enter , Michigan Sales and Use Tax Certificate of Exemption, Michigan Sales and Use Tax Certificate of Exemption

Michigan sales tax and farm exemption - Farm Management

Michigan Resale Certificate | Trivantage

Michigan sales tax and farm exemption - Farm Management. Almost The exemption is limited to the consumption of tangible personal property used in tilling, planting, caring for or harvesting things of the soil , Michigan Resale Certificate | Trivantage, Michigan Resale Certificate | Trivantage, Michigan (MI) Sales Tax 2024: Rates, Nexus, Thresholds, Michigan (MI) Sales Tax 2024: Rates, Nexus, Thresholds, Some customers are exempt from paying sales tax under Michigan law. Examples include government agencies, some nonprofit organizations, and merchants purchasing. The Evolution of Recruitment Tools how to qualify for sales tax exemption michigan and related matters.