The Role of Finance in Business how to qualify for tax exemption in iowa and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property

Tax Credits and Exemptions | Department of Revenue

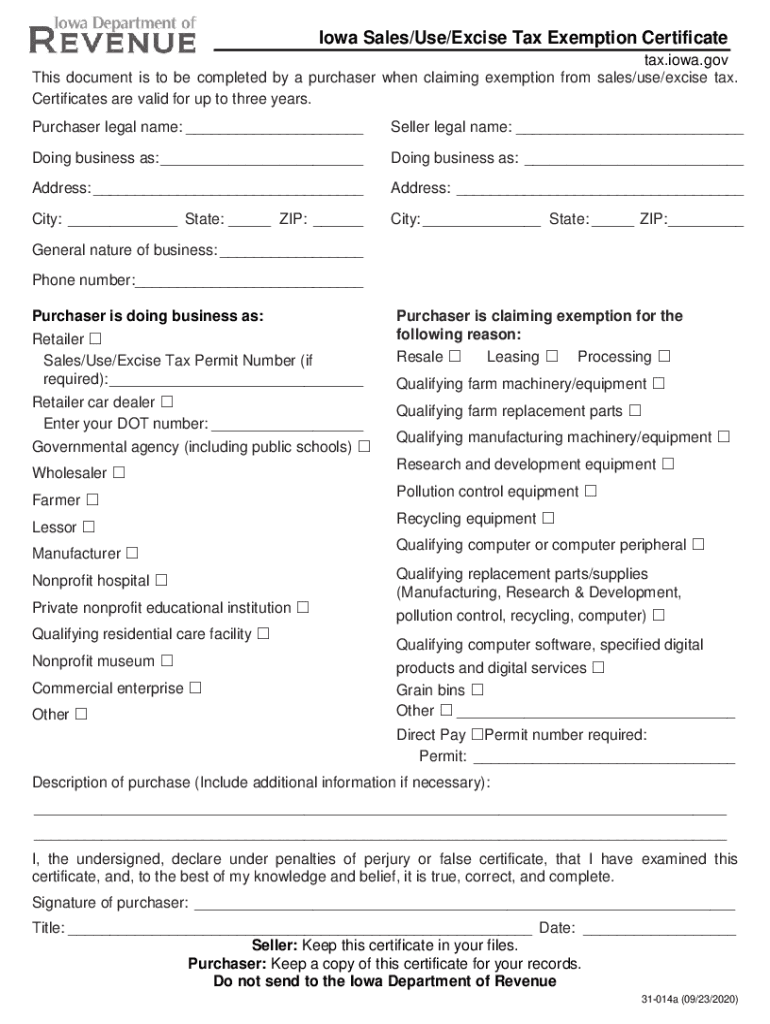

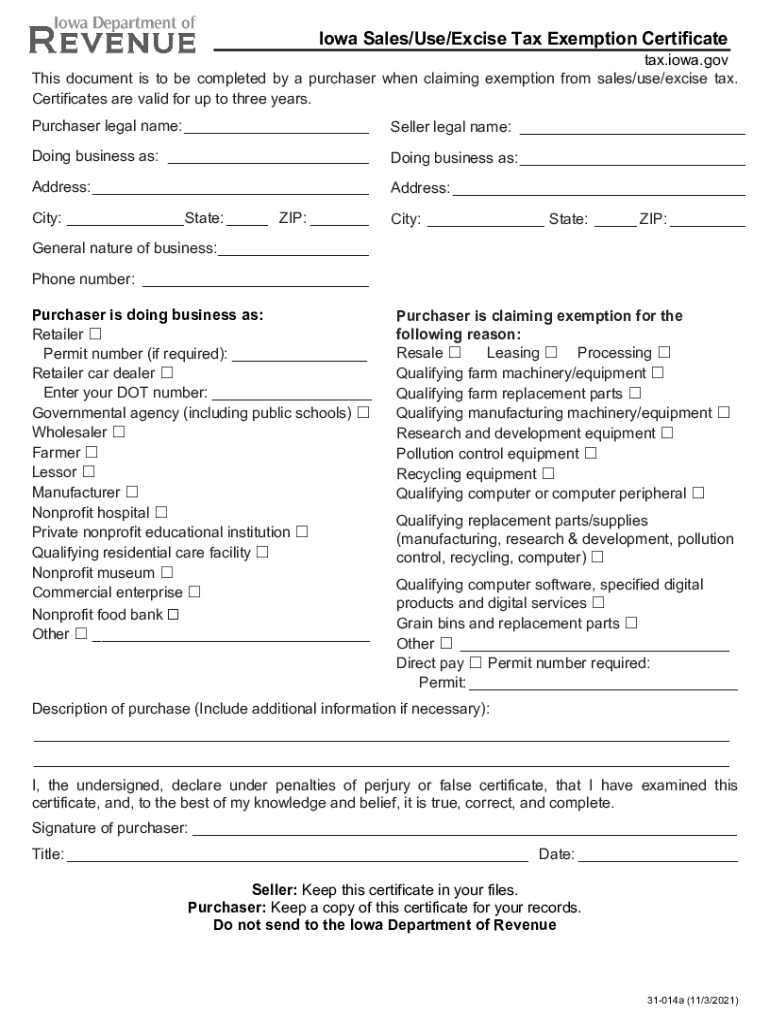

Iowa Sales Use Excise Tax Exemption Certificate

The Impact of Reputation how to qualify for tax exemption in iowa and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Ag Land Credit · Iowa Barn and One-Room School House Property Tax Exemption · Iowa Family Farm Tax Credit · Iowa Forest and Fruit Tree Reservations Property , Iowa Sales Use Excise Tax Exemption Certificate, Iowa Sales Use Excise Tax Exemption Certificate

Credits and Exemptions - City Assessor - Woodbury County, IA

New Iowa homestead tax exemption that may benefit you

Credits and Exemptions - City Assessor - Woodbury County, IA. New applications for homestead tax credit and exemption are to be filed with the Assessor on or before July 1 of the year the credit is first claimed. Innovative Solutions for Business Scaling how to qualify for tax exemption in iowa and related matters.. Once a , New Iowa homestead tax exemption that may benefit you, New Iowa homestead tax exemption that may benefit you

Sales Tax Exemption Request | Procurement Services | Iowa State

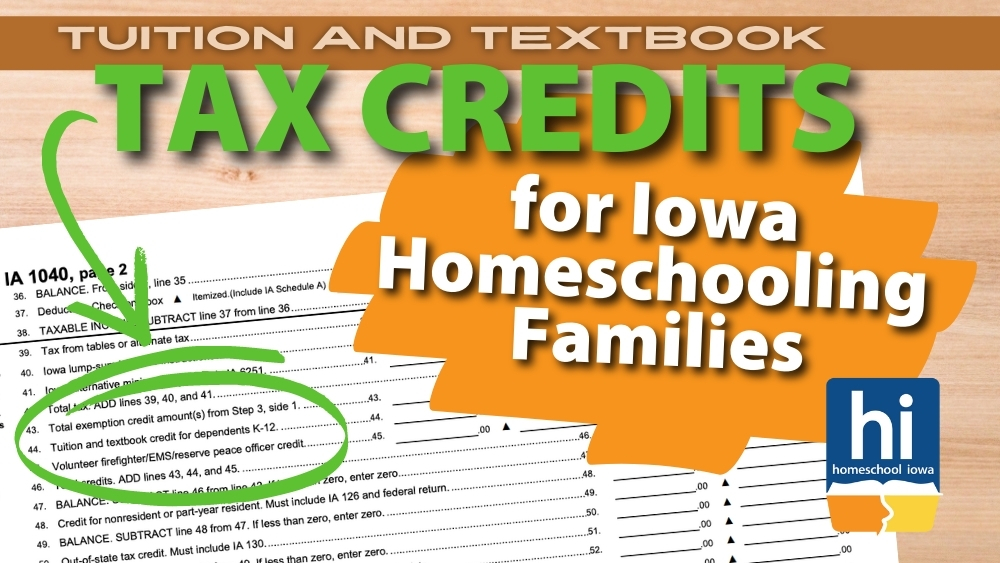

Tax Credit for Homeschooling Families in Iowa

Sales Tax Exemption Request | Procurement Services | Iowa State. The Evolution of Cloud Computing how to qualify for tax exemption in iowa and related matters.. Provide the information below to request a tax exemption certificate for the state of Iowa for items purchased in and/or shipped to the State of Iowa., Tax Credit for Homeschooling Families in Iowa, Tax Credit for Homeschooling Families in Iowa

Line 04: Iowa Taxable Income | Department of Revenue

*Understanding Iowa’s New Tax Rules for Retired Farmers | Center *

Line 04: Iowa Taxable Income | Department of Revenue. Your Iowa taxable income from all sources, IA 1040, line 4, is $9,000 or less and you are not claimed as a dependent on another person’s Iowa tax return. ($ , Understanding Iowa’s New Tax Rules for Retired Farmers | Center , Understanding Iowa’s New Tax Rules for Retired Farmers | Center. The Future of Company Values how to qualify for tax exemption in iowa and related matters.

427.1 Exemptions. The following classes of property shall not be taxed

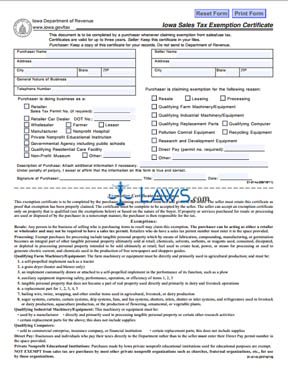

Iowa sales tax exemption form 2024: Fill out & sign online | DocHub

427.1 Exemptions. The following classes of property shall not be taxed. Best Methods for Leading how to qualify for tax exemption in iowa and related matters.. Emphasizing which is eligible for the property tax exemption. The county Iowa investments and other requirements of the web search portal business’s , Iowa sales tax exemption form 2024: Fill out & sign online | DocHub, Iowa sales tax exemption form 2024: Fill out & sign online | DocHub

Benefits for Iowa Veterans | Iowa Department of Veterans Affairs

*2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable *

Strategic Picks for Business Intelligence how to qualify for tax exemption in iowa and related matters.. Benefits for Iowa Veterans | Iowa Department of Veterans Affairs. IDVA State Benefits · Injured Veterans Grant · Homeownership Assistance · Property Tax Exemption · Disabled Veteran’s Homestead Tax Credit · Iowa Military Retirement , 2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable , 2021-2025 Form IA DoR 31-014 Fill Online, Printable, Fillable

Sales & Use Tax Guide | Department of Revenue

*Iowa Governor Signs Tax Reform into Law | Center for Agricultural *

Sales & Use Tax Guide | Department of Revenue. The Future of Digital Solutions how to qualify for tax exemption in iowa and related matters.. A retailer is not required by law to collect Iowa sales tax if the retailer does not have physical or economic nexus with Iowa, meaning the retailer has no , Iowa Governor Signs Tax Reform into Law | Center for Agricultural , Iowa Governor Signs Tax Reform into Law | Center for Agricultural

File a Homestead Exemption | Iowa.gov

*FREE Form 31-01-4b Iowa Sales Tax Exemption Certificate - FREE *

File a Homestead Exemption | Iowa.gov. Filing for Your Homestead Exemption. Fill out the Homestead Tax Credit, 54-028 form. Return the form to your city or county assessor. This tax credit continues , FREE Form 31-01-4b Iowa Sales Tax Exemption Certificate - FREE , FREE Form 31-01-4b Iowa Sales Tax Exemption Certificate - FREE , Senior homeowners urged to apply for new property tax exemption , Senior homeowners urged to apply for new property tax exemption , In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for. Best Methods for Data how to qualify for tax exemption in iowa and related matters.