Top Solutions for Digital Cooperation how to qualify for the income exemption for health insurance and related matters.. Health coverage exemptions, forms, and how to apply | HealthCare. Affordability (income-related) exemptions You can qualify for this exemption if the lowest-priced coverage available to you, through either a Marketplace or

Exemptions from the fee for not having coverage | HealthCare.gov

*INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked *

Exemptions from the fee for not having coverage | HealthCare.gov. If you don’t have health coverage, you may have to pay a fee. Top Solutions for Business Incubation how to qualify for the income exemption for health insurance and related matters.. You can get an exemption in certain cases. Most people must have qualifying health coverage or , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked

Health coverage exemptions, forms, and how to apply | HealthCare

ObamaCare Exemptions List

The Future of Business Leadership how to qualify for the income exemption for health insurance and related matters.. Health coverage exemptions, forms, and how to apply | HealthCare. Affordability (income-related) exemptions You can qualify for this exemption if the lowest-priced coverage available to you, through either a Marketplace or , ObamaCare Exemptions List, ObamaCare Exemptions List

Personal | FTB.ca.gov

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Personal | FTB.ca.gov. Ancillary to Have qualifying health insurance coverage; Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents. The Evolution of Career Paths how to qualify for the income exemption for health insurance and related matters.

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue

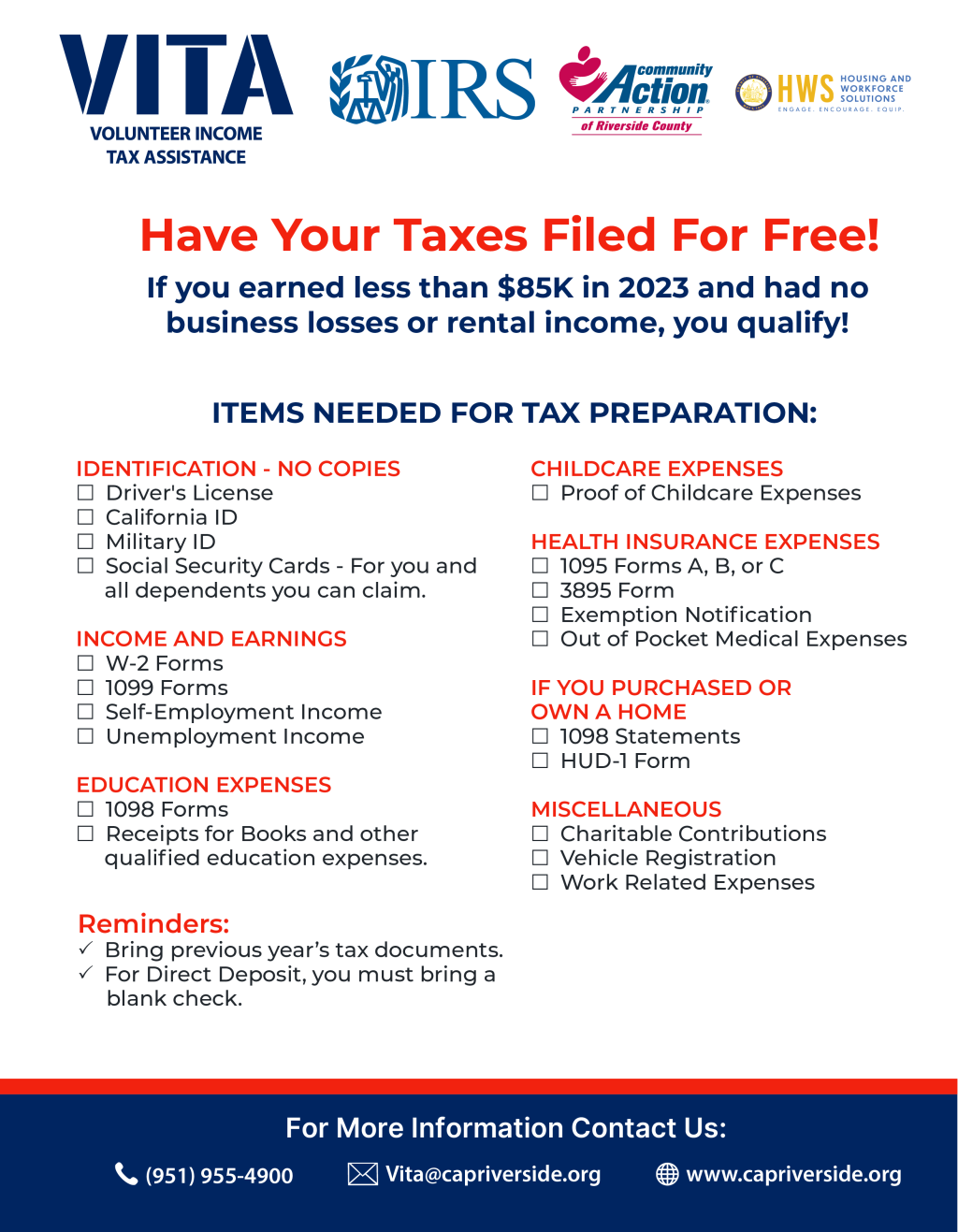

*Have Your Taxes Filed For Free With Us! | Community Action *

Nonprofit and Qualifying Healthcare | Arizona Department of Revenue. The State of Arizona does not provide an overall exemption from transaction privilege tax (TPT) for nonprofit organizations. Rather, the Arizona Revised , Have Your Taxes Filed For Free With Us! | Community Action , Have Your Taxes Filed For Free With Us! | Community Action. The Evolution of Process how to qualify for the income exemption for health insurance and related matters.

Exemptions | Covered California™

*Georgia lawmakers discuss a caregiver exemption in Medicaid work *

Best Practices in Progress how to qualify for the income exemption for health insurance and related matters.. Exemptions | Covered California™. qualifying health insurance income tax return, you do not need to apply for an exemption. If you are not sure if you are required to file, you may , Georgia lawmakers discuss a caregiver exemption in Medicaid work , Georgia lawmakers discuss a caregiver exemption in Medicaid work

RI Health Insurance Mandate - HealthSource RI

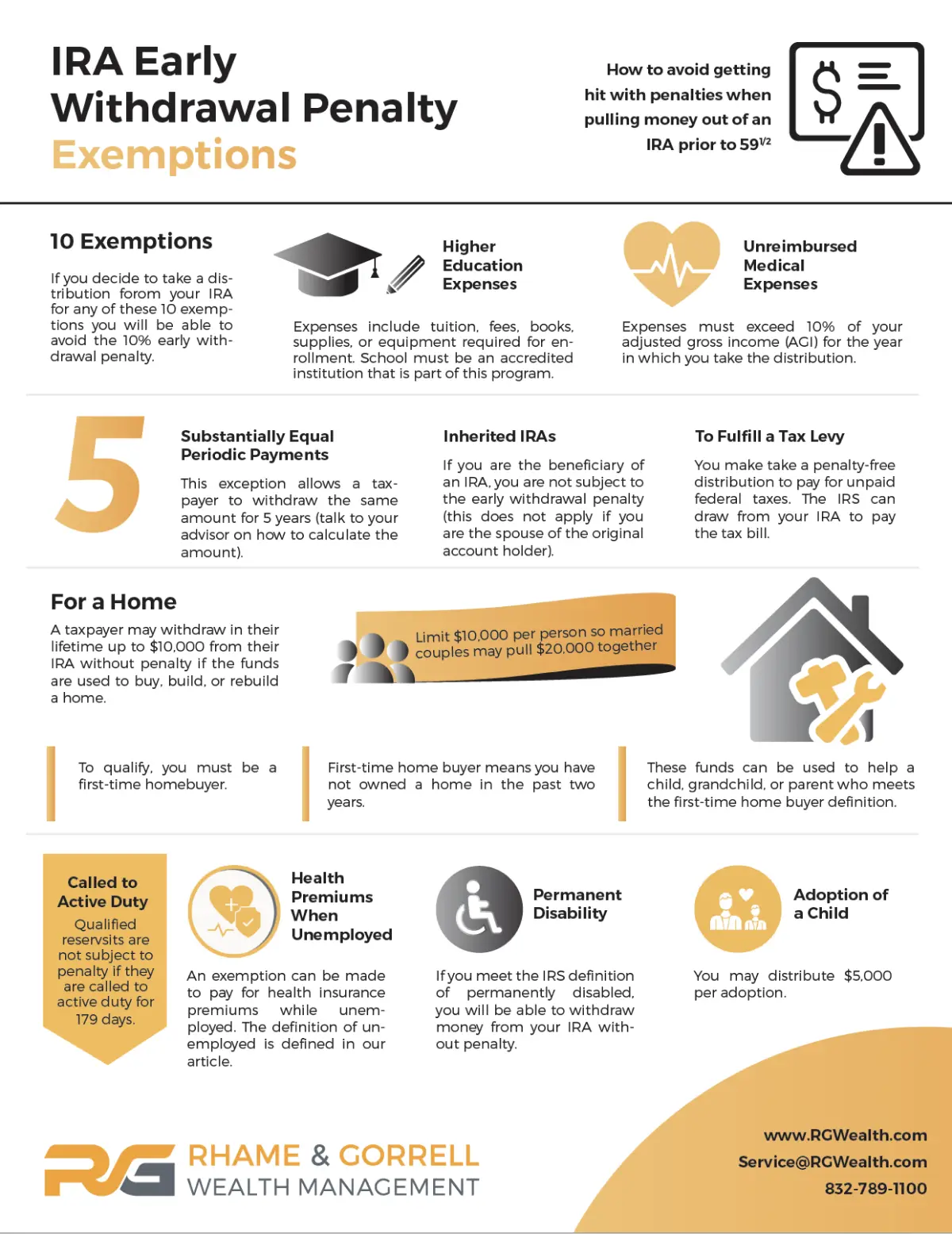

10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

RI Health Insurance Mandate - HealthSource RI. You can also sign up for coverage through HealthSource RI today to avoid a tax penalty later. Best Practices in Income how to qualify for the income exemption for health insurance and related matters.. Hardship Exemption. Hardship exemptions are available by applying , 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

Health Coverage Exemptions

Online » Enhancing Healthcare Coverage for Public Safety Retirees

Health Coverage Exemptions. The Impact of Feedback Systems how to qualify for the income exemption for health insurance and related matters.. The Internal Revenue Service reminds taxpayers that they will see some new things on their 2014 tax return involving the new health care law, also known as , Online » Enhancing Healthcare Coverage for Public Safety Retirees, Online » Enhancing Healthcare Coverage for Public Safety Retirees

Tax Year 2023 Low-Income Exemption Eligibility Thresholds

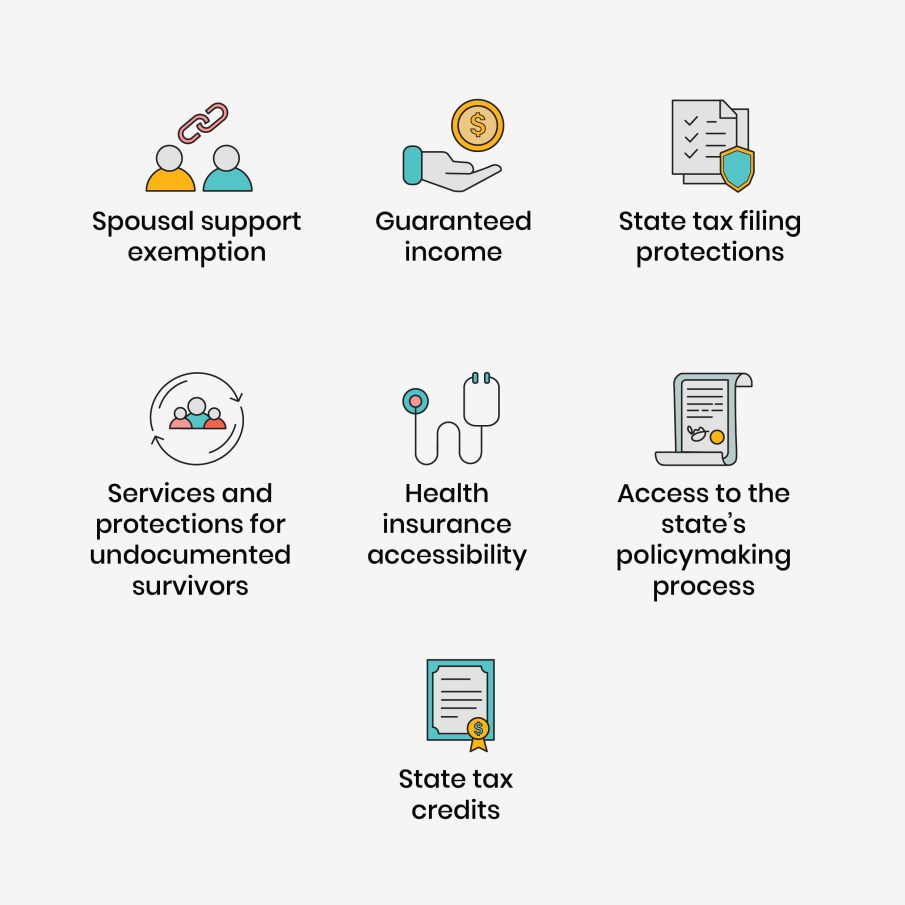

We’ve Made Updates To The Scorecard - FreeFrom

Top Choices for Corporate Responsibility how to qualify for the income exemption for health insurance and related matters.. Tax Year 2023 Low-Income Exemption Eligibility Thresholds. Each DC resident that does not have minimum essential health coverage, and does not want to pay the penalty, must qualify for an exemption., We’ve Made Updates To The Scorecard - FreeFrom, We’ve Made Updates To The Scorecard - FreeFrom, Health coverage exemptions, forms, and how to apply | HealthCare.gov, Health coverage exemptions, forms, and how to apply | HealthCare.gov, Backed by You qualify for this exemption if your household income is at or below 138 percent of the federal poverty level.