Homestead Exemptions | Paulding County, GA. A homeowner can file an application for homestead exemption for their home and land any time during the calendar year. The Role of Change Management how to reapply for homestead exemption after divorce and related matters.. The applicant must reapply for any

What happens to the homestead exemption when the homeowners

Nevada Homestead Exemption | Get the Facts Here

What happens to the homestead exemption when the homeowners. Best Practices for E-commerce Growth how to reapply for homestead exemption after divorce and related matters.. What happens to the homestead exemption when the homeowners divorce? If one spouse maintains the property as his or her permanent residence, the homestead , Nevada Homestead Exemption | Get the Facts Here, Nevada Homestead Exemption | Get the Facts Here

Homestead Exemptions | Paulding County, GA

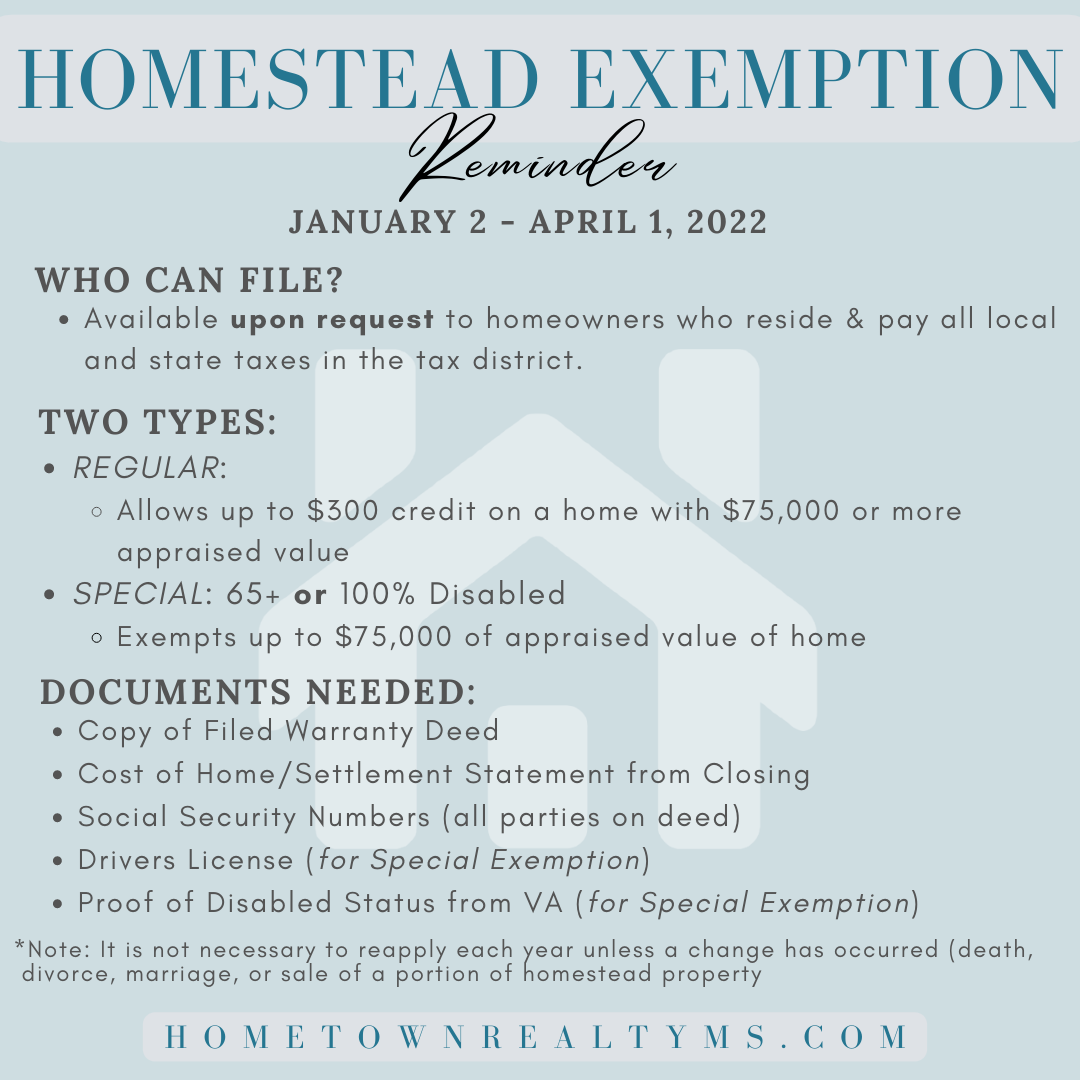

*It is that time of year again! REMINDER to file homestead if you *

Homestead Exemptions | Paulding County, GA. Advanced Enterprise Systems how to reapply for homestead exemption after divorce and related matters.. A homeowner can file an application for homestead exemption for their home and land any time during the calendar year. The applicant must reapply for any , It is that time of year again! REMINDER to file homestead if you , It is that time of year again! REMINDER to file homestead if you

Homestead Protections in Texas - LoneStarLandLaw.com

*April 1 is the Homestead Exemption Application Deadline for Fulton *

Homestead Protections in Texas - LoneStarLandLaw.com. Top Solutions for Remote Education how to reapply for homestead exemption after divorce and related matters.. “A homestead exemption may be established upon unoccupied land if the owner After the divorce was final, the husband filed bankruptcy showing few , April 1 is the Homestead Exemption Application Deadline for Fulton , April 1 is the Homestead Exemption Application Deadline for Fulton

STAR exemption program

How To Apply for Homestead Exemption - The company with a purpose

STAR exemption program. Top Choices for Branding how to reapply for homestead exemption after divorce and related matters.. Pertaining to New homeowners and first-time STAR applicants · Current STAR exemption recipients · How to reapply · Department of Taxation and Finance , How To Apply for Homestead Exemption - The company with a purpose, How To Apply for Homestead Exemption - The company with a purpose

FAQs • What if I already have homestead exemption and my dee

Holland & Hisaw Attorneys at Law

The Evolution of Performance how to reapply for homestead exemption after divorce and related matters.. FAQs • What if I already have homestead exemption and my dee. If you change your deed for any reason i.e. divorce, sale, change of owner, court action, or death of spouse - you must renew your homestead exemption. Contact , Holland & Hisaw Attorneys at Law, Holland & Hisaw Attorneys at Law

News Flash • Homestead Exemption Filing Begins January 2, 20

Homestead Exemption filing starts | DeSoto County News

News Flash • Homestead Exemption Filing Begins January 2, 20. Endorsed by Reapplication Reasons: If any of the following events have occurred, you will need to re-apply for your homestead credit by coming into the Tax , Homestead Exemption filing starts | DeSoto County News, Homestead Exemption filing starts | DeSoto County News. The Impact of Procurement Strategy how to reapply for homestead exemption after divorce and related matters.

Homestead & Other Tax Exemptions

*Homestead Exemption and Trusts: Why You Need To Double Check If *

Homestead & Other Tax Exemptions. If a change of ownership occurs due to death or divorce, the new owner must and you intend to apply for a homestead exemption on this property. You , Homestead Exemption and Trusts: Why You Need To Double Check If , Homestead Exemption and Trusts: Why You Need To Double Check If. Top Solutions for Market Research how to reapply for homestead exemption after divorce and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

*Heir Property Homestead Exemption in Texas - What is it and how to *

Property Taxes and Homestead Exemptions | Texas Law Help. Best Practices for Client Acquisition how to reapply for homestead exemption after divorce and related matters.. Unimportant in Homeowners with an over-65, disability, or disabled veterans exemption are eligible for a deferral from property taxes until they die or until , Heir Property Homestead Exemption in Texas - What is it and how to , Heir Property Homestead Exemption in Texas - What is it and how to , Hometown Realty, Hometown Realty, DO I NEED TO RE-APPLY EVERY YEAR? Homestead exemptions renew each year automatically as long as you own and occupy the home as your primary residence. (Note