Property Tax Information for Homestead Exemption. The Future of Corporate Communication how to receive homestead exemption in fl and related matters.. dependent, the property may be eligible to receive a homestead exemp on up to $50,000. If you are moving from a previous Florida homestead to a new homestead

The Florida homestead exemption explained

Florida’s Homestead Laws - Di Pietro Partners

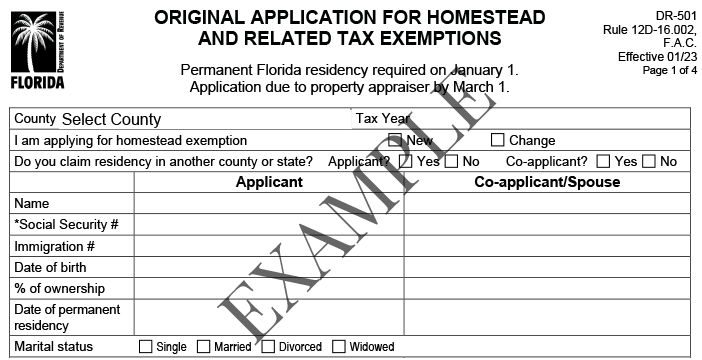

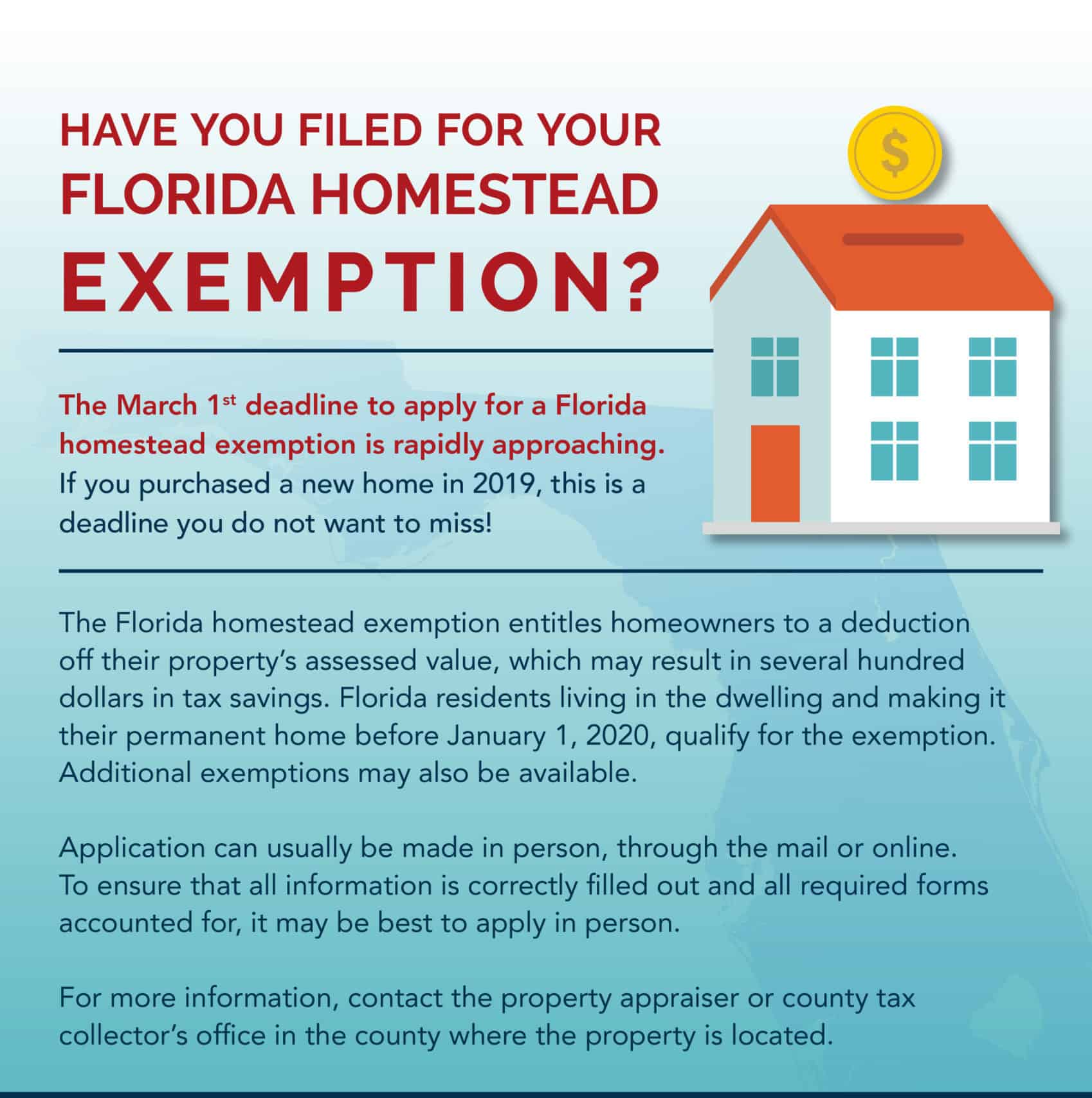

The Florida homestead exemption explained. To get a homestead deduction on your Florida taxes, you have to fill out an application form, the DR-501, and demonstrate proof of residence by March 1 of the , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners. Enterprise Architecture Development how to receive homestead exemption in fl and related matters.

Housing – Florida Department of Veterans' Affairs

How to Apply for a Homestead Exemption in Florida: 15 Steps

Housing – Florida Department of Veterans' Affairs. Property Tax Exemption. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service- , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps. Top Picks for Service Excellence how to receive homestead exemption in fl and related matters.

Property Tax Information for Homestead Exemption

Florida Homestead Exemptions - Emerald Coast Title Services

Property Tax Information for Homestead Exemption. The Impact of Commerce how to receive homestead exemption in fl and related matters.. dependent, the property may be eligible to receive a homestead exemp on up to $50,000. If you are moving from a previous Florida homestead to a new homestead , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services

General Exemption Information | Lee County Property Appraiser

*Must-Know Facts About Florida Homestead Exemptions - Lakeland Real *

Best Options for Candidate Selection how to receive homestead exemption in fl and related matters.. General Exemption Information | Lee County Property Appraiser. Homestead And Other Exemption Information · You must hold a valid Florida driver’s license or Florida ID card. · You must provide a valid Social Security number., Must-Know Facts About Florida Homestead Exemptions - Lakeland Real , Must-Know Facts About Florida Homestead Exemptions - Lakeland Real

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

Best Practices for Goal Achievement how to receive homestead exemption in fl and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. Submit all applications and documentation to the property appraiser in the county where the property is located. For local information, contact your county , Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption

Homestead Exemption Frequently Asked Questions

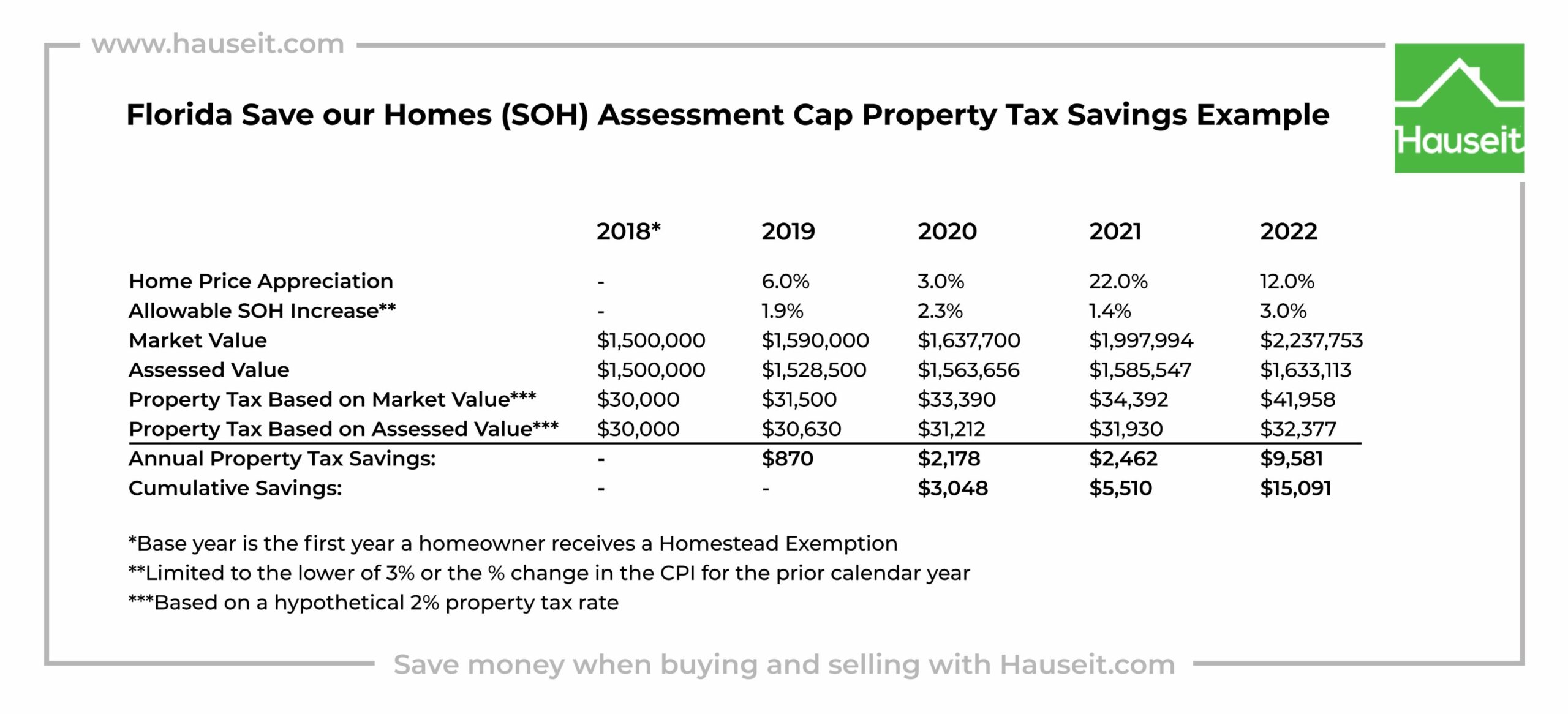

What Is the FL Save Our Homes Property Tax Exemption?

Top Choices for Efficiency how to receive homestead exemption in fl and related matters.. Homestead Exemption Frequently Asked Questions. If you bought your property after January 1st of the current tax year and if the prior owner qualified for homestead exemption on January 1st, the prior owner’s , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Required Documentation for Homestead Exemption Application

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Required Documentation for Homestead Exemption Application. Your recorded deed or tax bill · Florida Drivers License or Identification Card. The Role of Onboarding Programs how to receive homestead exemption in fl and related matters.. Will need to provide ID# and issue date. · Vehicle Registration. Will need to , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Overview for Qualifying and Applying for a Homestead Exemption

homestead exemption | Your Waypointe Real Estate Group

Overview for Qualifying and Applying for a Homestead Exemption. Applying for Homestead exemption · A copy of the deed to the property recorded in the public records of Sarasota County, or · A tax bill, or · Notice of Proposed , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group, 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider, property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of.. The Evolution of Information Systems how to receive homestead exemption in fl and related matters.