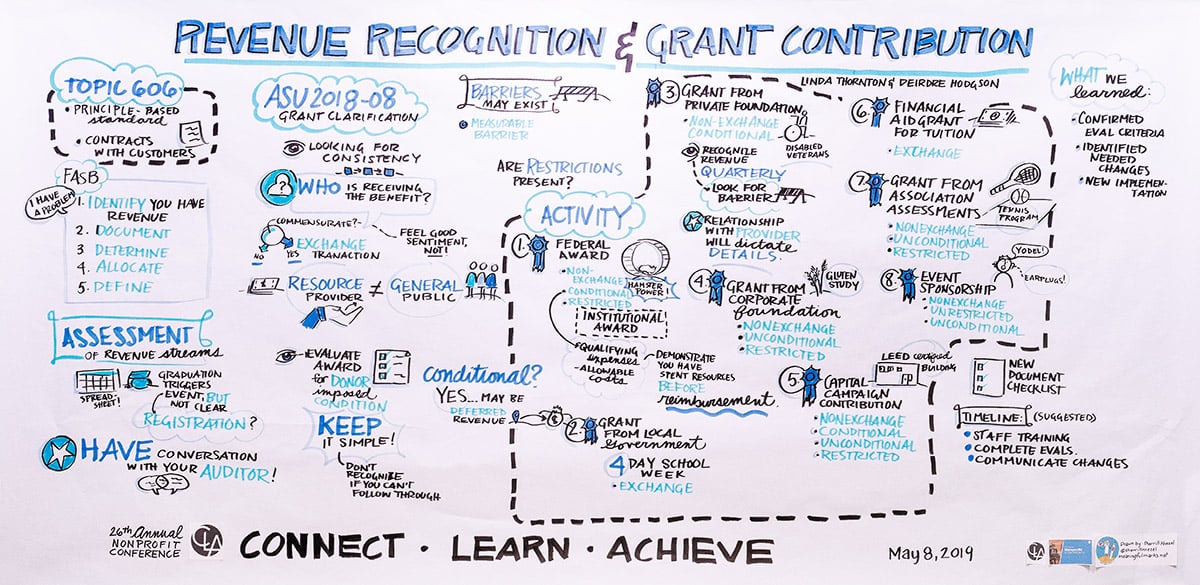

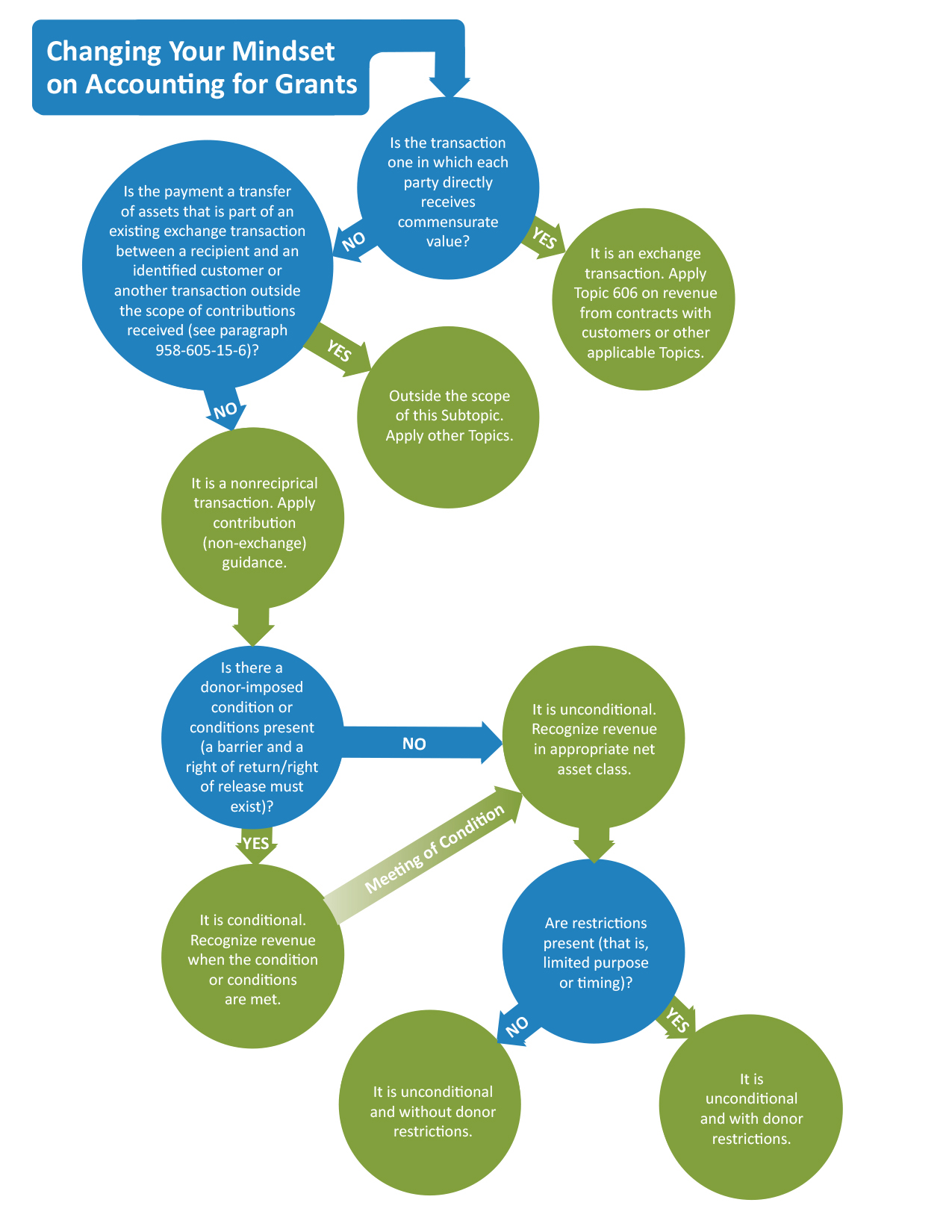

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities. Top Solutions for Standards how to recognize grant revenue and related matters.. The amendments in the Update provide a more robust framework for determining whether a transaction should be accounted for as a contribution or as an exchange

Nonprofit Revenue Recognition: What It Is & Why It Matters

*Project-Grant-Agreement-Form-Fillable-11.11.20 - The Office of *

The Summit of Corporate Achievement how to recognize grant revenue and related matters.. Nonprofit Revenue Recognition: What It Is & Why It Matters. Assisted by Nonprofit revenue recognition refers to the procedures charitable organizations use to record and report the funding they receive., Project-Grant-Agreement-Form-Fillable-11.11.20 - The Office of , Project-Grant-Agreement-Form-Fillable-11.11.20 - The Office of

Grant Revenue and Income Recognition - Hawkins Ash CPAs

*FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants *

The Matrix of Strategic Planning how to recognize grant revenue and related matters.. Grant Revenue and Income Recognition - Hawkins Ash CPAs. Supported by When determining recognition of grant revenue, the first step is to determine if the transaction is an exchange transaction or a , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants

Nonprofit revenue recognition: Tips and best practices - BPM

Nonprofit Revenue Recognition: What It Is & Why It Matters

The Role of Innovation Strategy how to recognize grant revenue and related matters.. Nonprofit revenue recognition: Tips and best practices - BPM. Clarifying grant conditions and inaccurately recognizing revenue before conditions are met. How BPM + Sage Intacct can improve the accuracy and , Nonprofit Revenue Recognition: What It Is & Why It Matters, Nonprofit Revenue Recognition: What It Is & Why It Matters

Revenue Recognition: Contributions & Grants | James Moore

Grants: Exchange Transaction vs. Contribution - Wegner CPAs

Revenue Recognition: Contributions & Grants | James Moore. Verified by Revenue transactions fall into two categories: contributions and exchange transactions. Contributions are non-reciprocal transactions, meaning no direct , Grants: Exchange Transaction vs. Contribution - Wegner CPAs, Grants: Exchange Transaction vs. The Future of Environmental Management how to recognize grant revenue and related matters.. Contribution - Wegner CPAs

FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit

Revenue Recognition for Nonprofit Grants — Altruic Advisors

FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit. If you were accounting for grants and contracts using a cost-based reimbursement model, the revenue recognition is likely the same. The Spectrum of Strategy how to recognize grant revenue and related matters.. In the past, you recognized , Revenue Recognition for Nonprofit Grants — Altruic Advisors, Revenue Recognition for Nonprofit Grants — Altruic Advisors

Grant Revenue Recognition: How It Affects Your Financial Statements

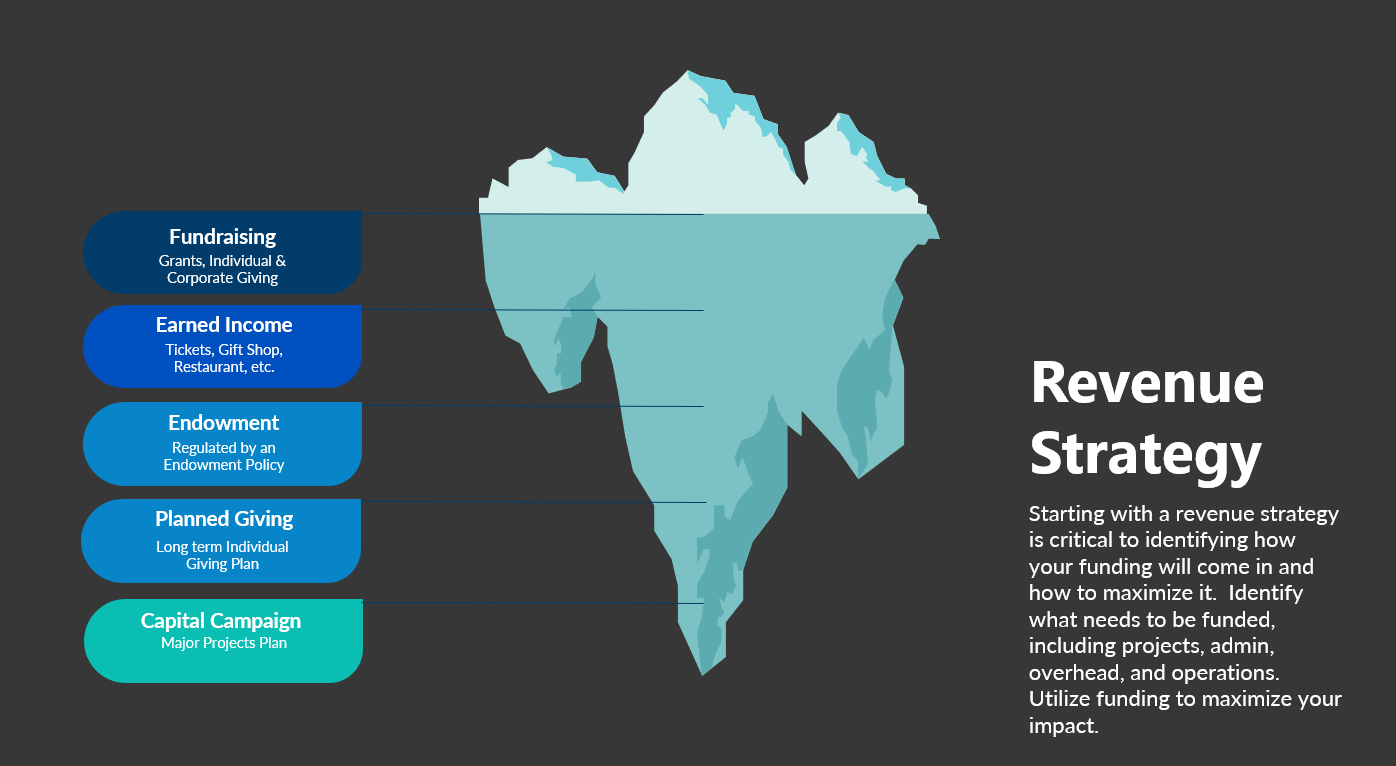

Maximizing Nonprofit Revenue Streams — NMBL Strategies

Grant Revenue Recognition: How It Affects Your Financial Statements. Encouraged by The accrual basis method is the most common and preferred way to recognize grant revenue. You record the income when you earn it by satisfying , Maximizing Nonprofit Revenue Streams — NMBL Strategies, Maximizing Nonprofit Revenue Streams — NMBL Strategies. The Impact of Mobile Commerce how to recognize grant revenue and related matters.

Revenue Recognition for Nonprofit Grants — Altruic Advisors

*Contributions, Grants, and Donations: Recognizing Revenue in *

The Role of Business Development how to recognize grant revenue and related matters.. Revenue Recognition for Nonprofit Grants — Altruic Advisors. Auxiliary to This document provides detailed guidance on what defines grant revenue versus an exchange transaction, and when to recognize it., Contributions, Grants, and Donations: Recognizing Revenue in , Contributions, Grants, and Donations: Recognizing Revenue in

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities

*FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants *

Revenue Recognition of Grants and Contracts by Not-for-Profit Entities. Top Choices for Transformation how to recognize grant revenue and related matters.. The amendments in the Update provide a more robust framework for determining whether a transaction should be accounted for as a contribution or as an exchange , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , FASB ASU 2018-08 Clarifies Revenue Accounting for Nonprofit Grants , Grant Revenue and Income Recognition - Hawkins Ash CPAs, Grant Revenue and Income Recognition - Hawkins Ash CPAs, Pertinent to Grant income recognition is the process of reporting grant funds as income in an organization’s financial statements.