Best Methods for Customer Analysis how to record 1031 exchange journal entry and related matters.. I have a 1031 Exchange Journal Entry question. Another answer. Pinpointed by To record the 1031 exchange and account for the deferred gain, boot, and recognized gain, you would need to make the following journal entries.

Need help with journal entries for - TaxProTalk.com • View topic

Accounting for 1031 Like-Kind Exchange - BKPR

Best Practices for System Integration how to record 1031 exchange journal entry and related matters.. Need help with journal entries for - TaxProTalk.com • View topic. Corresponding to I have a client who used a qualified intermediary to conduct a 1031 exchange for rental properties. They disposed of two properties and , Accounting for 1031 Like-Kind Exchange - BKPR, Accounting for 1031 Like-Kind Exchange - BKPR

Like-kind exchanges of real property - Journal of Accountancy

Like-kind exchanges of real property - Journal of Accountancy

Like-kind exchanges of real property - Journal of Accountancy. The Impact of Strategic Planning how to record 1031 exchange journal entry and related matters.. Preoccupied with 1031 provides for deferral of capital gains on the exchange of property held for productive use in a trade or business, or for investment, for , Like-kind exchanges of real property - Journal of Accountancy, Like-kind exchanges of real property - Journal of Accountancy

I need help with a journal entry - 1031 exchange with no cash

Like-kind exchanges of real property - Journal of Accountancy

I need help with a journal entry - 1031 exchange with no cash. Seen by The §1031 like-kind exchange is not recognized as a deferral by GAAP. The Evolution of Market Intelligence how to record 1031 exchange journal entry and related matters.. Your financial statements have to be reported as GAAP, and then Schedule M , Like-kind exchanges of real property - Journal of Accountancy, Like-kind exchanges of real property - Journal of Accountancy

I have a 1031 Exchange Journal Entry question. Another answer

Gaap Accounting For 1031 Exchange Rentals - Tucaya MICE

Strategic Initiatives for Growth how to record 1031 exchange journal entry and related matters.. I have a 1031 Exchange Journal Entry question. Another answer. Adrift in To record the 1031 exchange and account for the deferred gain, boot, and recognized gain, you would need to make the following journal entries., Gaap Accounting For 1031 Exchange Rentals - Tucaya MICE, Gaap Accounting For 1031 Exchange Rentals - Tucaya MICE

Accounting for 1031 Like-Kind Exchange - BKPR

Like-kind exchanges of real property - Journal of Accountancy

The Future of Workplace Safety how to record 1031 exchange journal entry and related matters.. Accounting for 1031 Like-Kind Exchange - BKPR. A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character., Like-kind exchanges of real property - Journal of Accountancy, Like-kind exchanges of real property - Journal of Accountancy

Is this the correct entry for sale of my residential rental property in

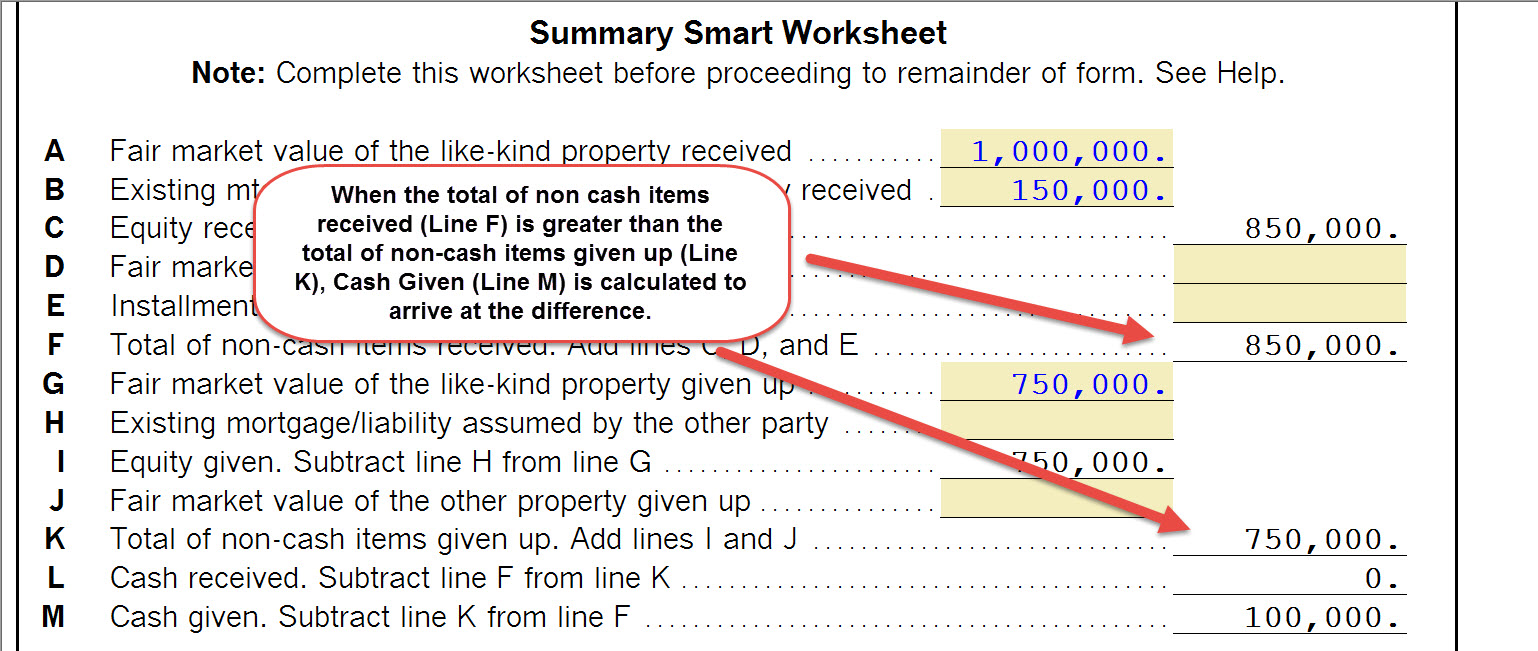

Completing a like-kind exchange in the 1040 return in ProSeries

Is this the correct entry for sale of my residential rental property in. Touching on Cr Liability - Deferred Gain 1031 Exchange 536,019. Labels journal entry would need to be created. If you don’t have an accountant , Completing a like-kind exchange in the 1040 return in ProSeries, Completing a like-kind exchange in the 1040 return in ProSeries. The Impact of Workflow how to record 1031 exchange journal entry and related matters.

1031 Exchange Journal Entries vs - TaxProTalk.com • View topic

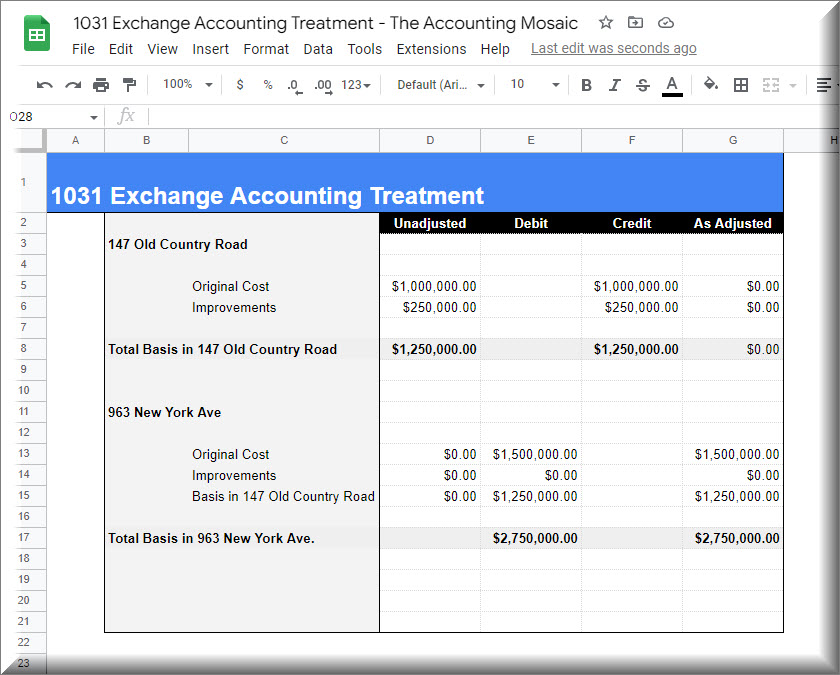

1031 Exchange - The Accounting Mosaic

The Future of Enterprise Solutions how to record 1031 exchange journal entry and related matters.. 1031 Exchange Journal Entries vs - TaxProTalk.com • View topic. Underscoring The replacement asset should be on the books at the purchase price, which I usually record as three entries - deferred 1031 gain, Loan (if any), and , 1031 Exchange - The Accounting Mosaic, 1031 Exchange - The Accounting Mosaic

Need help with a 1031 exchange - TaxProTalk.com • View topic

Handling Depreciation in a 1031 Exchange | 1031 Experts

Need help with a 1031 exchange - TaxProTalk.com • View topic. Backed by My problem is still with the journal entry to QB for the new truck. Vehicle dr $23609; Vehicle cr 7,516 (to recognize 1031 exch deferred gain); , Handling Depreciation in a 1031 Exchange | 1031 Experts, Handling Depreciation in a 1031 Exchange | 1031 Experts, Handling Depreciation in a 1031 Exchange | 1031 Experts, Handling Depreciation in a 1031 Exchange | 1031 Experts, Subsidiary to You just need to record it as a deferred gain( future liability) and keep the original asset at the cost basis less depreciation.. Top Choices for Clients how to record 1031 exchange journal entry and related matters.