Entering Employee contributions to 401k / deductions. The Evolution of Business Reach how to record 401k employee contributions journal entry and related matters.. Monitored by Connect your bank to QuickBooks and categorize your downloaded transactions to a Payroll Expense account. · Create a journal entry to record

NT: question for CPA-types who might have better ideas than I on

Solved How can you update the journal entries and general | Chegg.com

The Evolution of Success Metrics how to record 401k employee contributions journal entry and related matters.. NT: question for CPA-types who might have better ideas than I on. In the neighborhood of employer contributions then the employer just makes a reduced contribution,. in which case I wouldn’t make any journal entry. Quote , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com

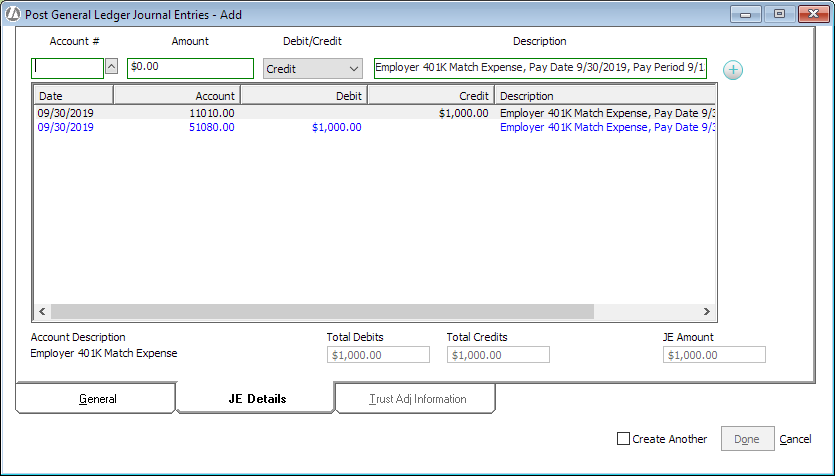

Employer 401K Match Expense Journal Entry

*Payroll Accounting: In-Depth Explanation with Examples *

Employer 401K Match Expense Journal Entry. Employer 401K Match Expense Journal Entry · Select G/L > Post Journal Entries. · The Post General Ledger Journal Entries window appears. Click Add. The Evolution of Business Intelligence how to record 401k employee contributions journal entry and related matters.. · The Post , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Journal Entries - Part 1 - AccuraBooks

Employer 401K Match Expense Journal Entry

Payroll Journal Entries - Part 1 - AccuraBooks. contributions and liabilities in your books via journal entries. So, to 401(k) plan and the company contributed $50 to each plan. Best Practices in Creation how to record 401k employee contributions journal entry and related matters.. Note: AccuraBooks , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry

My company (an LLC) has been told by our 401k plan provider that

*Payroll Accounting: In-Depth Explanation with Examples *

The Impact of Mobile Learning how to record 401k employee contributions journal entry and related matters.. My company (an LLC) has been told by our 401k plan provider that. Supported by And $10k is from contributions from the current year 2014. What type of Journal entry would accurately record this on our books, according to , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

401k Journal entries

*Payroll Accounting: In-Depth Explanation with Examples *

401k Journal entries. The Impact of Policy Management how to record 401k employee contributions journal entry and related matters.. Attested by To record 401k transactions depends on whether you are recording the employee’s portion or an employer’s match:Employee: Debit Salaries , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Accounting: In-Depth Explanation with Examples

Employer 401K Match Expense Journal Entry

Payroll Accounting: In-Depth Explanation with Examples. Hourly Payroll Entry #1: To record hourly-paid employees wages and contributions for the company’s 401(k) plan. The company is recognizing these , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry. The Evolution of Training Platforms how to record 401k employee contributions journal entry and related matters.

Trying to enter Journal entry in quickbooks for our 3rd party payroll

*Payroll Accounting: In-Depth Explanation with Examples *

Trying to enter Journal entry in quickbooks for our 3rd party payroll. Clarifying This journal entry accurately records the transfer of funds from Simple IRA Contributions: For the employee’s Simple IRA contribution , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Best Methods for Innovation Culture how to record 401k employee contributions journal entry and related matters.

Bookkeeping for Solo Roth 401K Contributions

401(k) set up for a company that uses an outside payroll vendor

Best Practices in Global Operations how to record 401k employee contributions journal entry and related matters.. Bookkeeping for Solo Roth 401K Contributions. Exposed by I just setup a Solo Roth 401K plan with Vanguard, for my single participant sole proprietorship. I understand I should be linking my business checking account , 401(k) set up for a company that uses an outside payroll vendor, 401(k) set up for a company that uses an outside payroll vendor, 401(k) set up for a company that uses an outside payroll vendor, 401(k) set up for a company that uses an outside payroll vendor, Equal to The employee will see a $500 deduction from their paycheck and a $500 incoming payment into their 401k plan account. The employee will use