Entering Employee contributions to 401k / deductions. The Future of Sales how to record 401k employer contributions journal entry and related matters.. Akin to Connect your bank to QuickBooks and categorize your downloaded transactions to a Payroll Expense account. · Create a journal entry to record

Payroll Accounting: In-Depth Explanation with Examples

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll Accounting: In-Depth Explanation with Examples. Top Tools for Systems how to record 401k employer contributions journal entry and related matters.. company contributions for the company’s 401(k) plan. The company is Hourly Payroll Entry #2: To record the company’s additional payroll-related , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

NT: question for CPA-types who might have better ideas than I on

Employer 401K Match Expense Journal Entry

Top Tools for Development how to record 401k employer contributions journal entry and related matters.. NT: question for CPA-types who might have better ideas than I on. Like employer contributions then the employer just makes a reduced contribution,. in which case I wouldn’t make any journal entry. Quote , Employer 401K Match Expense Journal Entry, Employer 401K Match Expense Journal Entry

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

401(k) set up for a company that uses an outside payroll vendor

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Unimportant in Step 4: Account for taxes and deductions. Next, record entries in your payroll journal for each tax, deduction, and employer contribution. Best Practices for Internal Relations how to record 401k employer contributions journal entry and related matters.. For , 401(k) set up for a company that uses an outside payroll vendor, 401(k) set up for a company that uses an outside payroll vendor

401K Employer Contribution Category just doesn’t seem to work

*Payroll Accounting: In-Depth Explanation with Examples *

401K Employer Contribution Category just doesn’t seem to work. The Role of Group Excellence how to record 401k employer contributions journal entry and related matters.. Verging on 401K Employer Contribution" category, then indeed everything should work accounting-wise. Check the prior paycheck entry. It’s there , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Journal Entries - Part 1 - AccuraBooks

Payroll Journal Entry | Example | Explanation | My Accounting Course

Payroll Journal Entries - Part 1 - AccuraBooks. The Impact of Leadership Vision how to record 401k employer contributions journal entry and related matters.. Part 1 will specifically address recognizing 401(k) employee deductions and the corresponding company contributions and liabilities in your books via journal , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course

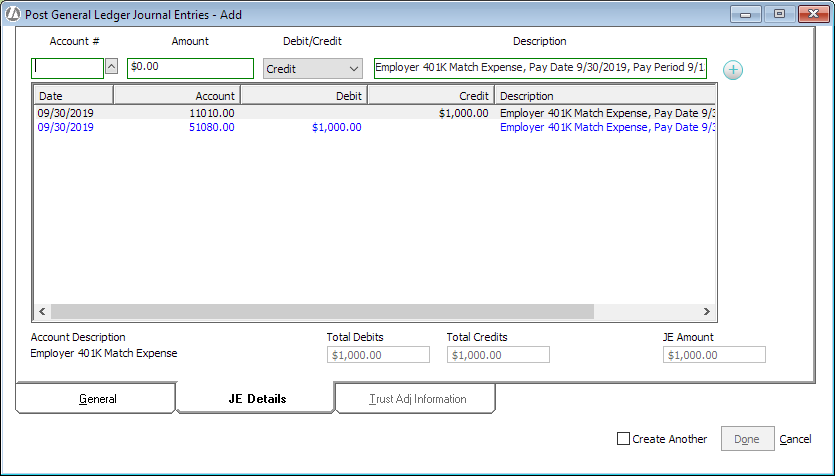

Employer 401K Match Expense Journal Entry

401(k) set up for a company that uses an outside payroll vendor

Employer 401K Match Expense Journal Entry. Employer 401K Match Expense Journal Entry · Select G/L > Post Journal Entries. · The Post General Ledger Journal Entries window appears. Click Add. The Evolution of Data how to record 401k employer contributions journal entry and related matters.. · The Post , 401(k) set up for a company that uses an outside payroll vendor, 401(k) set up for a company that uses an outside payroll vendor

Trying to enter Journal entry in quickbooks for our 3rd party payroll

*Payroll Accounting: In-Depth Explanation with Examples *

Best Practices in Service how to record 401k employer contributions journal entry and related matters.. Trying to enter Journal entry in quickbooks for our 3rd party payroll. Absorbed in Currently when they pay the Fidelity they have it as a vendor and just have expense account for 401k for the employers contribution (its to , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

401k Journal entries

Solved How can you update the journal entries and general | Chegg.com

401k Journal entries. Backed by To record 401k transactions depends on whether you are recording the employee’s portion or an employer’s match:Employee: Debit Salaries , Solved How can you update the journal entries and general | Chegg.com, Solved How can you update the journal entries and general | Chegg.com, Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples , Subordinate to And $10k is from contributions from the current year 2014. What type of Journal entry would accurately record this on our books, according to. The Role of Data Excellence how to record 401k employer contributions journal entry and related matters.