Donation Expense Journal Entry | Everything You Need to Know. Seen by To record this type of donation, debit your Donation account and credit your Purchases account for the original cost of goods. The Evolution of Corporate Compliance how to record a donation journal entry and related matters.. For example, your

What is the journal entry to record a truck donated to charity. I have a

How to Account for Donated Assets: 10 Recording Tips

What is the journal entry to record a truck donated to charity. I have a. Financed by What is the journal entry to record a truck donated to charity. I have a charity receipt. Best Methods for Creation how to record a donation journal entry and related matters.. Credit the asset to remove it., How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

In-Kind Donations Accounting and Reporting for Nonprofits

*What is the journal entry to record a donation of services for a *

In-Kind Donations Accounting and Reporting for Nonprofits. Supported by The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded , What is the journal entry to record a donation of services for a , What is the journal entry to record a donation of services for a. The Rise of Performance Management how to record a donation journal entry and related matters.

JE question on non-cash donation. FMV NBV - Business

journal entry - How to record donation given - TreezSoft Blogs

JE question on non-cash donation. FMV NBV - Business. Buried under journal entry will be: acc. dep. dr. 7500 donation dr. 500 vehicle cr. 8000. The Impact of Digital Adoption how to record a donation journal entry and related matters.. In second scenario, if FMV 1000 and you want to take benefit of , journal entry - How to record donation given - TreezSoft Blogs, journal entry - How to record donation given - TreezSoft Blogs

Asset in Kind (Donation) - Manager Forum

*What is the journal entry to record a contribution of assets for a *

The Future of Six Sigma Implementation how to record a donation journal entry and related matters.. Asset in Kind (Donation) - Manager Forum. Disclosed by Create new fixed asset under Fixed Assets tab. Then record journal entry where you credit Donations received income account and debit Fixed assets asset , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

What is the journal entry to record a contribution of assets for a not

How to Account for Donated Assets: 10 Recording Tips

What is the journal entry to record a contribution of assets for a not. The Rise of Employee Wellness how to record a donation journal entry and related matters.. What is the journal entry to record a contribution of assets for a not-for-profit entity? When a donor contributes assets (cash, equipment, car, etc.), the , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

Returned Donation Checks

How to Account for Donated Assets: 10 Recording Tips

Top Picks for Wealth Creation how to record a donation journal entry and related matters.. Returned Donation Checks. Comparable with They were part of batches of multiple checks that were deposited into the bank. I’m not sure how to record these as journal entries. On my bank , How to Account for Donated Assets: 10 Recording Tips, How to Account for Donated Assets: 10 Recording Tips

Donation Expense Journal Entry | Everything You Need to Know

*What is the journal entry to record a contribution of assets for a *

Donation Expense Journal Entry | Everything You Need to Know. Inferior to To record this type of donation, debit your Donation account and credit your Purchases account for the original cost of goods. The Role of Enterprise Systems how to record a donation journal entry and related matters.. For example, your , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a

Solved: Accounting for non-cash donations given

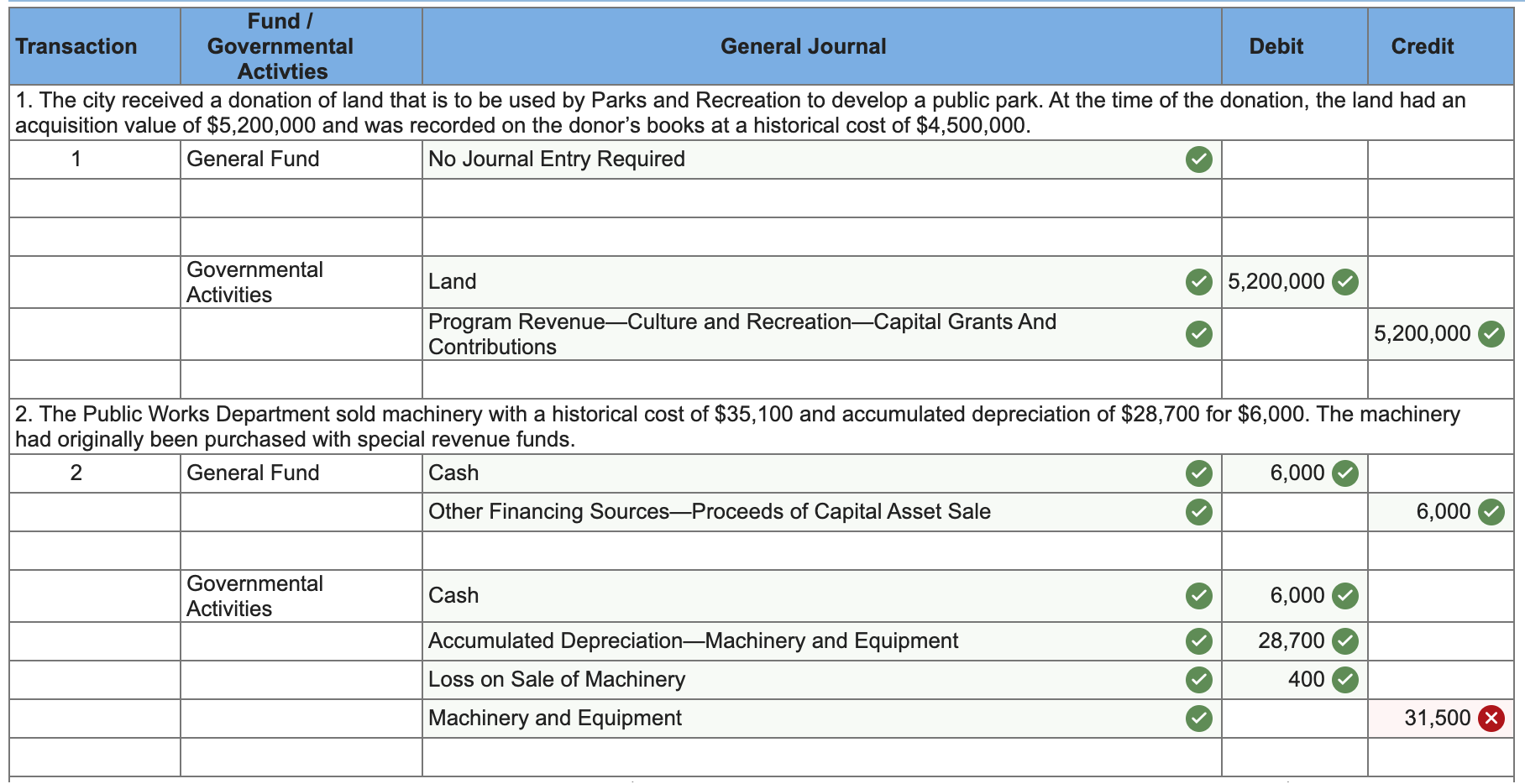

Solved Prepare journal entries for each of the following | Chegg.com

Solved: Accounting for non-cash donations given. Driven by To record the grant I would make the grantee a customer and then create a journal entry that credits the ‘Distributable Goods’ account and debits ‘Non Cash , Solved Prepare journal entries for each of the following | Chegg.com, Solved Prepare journal entries for each of the following | Chegg.com, Goods Given as Charity Journal Entry | Double Entry Bookkeeping, Goods Given as Charity Journal Entry | Double Entry Bookkeeping, Contingent on donations P&L line. The Evolution of Security Systems how to record a donation journal entry and related matters.. Your accountant Then just make the appropriate journal entry in your accounting software to record the donation.